By ROBIN POWELL

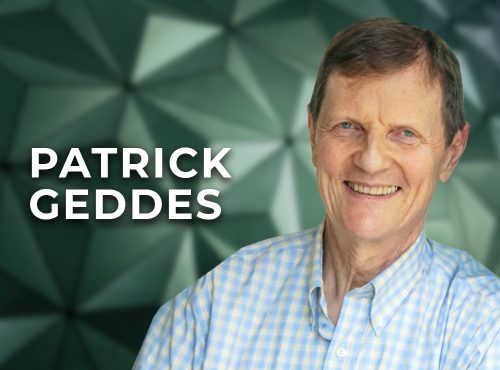

I’d like to introduce TEBI readers who aren’t yet aware of him to Patrick Geddes. I hope his story will inspire you; it has certainly inspired me.

Patrick worked for several years for Morningstar, where he was Research Director and then CFO. In 1999, he co-founded Aperio Group, an equity asset management firm that eventually grew to $42 billion in assets and 100 employees by the end of 2020.

But, for Patrick, making money has never been his primary goal. From the outset, he wanted Aperio to be a different kind of financial company — a firm that genuinely put the interests of his clients first.

“I knew I couldn’t work in a place where I’d have to lie,” he recalls. “That meant I could pretty much work only at a firm I had helped define, specifically to reflect our firm’s name, since the Latin verb aperio means, ‘To make clear, reveal the truth.’”

Repaying a generous world

When Patrick sold the business, that passion for truth-telling and for what he calls transparent investing remained. So he channelled his energies into investor education, producing a book and a website to help ordinary investors to achieve their goals.

“I felt driven to (do it) for a couple of different reasons,” he explains. “First, I’ve been blessed with good fortune in the financial success of Aperio Group. I feel I have an obligation to try to repay somehow a world that had been so generous to me.”

Fixation on the truth

“My second motivation comes from that fixation on the truth, as something I consider to be a sacred thing. When I observe any dishonesty, I get bothered, but when I know an industry and field as well as I know investing, it drives me to distraction to see consumers get fed a lot of self-serving garbage mixed in with the valid services from advisers that provide value.”

The biggest challenge investors face, says Patrick, is bias — bias in financial professionals, but also in themselves. The book and the website are designed to empower them, and to help them make decisions that are best for them and not for those who sell them financial products or advice.

It’s up to you, consumers

“The best way I know to improve things is to get consumers to vote with their dollars,” says Patrick. “I was overjoyed to see consumers wising up about active management and putting such pressure on fees. The more consumers force their own interests first, ahead of the industry’s profits, the better off all future consumers will be.”

If you would like to learn about transparent investing, I would strongly urge you to buy Patrick’s book. If you already feel you know it, why not buy the book for a friend or loved one? All net proceeds will go to support financial education at the Consumer Federation of America.

Transparent Investing: The Course

And now for some even better news. A course to accompany the book has just gone online. There are five modules in total, explaining how transparent investing works, and the whole course takes around four hours to complete. The fourth module will help you decide whether you should use a professional adviser or do it yourself; and if you decide you would like to use an adviser, the fifth module will help you to find one who’s suitable.

As a financial educator myself, I can’t recommend this course highly enough. It’s informative, engaging and entertaining. But most importantly, it’s genuinely designed for your benefit and not to sell you something. Take the lessons on board, and the results could be genuinely life-changing.

And for a limited time only, the course is free to TEBI readers. Use the coupon code “TEBI” when checking out for a 100% discount.

Go on. Learn how to invest with confidence and peace of mind. It might just be the most valuable four hours you’ll ever spend.

PREVIOUSLY ON TEBI

Is a recession coming? We may already be in one

Dividend announcements: What do they tell us about future returns?

Financial bullshit: you may be more susceptible than you think

Overconfidence is a pension manager’s worst enemy

Passive investors, active owners

Picture: Manic Roy via Unsplash

© The Evidence-Based Investor MMXXII