Facts change, and Chancellors change! As we identify updates and corrections for our book “How To Fund The Life You Want”, we will list them below the form on this page. Click here to leap down to updates and corrections.

♦♦♦ A word about reviews: if you’ve enjoyed our book, we’d really appreciate you leaving a review on Amazon. It doesn’t need to be a long one. Most books in the UK are sold through Amazon, so even a short review there helps us to spread the word about the book. ♦♦♦

Send us your corrections (or comments)

If you find any errors of fact in the book (or our workbook), please use the form below to let us know about them. We also welcome your thoughts about how we can improve the book for future editions.

Updates and corrections

Chapter 2: Invest In … Yourself

Correction on EMPLOYER PENSION CONTRIBUTIONS, page 30. Although a typical employer must contribute 3% provided you contribute 5%, not all of your 5% is deducted from your salary. The deduction from your salary is 4%, the remaining 1% of “your” contribution is provided by HMRC, in the form of tax relief.

Chapter 3: Manage Your Money

Update on PENSIONS MOUNTAIN, pages 56–57. The state pension has increased; Which? updated its retirement spending survey in April 2022; the PLSA has recently updated its equivalent survey; and inflation has risen considerably. All these affect the underlying calculations that gave the approximate figures in the “pensions mountain” graphic. Please remember our caution that it is designed only to give a broad impression. We highly recommend you use worksheet 3b from our workbook to help you to use the same logic – but with figures you choose yourself, based on your own life and the latest data.

Chapter 6: Take The Right Risks

Update on “SAFE” WITHDRAWAL RATE, page 119. Morningstar have published a very detailed report (note: all based on US data) that gives a thorough testing against historical data to every possible variant on managing this withdrawal rate. You have to register your email address to download the report, but it’s well worth if you want to look into this issue more deeply.

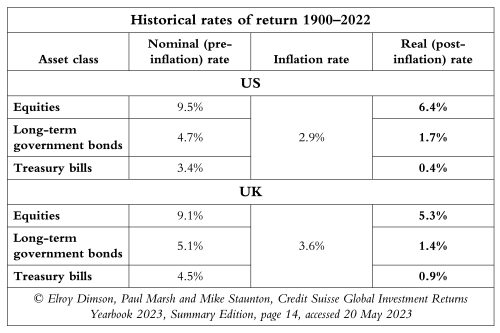

Update on LONG-TERM ASSET RETURNS, page 123. Elroy Dimson, Paul Marsh and Mike Staunton regularly update their Credit Suisse work mapping long-term returns. Their data as at May 2023, following the same table format we presented on page 123 of our book, is as below.

As might be predicted when the new data adds just one more year to a very long-term average, the returns on equities are not much changed.

The most notable change to us is the difference in the real return on long-term UK government bills, which has fallen from 1.8% to 1.4%. This is a significant change in such a short time. The crisis in the bond market initiated by the Liz Truss government has shown that bonds can experience significant volatility, a volatility that reduces their contrast with equities on the asset spectrum. This was an unpleasant shock to many people invested in portfolios towards the “defensive” end of the spectrum. In the book we challenged the widespread use of “lifestyling” portfolios that aim to reduce volatility as their owners approach retirement age, hiding an assumption that the owners will buy an annuity as a one-off life event. Many of these portfolios, which were heavily invested in bonds and bills, suffered particularly nasty setbacks during the bond crisis.

However, the drop in return on long-term US government bonds was less, again emphasising the value of international diversification.

Correction on COMMODITIES as an asset class, page 127. The real return is -2.6% (inflation averaged and subtracted only for the years that these commodities records are available, 2007 to 2022). Because of the short duration of the records, conclusions about this asset class need to be handled with care, but the same fundamental story appears: the real return has been negative.

Update on ANNUITIES, page 129. Since we published the book, annuities have become cheaper. That is, you can get more income from an annuity per pound you spend. This is because global interest rates have risen. We focused your attention in the book on the value of later-life annuities (covered in detail in Chapter 7: Manage Your Mix). We still maintain that is where the spotlight should fall.

We note that even though prices have fallen for annuities that are not index-linked against inflation, annuities that include inflation protection remain pricier. And the recent surge in inflation is a reminder of its insidious long-term effects.

However, we would not wish to discourage you from looking at online comparison tools such as the Moneyhelper annuity tool, just to gauge the costs and benefits of an annuity taken at any point in your retirement. Tools like these can help you look at the costs and constraints quickly (and without provoking an avalanche of sales calls). We also recommend this Financial Times article which gives a very well-rounded look at the issue and options (paywall).

Chapter 7: Manage Your Mix

Update on COMBINING PENSIONS, pages 149 and 166. For a great explanation of the issues to consider, see the excellent recent paper by Steve Webb and Dan Mikulkis: Five good reasons to consolidate your DC pensions – and five reasons to be careful. As well as considering whether you would lose employer contributions by combining your DC pensions, consider any other benefits you might lose: for example, your right to access money more easily if one of your pension pots is small.

Update on TAX FOR PEOPLE LIVING OUTSIDE THE UK, pages 156 and 157. We advise readers living under tax regimes outside the UK to note: even if you can benefit from any tax principles because of savings or income in the UK, if you are living abroad, your local tax authority will probably levy different tax principles that clash with them. For example, they may apply higher rates – or disregard the tax-free status of benefits available to people living in the UK, such as ISAs or tax-free pension cash. Nothing in our book should be read as commenting on any tax regime outside the UK.

Update on PENSIONS ANNUAL ALLOWANCE (page 158), which rose from £40,000 to £60,000 a year in April 2023. This meant that if you are a higher earner (or have cash to spare from other sources, such as an inheritance), you can put much more into your pension while benefitting from the tax subsidy that comes with it. For people in that happy situation, this will widen the advantage gap between investing for your future life in a pension, as opposed to investing in a stocks and shares ISA. This is because ISA contributions remained capped at £20,000 a year. However … see the next paragraph.

Update on ISAs, page 158. In the 2024 Budget a consultation was announced about increasing the stocks and shares ISA allowance by £5,000 a year – provided you invest the additional money in UK companies. If it is introduced, that will be in a later tax year, yet to be confirmed.

Update on DIVIDEND TAX and CAPITAL GAINS TAX, pages 157 and 159. For dividend tax, the £2,000 allowance was reduced in the 2022 Autumn Statement. It will fall to £1,000 in 2023, and £500 in 2024. A similar fall will take the capital gains tax allowance from £12,300 to £6,000 and then £3,000. These apply to investments held outside a pension, and don’t apply to a stocks and shares ISA.

Update on LIFETIME ALLOWANCE, page 161 onwards. In our book we described the lifetime allowance as a “distinctive and especially unpopular tax”. It looks like Chancellor Jeremy Hunt must have been as avid a reader of How To Fund The Life You Want as the rest of you, because in his Spring 2023 budget he announced its compete abolition. This is a major and very welcome simplification (although note that the Labour Party has said it will reverse the abolition if it takes power). It means that you can now grow your investment-based (DC) pension pot as large as you like, without suffering a punitive extra tax on growth above £1,073,100. This might seem like an implausible sum, but for those who start early and invest in an evidence-based way, it’s closer at hand than you think. It’s worth noting that this change has a side-effect of limiting the maximum you can claim as tax-free cash to 25% of the current lifetime allowance (£268,275), except if you have taken out specific protections that were available up to 2016. (It will be interesting to see if the £268,275 sum will be uprated to keep pace with inflation.)

Update on VANGUARD AND ESG, page 169. Vanguard has disengaged from a Net Zero initiative, one supported by many other fund managers. This is only one area of ESG, but obviously an important one, as it focuses on climate change. The statement from Vanguard however says that this “will not affect our commitment to helping our investors navigate the risks that climate change can pose to their long-term returns”.

Update on SOCIAL CARE TAXATION, pages 156–7 and 180–184. The Health and Social Care Levy we referred to has subsequently been abolished. The reforms we explain in the book delivering new social care benefits (ie, caps and subsidies) are still the official plan, funded through general taxation instead, from October 2025. However, many political commentators are talking about these reforms as if they are also a dead letter. The 2024 General Election is almost certain to throw them into further doubt. In addition:

- Update on SOCIAL CARE COSTS, page 181, and ANNUITIES, pages 184–5. Given that state support is so uncertain, it is good that the Financial Times ran a useful 2023 article looking at private social care costs, which are (of course) rising; an article that provides fresh data to compare with the figures we gathered in the book. It also points out that “immediate needs annuities” can be bought (from a handful of providers) to pay care costs with a fixed income. Notably, this income will be tax free if it’s paid directly to the registered care provider. No doubt terms and conditions apply, but it’s worth knowing that this type of annuity can be part of the overall mix of choices for later-life annuities.

- Correction on “HOTEL” COSTS, pages 182–183. It only affects the care cost support above, currently planned for 2025. We said that hotel costs, which will be subtracted from residential care costs as you progress towards the cap, could be as much as 2/3 of the cost of residential care. A reader kindly wrote to us to clarify that hotel costs will in fact be capped under the new rules, at £200 a week (2022 figures). (In government jargon, these are referred to as DLCs or daily living costs.) This means that if, at the time of the new rules, you have to stay in a residential care home, you will progress towards the cap (currently £86,000) more quickly than we modelled on page 183. This will be because more of your care home costs will be spent on care itself, not the DLCs. Also, as things stand in 2024, the full state pension figure covers the DLCs.

Chapter 9: Find a first-rate adviser

Update on VANGUARD’S FINANCIAL ADVICE SERVICE, page 216. Sadly this innovative low-cost service has now been closed by Vanguard.

Update on SOURCES OF GUIDANCE, page 212. We also recommend HonestMoneyNow as a deep, wide source of impartial guidance about investing, targeted and written for people living in the UK. It is maintained by the ferociously independent UK Shareholders’ Association.