Robin writes:

I worry for young people from a financial perspective. They’re being pressurised by advertisers, social media and their peers into doing just the wrong things. They’re spending more than they can afford and, instead of investing, gambling their hard-earned money on stocks, cryptocurrencies and risky financial products they shouldn’t go anywhere near. To quote William Bernstein the other day, giving young people access to “free” trading is like handing out chainsaws to toddlers.

Yes, thanks to the dramatic recovery in global markets over the last twelve months, this new generation of amateur traders hasn’t done too badly. The truth is, however, that the vast majority could have done better by simply investing in a low-cost index fund. And, when a crash or steep correction comes, as some day it inevitably will, many of these fresh-faced speculators are in for a rude awakening.

The good news is that there’s a small but growing number of talented financial writers who are trying to steer young people away from all the harmful advice and information at their fingertips. One such writer is IONA BAIN, editor of the excellent blog Young Money.

Iona has written a new book called Own It! which is packed with sensible advice about money, saving and investing. We’re going to be publishing two extracts from the book, of which this is the first. In it Iona explains why, for reasons totally out of their control, people in their 20s and 30s today are at a huge disadvantage, financially, compared to their parents’ generation.

Iona writes primarily for a UK audience, but there’s plenty here that’s of use and relevance to millennials in other countries too.

Let’s start with a reality check. When it comes to money, our generation has been well and truly mugged off. In the past two decades, we have seen not one but two economic shocks that have disproportionately harmed young people. First, we had the 2008 financial crisis, which sparked a series of policy decisions and economic trends that put millennials at a major disadvantage compared to their elders.

Then, we had the cruel paradox of Covid-19. While older people were far more likely to be affected by the virus itself, it was young people (particularly generation Z) who bore the financial brunt of lockdowns and extreme restrictions on all our lives.

Own It! isn’t primarily about economics, but it is the mother of all our personal finances, so let me give you a very broad overview so you can really get the rest of the book. I’ll also be introducing some key concepts to warm you up and some ideas which may sound technical. But don’t worry, all will become clear in due course.

Crash dummies

Like many other millennials, i.e. born between the early 80s and the late 90s, I graduated during the financial crash, which roughly lasted between February 2007 and May 2009.

It was, at that point, the worst global recession since the 1930s Depression. A technical recession is where GDP – that is gross domestic product (the main measure of economic output) – falls for at least six months. The UK’s recession lasted 15 months.

The fallout affected millennials more than anyone else. We faced tougher competition for fewer jobs and had to accept lower pay. By 2018, people in their 30s were typically paid 7% below 2008 levels, while those in their 20s received 5% less. For the over-60s, average pay dropped just 1% from 2008–2018.

Tuition fees were jacked up from £3000 to £9000 a year by 2012 and yet each class of graduates were earning less than the last. By 2015 it was estimated that nearly 59% of graduates were working in jobs that did not even require a degree. Pretty galling, huh?

Those who left school straight after their GCSEs during the crisis were even worse off. They were 20% less likely than previous school leavers to find work, with their wages taking up to seven years to recover.

We have also faced a major housing crisis since 2008. Property prices soared, but housebuilding fell to its lowest level since the Second World War. Banks became much more reluctant to provide first-time buyers with affordable mortgages. All this meant home ownership more than halving among 25–34-year- olds in some parts of the country.

To cap it all, living costs also swelled, from the price of our daily commute to our household bills.

So, as you can see, young people weren’t in a fantastic place even before the Covid-19 crisis came along. Something else that’s proved to be a major financial buzzkill? The decline of savings.

Can savings be saved?

Customers who put their spare cash in a savings account receive a reward known as an annual equivalent rate (AER). This is a form of interest. If you save, you earn interest. If you borrow, you pay it.

Why do banks and building societies pay us to save? Because they use our cash to help provide loans, credit cards and mortgages to borrowers, who pay an annual percentage rate (APR) on their debt to cover all the costs and risks involved.

So, for example, putting £1000 in a savings account with an interest rate of 1.5% would earn you £15 in the first year. But if you borrowed £1000 on a credit card at a fairly typical APR of 20%, you would pay £200 (if you weren’t on an interest-free offer, that is).

In times gone by, banks and building societies relied on cash deposited in their coffers (hence the formal name: deposit savings). All that changed post-2008.

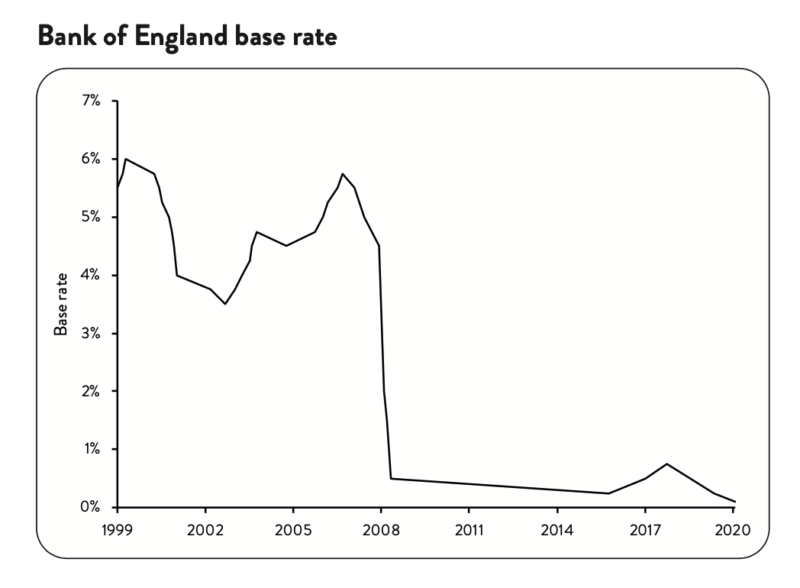

The Bank of England (BOE), the central bank responsible for keeping the UK economy on track, karate-chopped the UK’s national interest rate (usually called the base rate) to just 0.5%.

This eased the pressure on borrowers who didn’t have to pay as much interest on their debts. But since the base rate is the anchor for ALL interest rates in the UK, it also prompted banks and building societies to cut the interest they pay on savings to virtually nothing.

What’s more, the BOE offered cheap loans to banks and building societies, which in turn were passed on to borrowers and businesses from 2012–2018. This scheme, known as Funding for Lending, killed any incentive to reel in savers’ money.

All this was bad enough, but Covid-19 made matters far worse. Prior to the pandemic, the base rate had crept up to 0.75%, but in March 2020 it was slashed to 0.25%, then to a new low of 0.1%, in a desperate bid to keep money flowing around the economy while the UK went into lockdown.

All this means that young people who try to do the right thing and squirrel cash away for the future are getting nada in return.

In fact, they’re being slapped around the face with a wet kipper – and that kipper’s name is inflation.

Let me explain …

Inflation nation

Inflation is the rate at which the cost of stuff rises. It’s measured by an index (or rather various indices, plural) which is a number that gives the value of something now relative to its value at another time.

If the main inflation index – which is the Consumer Price Index in the UK – is at 4%, this means that you need £104 to buy the same stuff this year that you could have bought last year with £100. Inflation reduces the purchasing power of your money.

So, if your savings AER (and indeed your wage growth) is any lower than the rate of inflation, you are LOSING money in real terms.That’s because the value of your money hasn’t grown enough, even with interest on top, to keep pace with the rising cost of stuff.

Inflation isn’t all bad. If we had the opposite – deflation – prices would fall, and consumers would put off big purchases in the hope of getting even bigger bargains in the future, and that would stall the economy. And inflation is great for borrowers (both individuals and governments) because if inflation reduces the value of your money, it also reduces the value of your debt. But when interest rates have slumped, inflation is the savings Death Star. (Cue the Imperial March …)

With inflation mostly higher than typical interest rates for the past decade, we’ve had a truly messed-up situation where people stand to lose money if they save it.

And remember, inflation doesn’t have to be that high for savers to lose out: the base rate just has to stay rock bottom. This is very likely when it makes debt cheaper and might stimulate spending post-Covid, which in turn will probably push up inflation, further squeezing savers.

Economics: don’t cha love it?

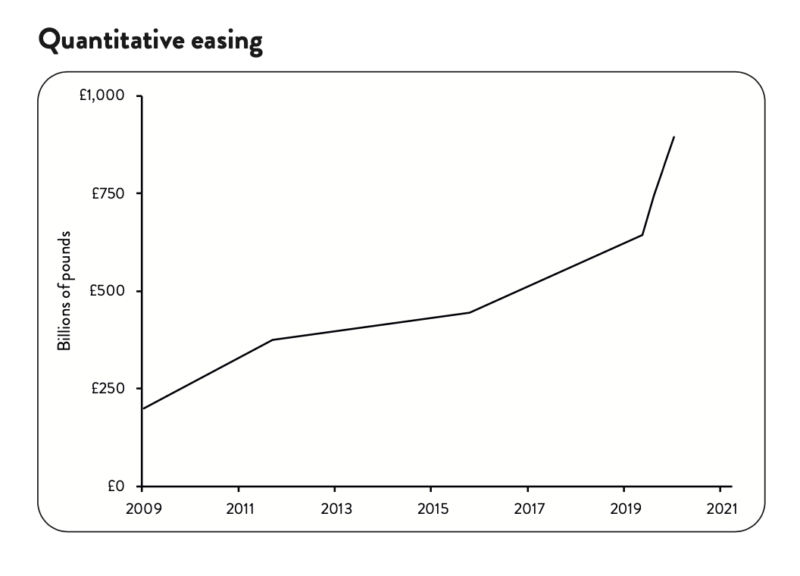

And there’s one more thing to consider: quantitative easing (QE). Try saying that out loud.

Pumped-up banks

Post-financial crash, the central banks used a new trick to try and revive the economy. They created new digital cash to buy a kind of asset. Assets are the bread and butter of this book

– basically, they are valuable things we can own. Lamonts Financial Glossary (oooh!) defines an asset as:

Anything owned that is of benefit. Assets can be tangible (such as property, machinery, cash or investments) or intangible (such as goodwill, trade markets or brand names).

Like many central banks, the Bank of England has used QE (worth £895bn, as of November 2020) to buy a kind of asset known as a bond, specifically a government bond. We’ll talk about these in more detail in part 2. For now, all you need to know is that central banks have done this to try and hold down interest rates across the financial system so that banks, businesses and individuals could use cheap loans to borrow their way back to financial health.

Now, the Bank of England argues that QE has been a boon for young people, raising the average household income by £9000 in a decade, as we benefit from businesses borrowing to expand and paying higher wages as a result.

Hmm.That’s an interesting take. But let’s consider how QE also raised the value of assets right across the economy.

How QE slayed millennials

As interest rates dropped on mortgages (i.e. home loans), it boosted demand for property among those who could afford it – at a time when supply was already low. Property prices rose by 43% in the 2010s, far more than they would have done without QE and far higher than wage growth in the same period.

A more complex but equally important consequence of QE is how it raises the value of another key asset that is a BIG focus of this book. Stocks and shares, commonly abbreviated to shares and also known as equities (stocks, shares and equities are all the same thing), are individual slices of a company that you can own – like pieces of a cake – so long as that company is listed on a stock exchange or stock market.

Companies sell these slices to help raise money for their business. If you buy a share, you own a small part of the company and become a shareholder (or equity holder). The value of your shares will go up and down depending on what’s happening to the company, the industry/country it’s operating in and how well the overall economy is doing.

QE is the gift that keeps on giving for shareholders for many reasons. Stock markets go “yay” when central banks inject money into the economy, while companies can invest and become more valuable if they can borrow cheaply.

Plus, if people can’t earn high interest on bonds or deposit savings, they look for better options elsewhere – like shares. Higher demand for shares raises their value, and more valuable shares raises demand for them.

It’s easy to see how all this more than DOUBLED the value of shares listed on the FTSE 100 index, i.e. Britain’s main stock exchange, over the past decade. Even after the stock market bloodbath of early 2020, market watchers were surprised at just how quickly share prices rebounded on the back of more QE, appearing to defy wider economic pessimism. Most economists now believe QE will become a mainstay of modern economic policy.

Who has benefited from all this? Shareholders and homeowners, who tend to be older people. Millennials have largely missed out on this whole asset-boosting orgy. Sniff.

Snowflakes versus gammons

That’s why we’re hearing so much about intergenerational inequality. And this itself is inflaming intra-generational inequality. That means there is a two-track economy among younger people. Those who can access the Bank of Mum and Dad are doing far better than those who can’t. And that divide is only likely to widen post-Covid.

Young people from more affluent families are also more likely to benefit from The Knowledge. They beat the system. They know the ruses to get on the housing ladder sooner. They take advantage of the loopholes that allow them to pay less tax. They know how to get their costs falling and their long-term wealth rising. Around 9% of them even have second properties!

It’s not just about having a bit more money (though that’s always nice). It’s about the inside track too. It’s a sad irony that the young people who need the most financial guidance and support are the ones least likely to receive it. We used to talk about the haves and the have-nots: now, it’s about the have- helps and have-no-helps.

Now you can see why QE is accused of promoting huge inequality, both between AND within generations, by inflating the prices of assets that richer, older investors already own.9 But we also need to cut the baby boomers some slack.

OK, boomer: let’s call a draw

Yes, parental handouts exacerbate the financial differences among millennials. But what else are families supposed to do? Should they hold back in the vain hope that governments will step up? If our parents hadn’t got involved and become one of the largest mortgage lenders in the UK,10 where would many of us be now?

Plus, boomers have suffered their own woes, from mis-selling scandals to an array of unexpected charges and taxes on their pensions. And they endured the Wild West of banking and financial advice in 1980s–1990s. Bad boys in finance are nothing new!

Besides, we weren’t the only ones screwed over by low interest rates and QE. Many baby boomers scrimped their butts off to pay down mortgages when rates regularly hit the double figures % in the 1970s and 1980s. Was it too much for them to hope they could draw on the interest from their savings in retirement? Seemingly yes.

And having all the natural advantages in the world is still no guarantee that you and your family will always end up on top, such is the minefield that is modern finance. Governments, central banks and financial firms shift the goalposts on savings, investments, taxes and pensions so often, even dodgy old FIFA would object.

People of all ages need to be as sharp as a pin to avoid being bamboozled, befuddled and burnt by financial firms, such is the level of jargon and mis-practice still being allowed by regulators and politicians today.

Don’t get mad, get informed

Now, you’ll be relieved to hear the worst is over. Kudos for sticking with me.

At this stage I wouldn’t blame you for, at least, feeling a bit down and, at most, having the urge to scream into a pillow.

This might sound a bit masochistic on my part but — good! A little bit of righteous indignation should fire you up and make you want to learn how to get the better of all this.

And look, I had to find a way to shock you. There are, like, a bazillion claims on your attention. Most of us are in a near- constant state of ‘overwhelm’ today.

It’s easy to get depressed about your prospects when you glimpse headlines and see nothing but bad news. It’s tempting to push this economic and finance stuff to the back of your mind. But it’s far wiser to face things as they really are so you can take decisive action.

And really – what’s the point in feeling bitter and hopeless? My motto on the Young Money Blog is: “Don’t get mad, get informed.”

Next time: You’ve read about the problem. But what can you do about it?

Own It! by IONA BAIN is published by Harriman House.

PREVIOUSLY ON TEBI

Europe’s active managers failed the test in 2020

The risks in buying individual stocks

After Cowspiracy and Seapspiracy, is it time for Fundspiracy?

Sustainable investing is about returns we may never notice

There’s more to life than trading stocks

Do we become better investors as we age?

Are YOLO traders undermining efficient markets?

Don’t let the stock market distract you

FIND AN ADVISER

“You don’t have to be smarter than the rest,” Warren Buffett has told young people. “You have to be more disciplined than the rest.”

There’s no time like the present to start investing

Need professional help? We can point you in the right direction.

Wherever you are on your investing journey, if you would like us to put you in touch with a suitable adviser, just click here and send us your email address, and we’ll see if we can help.

© The Evidence-Based Investor MMXXI