By JOE WIGGINS

I have an investment decision to make and I want to buy a fund. I need to allocate money to a particular asset class and have to decide whether to use a passive market tracker fund to gain exposure or invest with an active manager. The odds are not in favour of the active option — over the last decade only 10% of managers in the asset class have outperformed the benchmark — however, I have identified a manager with unsurpassable pedigree in the area, a fantastic performance track record and a robust investment process. Which option should I choose?

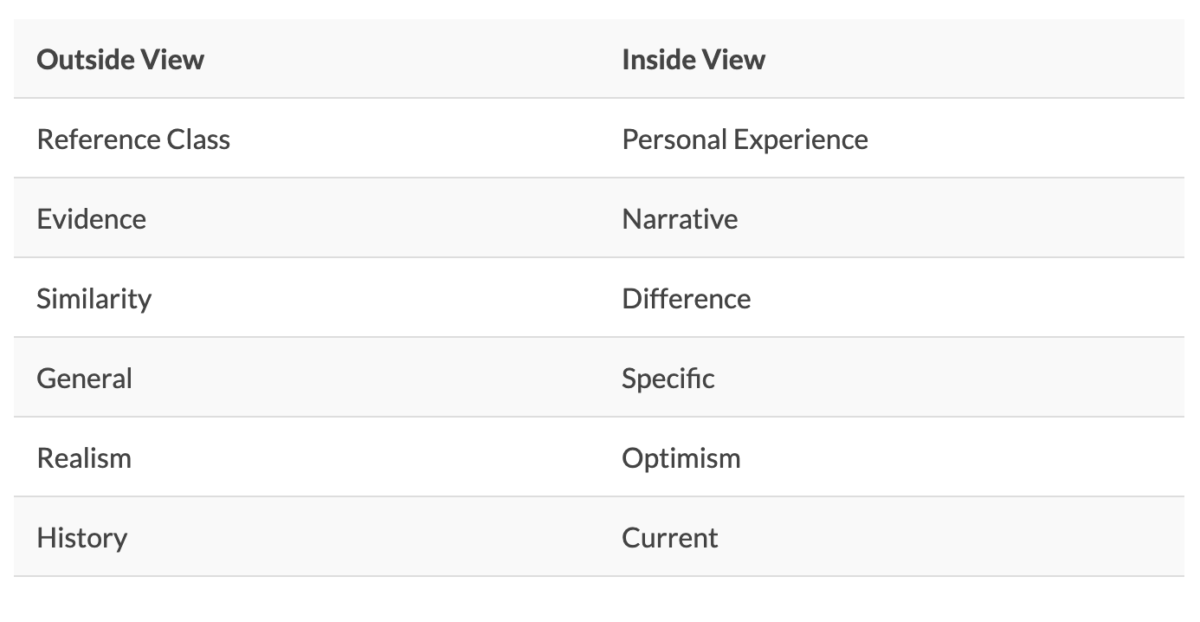

The stark contrast of perspectives underpinning this question is an example of what Kahneman and Tversky would label as the “outside view” versus the “inside view”.[1] The outside view in this scenario is that 10% of active managers achieve success in the asset class, and is what we can consider to be our base case or reference class — it provides a statistical framework for informing a decision. My experience of being impressed by a particular manager is the inside view, which is developed using information specific to my individual case which, as Michael Mauboussin notes, may include “anecdotal evidence and fallacious perceptions”.[2]

We can broadly characterise the outside and inside view informing any decision as having the following features:

Our general tendency is to focus on the inside view – we adore narratives, tend to believe that our own experiences are exceptional and are overconfident in our abilities. Use of the inside view is particularly prevalent in the active asset management industry as, of course, it must be – if something does not work on average then it must be forged on the notion of edge, competitive advantage and exceptionalism.

The inside view is also so much more compelling – those wonderful and usually superfluous stories of active managers gaining an advantage by visiting the factory of a target company (it always seems to be a factory) or meeting management are both diverting and persuasive. The problem is that they do not change the odds; rather they simply encourage us to forget them. We often think that the additional insights from detailed research are improving our decisions, but in many cases they are simply making us neglect the base rate (whilst erroneously increasing our confidence).[3]

Returning to the question with which I began this post; if I select the active manager option then I need to support that decision with one of two claims. I can argue that the base rate is incorrect and therefore the odds are more favourable than they appear — there is something about historical experience which means it is not representative of the future. Alternatively, I can accept the probabilities but possess such belief in my active manager selection capabilities that I am not concerned by them. In most cases we don’t actually make either of these arguments explicitly, we simply ignore the outside view and make the case using our inside view — which is usually sufficiently captivating to overwhelm more prosaic considerations.

This is not to suggest that the inside view is of no merit, but rather it should be used only as a complement or adjustment to the outside view. Our starting point should always be a consideration of the reference class or general evidence that frames a particular scenario. We can then revise this (usually modestly) if we obtain relevant information that is specific to our case. A failure to follow this approach means that we will consistently make decisions which “feel” right but where the odds are stacked against us.

JOE WIGGINS works in the UK asset management industry. He has a MSc in Behavioural Science from London School of Economics. This article was first published on Joe’s blog, Behavioural Investment, and is reprinted here with his permission.

References:

[2] Mauboussin, M. J. (2012). Think twice: Harnessing the power of counterintuition. Harvard Business Review Press.