By ALEX BRYAN, Director of Passive Strategies for North America at Morningstar

There are many apparent contradictions in investing. For example, the market quickly responds to news and incorporates public information into prices. This makes it difficult to beat. Yet, simply buying recent winners appears to succeed where diligent fundamental research often fails.

Conflicting messages like this can be confusing. Fortunately, many of these puzzles can be resolved. Their resolutions can provide insight into investment strategies that have a good chance to succeed. Here, we’ll take a closer look at four investment puzzles.

1. The failure of active managers and success of simple rules

Although they are better trained and better equipped than ever, most active stock fund managers have failed to beat their index peers. Yet, simple rules like screening for stocks with high profitability, low valuations, or strong recent performance have succeeded where active managers have failed. Even simply weighting all stocks equally pays off. What gives?

High fees and competition among well-informed investors go a long way toward explaining why active managers underperform. Competition makes it difficult for most to recoup their fees because it drives prices toward fair value by incorporating diverse views, which reduces error. While skilled investors may occasionally have insights the market doesn’t fully appreciate, it’s difficult to consistently find an edge when everyone has access to the same information.

Given that competitive pressure, it’s surprising that many simple rules have beaten the market. It turns out that many of them work because they take advantage of the few factors that have tended to pay off, like value, quality, momentum, and small size. For example, equal weighting tilts a portfolio toward smaller stocks, which have historically offered higher returns than large-cap stocks–possibly as compensation for their higher risk. Mispricing, arising from systematic behavioral biases, is probably a bigger part of the story explaining the success of the other factors.

Many active managers indirectly harness these factors through their bottom-up approach to stock selection. Still, simple rules tend to do better than similar qualitative active strategies.

Stock-picking is hard because the market offers low-quality feedback. Strong performance might reinforce managers’ confidence in their decision-making process, but they often take more credit (and blame) than they deserve. Performance is often more a factor of luck than skill, which makes it difficult to learn from mistakes or even realise when they happen. Simple rules are easier to test, more consistent, and less susceptible to biases that can hurt performance.

2. The market seems efficient, but momentum investing works

Market efficiency is the idea that security prices reflect all relevant publicly available information and adjust quickly to new information, making it difficult to consistently outperform. On the surface, it seems the market is efficient. As soon as news about a company comes out, its impact is immediately assessed by man and machine alike. It gets tweeted, debated, and traded on, almost instantly.

Momentum is at odds with market efficiency. It suggests that it’s possible to predict future performance from past performance–information that is widely available. Price momentum is consistent with the market under-reacting to new information, causing prices to respond more slowly than they should. Herding behavior can also contribute to momentum by pushing prices away from fair value.

How do we reconcile momentum with the apparent speed at which the market reacts to new information and difficulty beating it with fundamental research? The market probably isn’t as efficient as it appears. But most investors don’t benefit from its inefficiencies because they don’t focus on the sources of systematic errors and are susceptible to making the same errors themselves. For example, investors may anchor to an initial investment thesis and discount new information that conflicts with it. Others prematurely sell winners to lock in gains or avoid selling losers in hopes of breaking even. Many are also slow to recognize change. All these effects can lead to momentum.

Momentum could be eliminated if enough investors traded on it, yet most shun the idea, focusing instead on fundamental analysis. Here the competition is fierce and it’s tough to find an edge because everyone is looking at the same data. The presence of momentum suggests investors may be able to uncover fundamental data that isn’t baked into stocks’ prices, but it doesn’t help if most people suffer from the same biases that create momentum.

The market isn’t perfectly efficient, but it’s probably more efficient at valuing companies than most investors, who bring their own biases to the table.

3. Valuations matter, but they’re not an effective market-timing signal

There’s no question that valuations matter. The higher they are, the lower future returns tend to be, and vice versa. So, it would seem reasonable to sell when valuations are high and buy when they are low. But it turns out that isn’t a great strategy.

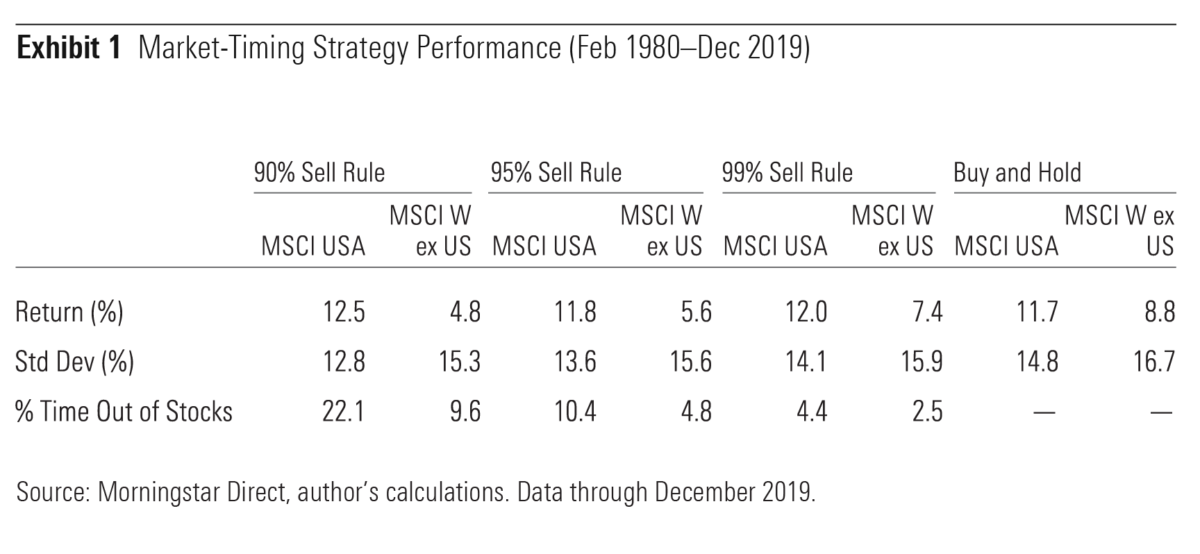

To illustrate, consider a strategy that compares the current price/earnings ratio of the MSCI USA Index against the month-end values over the past 10 years. If the current valuation at the end of each month doesn’t exceed the 90th percentile, it stays invested in stocks for the next month, otherwise it switches into 10-year Treasuries. Exhibit 1 shows the results. It also shows how the strategy would have done if applied to the MSCI World ex USA Index or if investors had waited until valuations exceeded the 95th and 99th valuation percentiles before selling.

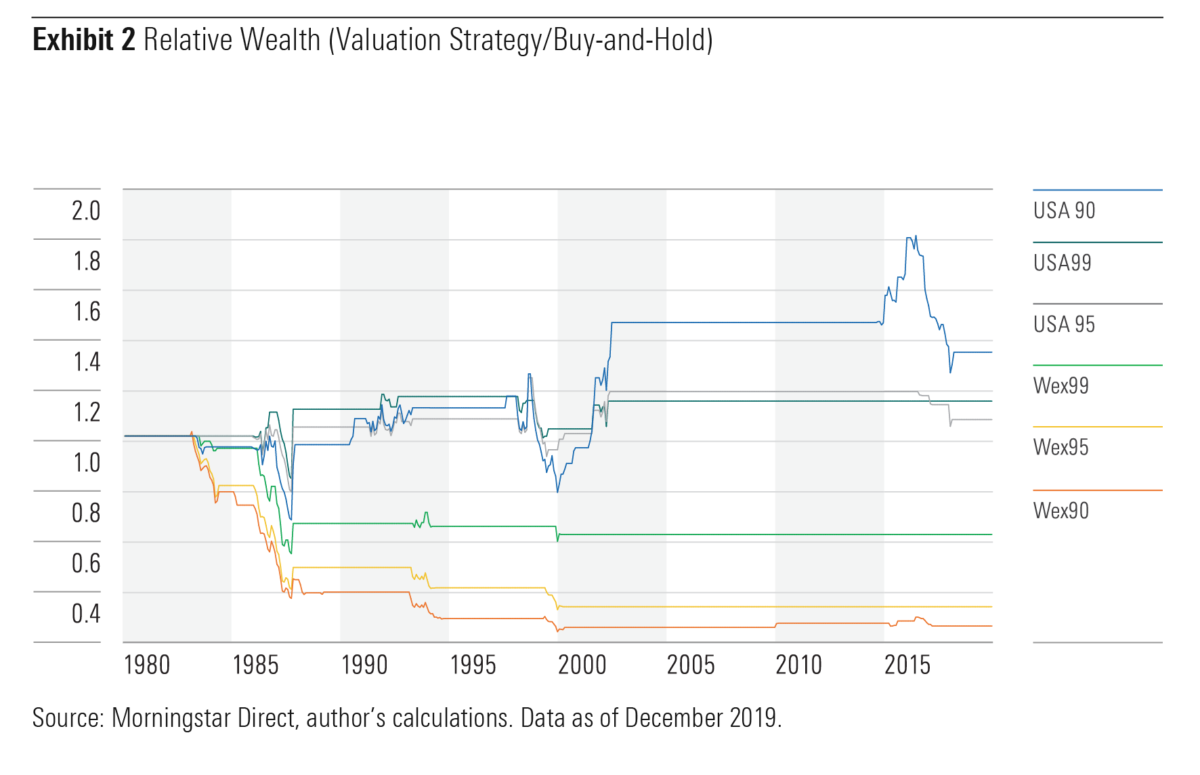

The results are mixed. The valuation-timing strategy posted slightly better returns than the buy-and-hold approach when applied to the U.S. stock index, but considerably lower returns when applied to foreign stocks. A closer look reveals most of the benefit of the U.S. strategy was concentrated in a few brief periods. In between, it experienced long stretches of underperformance, as shown in Exhibit 2.

Why didn’t the valuation-timing strategy work better? There are three reasons. 1) Valuations tend to move in the same direction across asset classes. When they’re high for stocks, bond yields are usually low. 2) Expected returns are almost always higher for stocks than bonds, even when their valuations are high. Otherwise, few would be willing to accept stocks’ greater risk. So, there’s an opportunity cost of being out of the market that can be hard to overcome. 3) The link between valuations and returns is weak over short periods, where there’s still a fighting chance to overcome the opportunity costs.

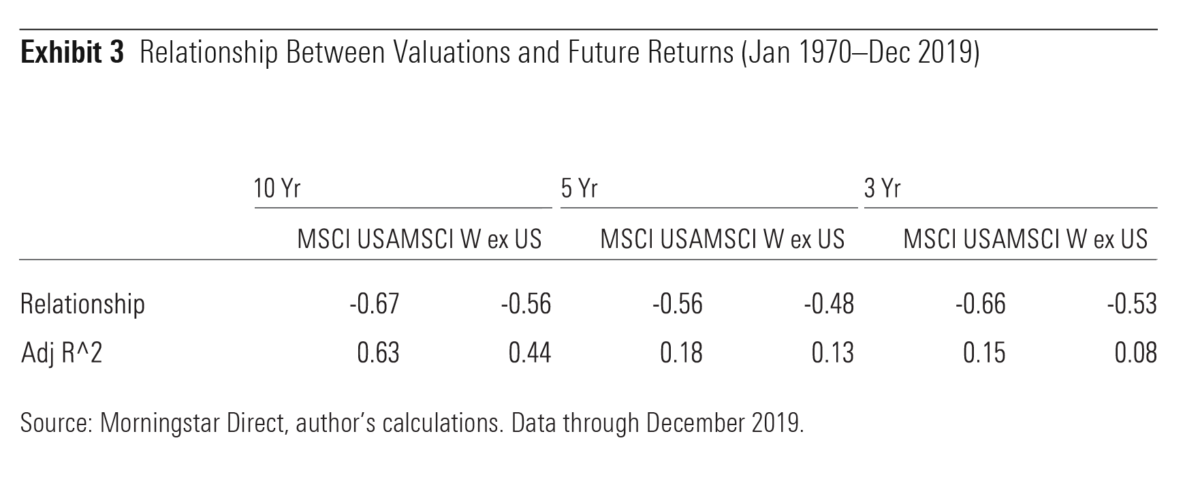

Exhibit 3 illustrates this point. It shows the historical relationship between price/earnings and future returns over several horizons for the MSCI USA and MSCI World ex USA indexes. In each case, there’s a significant negative relationship between valuations and future returns, but that relationship is strongest over long horizons and weak over shorter ones. Valuations can explain 63% of the variation in returns of the MSCI USA Index over 10 years but only 15% over three years. It’s a bad idea to use a long-term signal to make short-term market-timing decisions.

4. Risk and reward are linked, except among stocks (and junk bonds)

There’s a clear relationship between risk and return across asset classes. Cash and short-term government bonds tend to offer miserly returns but carry almost no risk. Bond returns are tied to credit and interest-rate risk. Long-term bonds and those rated below-investment-grade tend to offer higher returns than their short-term and high-quality counterparts. Stocks are riskier still because shareholders get paid after bondholders and there is no legal guarantee that they will be paid anything at all. To compensate, stocks offer higher expected returns.

This makes sense. Rational investors should be willing to take more risk only if they expect to earn higher returns to compensate. Otherwise, why take the risk?

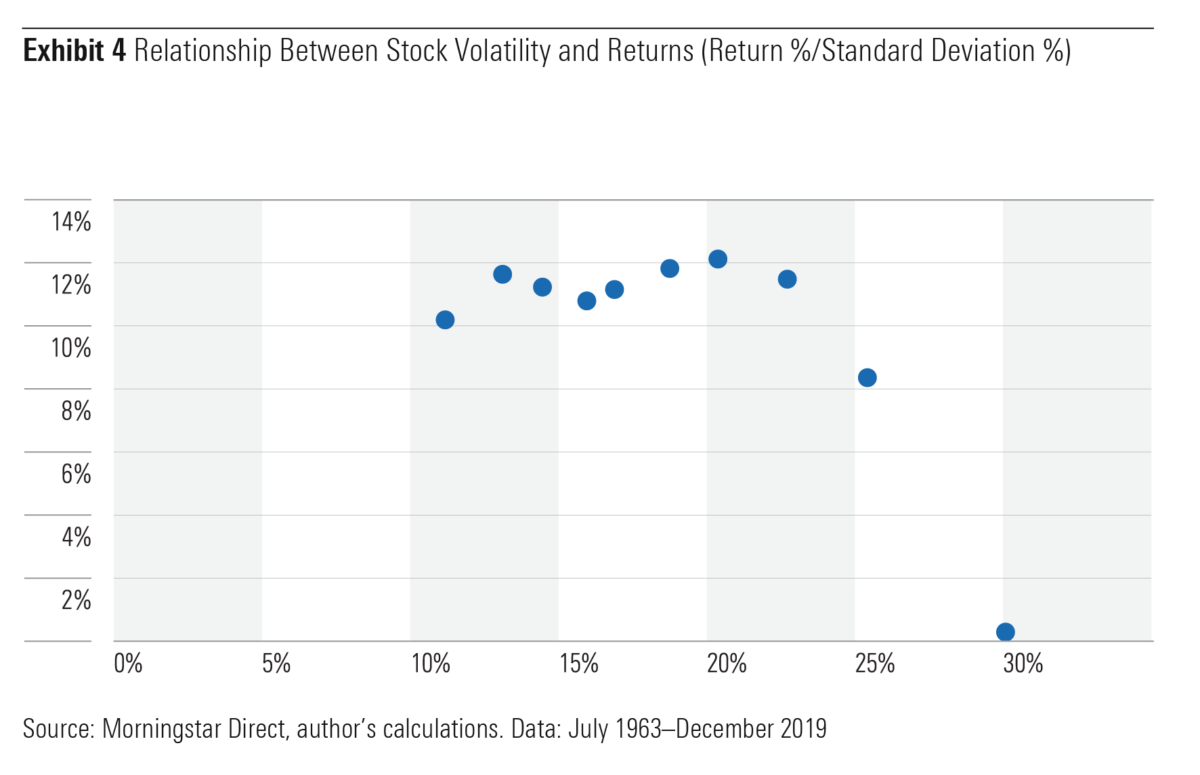

Yet, the relationship between risk and return breaks down within the stock market. (It also breaks down among junk bonds, where the lowest-quality bonds have lagged BB rated bonds over the long term, likely because of yield-chasing.) Exhibit 4 shows the return and volatility of 10 portfolios that selected stocks based on past volatility. The relationship between volatility and return was flat, except among the riskiest stocks, which significantly underperformed.

Volatility isn’t a perfect measure of risk, but it aligns with how most people understand risk. Stocks with greater volatility tend to have greater downside risk; the opposite is true of stocks with low volatility. Why is there a clear relationship between risk and return across asset classes but not among stocks? Risk is front and center in investors’ asset-allocation decisions, but less so when it comes to security selection, where many rely primarily on diversification to control risk. Consequently, risk is more likely to affect expected returns across asset classes.

Risker stocks are more likely to be overvalued than their more-defensive counterparts because they offer greater upside potential, which could make them attractive to investors trying to beat a benchmark. They tend to trade at high valuations, have low profitability, and often face considerable uncertainty. Investors’ greed likely overrode fear, leading to subpar returns.

Embrace complexity

The world isn’t black and white. There are few things investors can take for granted. But those willing to embrace the grey and dig beneath the surface can gain a richer understanding of how markets work and sharpen their edge.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

This article first appeared on Morningstar.com and is republished here with permission.

Picture: Olav Ahrens Røtne via Unsplash