By JASON BUTLER

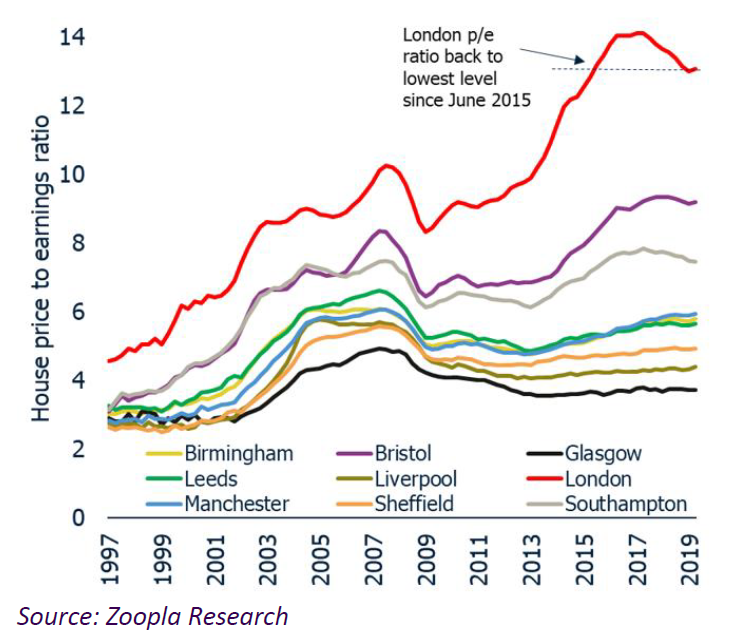

There is no doubt that buying a home is much more difficult today than it was just ten years ago. The main measure of affordability is the average price of a house divided by the average salary. In most regions of the UK this ratio has got larger, with London having the highest ratio as the chart below shows.

Enter the Help to Buy scheme

Not only is it hard for those on average earnings to obtain a big enough mortgage, but they also face having to find enough for a deposit. To address this affordability issue and to boost the supply of new housing, the government launched the Help to Buy (HTB) scheme in April 2013. This enables people who don’t currently own any residential property or land (not just first-time buyers) to buy their main home, with an equity loan from the government on favourable terms. Full details of the scheme are available here.

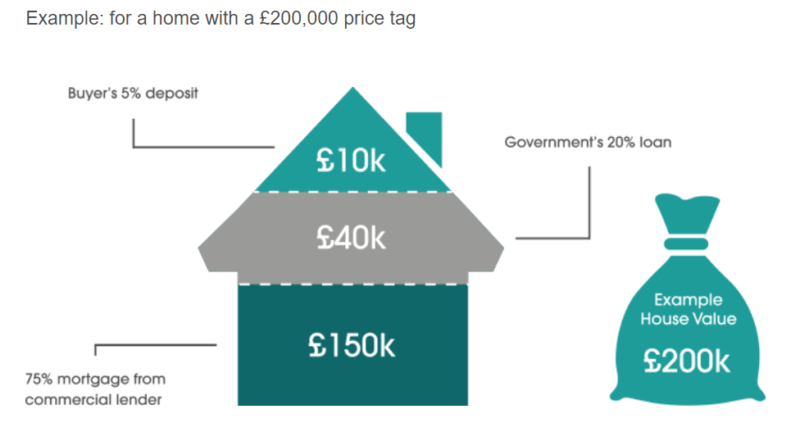

The diagram below shows how the scheme works in simplified form for homes in England, outside of London.

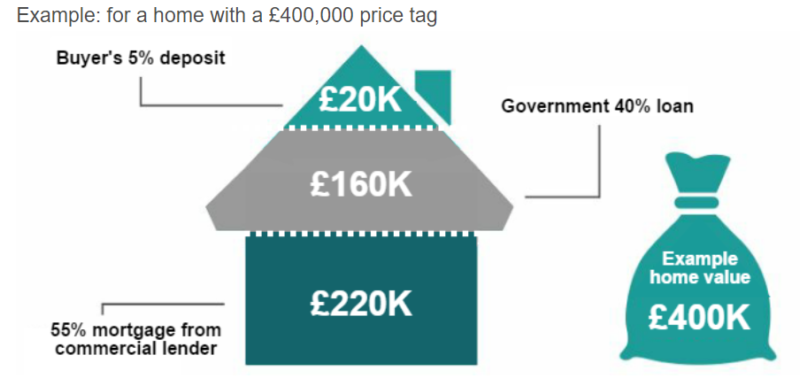

And this diagram shows how the scheme works for homes in London.

Subject to you buying a newly built home in England costing no more than £600,000, from a builder that participates in the HTB scheme, and you paying a deposit of at least 5% of the purchase price, and having a mortgage of at least 25%, the government will lend you up to 20% (40% in London), which will be interest free for the first 5 years.

The only downsides for the scheme are:

Because you can only buy a newly built property, you’ll pay a premium of between 15-20% over the price of a similar “second-hand” property. [1]

The government takes the same percentage of the property’s value when you come to repay the loan or sell the property. This is not great if property values rise, but a great deal for you if the value of your property falls, as you’ll end up repaying less than you borrowed. In this respect the government is taking on up to 20% of the very real risk, particularly in the early years, of the future value going down.

Currently the Help to Buy loan is available to all buyers, not just first-time buyers, but this is due to change in April 2021, when the scheme will be restricted to first time buyers and, outside of London, lower regional price limits will apply.

First-time buyers can also combine the Help to Buy loan with either a Help to Buy ISA (if they have one) or the newer Lifetime ISA to fund their deposit, subject to the purchase price not exceeding £450,000 (or £250,000 in the case of Help to Buy ISA used to buy property outside of London).

Full details of all government homebuying support is available on this website.

How to make your new home even more affordable

There is, however, a way to make your new home even more affordable – whether or not you use any of the government buying schemes – and which few buyers of new homes realise. It’s called negotiating.

Henry Pryor is a very well-known residential buying agent (that means he finds expensive homes for people and negotiates the terms) who frequently provides expert comment on residential property to the media. I asked him how flexible builders are on their asking price for new homes and this is what he said:

“Many buyers, not just first-time buyers, think that the asking price of a property is like the price tag on a jacket in a store. They would never think of haggling. But just as with new cars, you can often get a better deal at the end of the month/quarter/financial year. [The fact is] most builders are hoping that about a third of the price they get is profit. That’s the pain threshold. That’s what’s up for grabs.”

The asking price is just that. Don’t for one-minute think that this what you must pay. Your home is one of the most expensive things you’ll ever buy, so it makes sense to be a savvy buyer.

To summarise:

New homes are priced at something like a 20% premium to second-hand homes. Yes, they might be shiny and new, but they might not be as solid and as well built as an older property that is in good order;

If you’re a first-time buyer or not in a chain, you are very attractive to the builder as you can complete quickly;

About 30% of the asking price (forget any discounts or reductions the sales agent points to from some previous asking price) is the builder’s profit and potentially up for grabs;

The builder is likely to be more motivated to lower their price to do a deal as they approach a quarter or year-end, so bear that in mind, particularly on larger developments;

The less emotionally attached you become to the new property and the more you are prepared to walk away, the more likely you are to be able to negotiate a larger discount. House sales agents are professionals and they rely on emotions clouding buyers’ financial judgement;

The government Help to Buy scheme and ISAs are available at whatever price you pay (below £600,000). The builder can’t stop you accessing that support just because you drive a hard bargain.

My five-step approach to negotiating a new home purchase

Get a mortgage approval in principle – with or without the Help to Buy loan – for the maximum you are prepared to afford in terms of deposit and monthly repayments (don’t forget things like insurance, utilities and maintenance), as this shows you are serious and can proceed with a purchase;

Find at least three possible new homes from different sites that meet your needs, as this will give you options for playing one builder off against another;

Make an offer that is about 25% below the asking price, but with a commitment to complete quickly if accepted;

Don’t offer to meet the builder ‘halfway’ if they counter-offer, but instead go up in 2.5% increments from your opening offer price. You need to anchor them to your initial offer, and not let them anchor you to their original asking price;

Be prepared to walk away if they won’t play ball. Turn the current uncertainty to your advantage. Dismiss any talk from the sales negotiator of ‘last few remaining’ or ‘strong interest’ or ‘demand is increasing’. Prices are about as high as they have ever been, and once people start selling the new homes they bought when Help to Buy first came in about 5 or 6 years ago, and the Help to Buy scheme becomes restricted to first time buyers and lower price caps in 2021, the downside to prices of new build homes looks high.

You have nothing to lose by negotiating a much lower price on a new build property and everything to gain.

Footnotes

[1] https://www.nao.org.uk/press-release/help-to-buy-equity-loan-scheme-progress-review/

JASON BUTLER is a former financial adviser, based in Suffolk. He is a personal finance columnist for the Financial Times, and is Head of Financial Education at Salary Finance. You can find out more about him on his website.

If you’re interested in reading more from Jason, here are a few of the other articles he’s contributed to TEBI:

Beware investing in serviced accommodation

Time to face up to your money mistakes

Five steps to achieving financial freedom

If you don’t ask, you don’t get

Match your spending with your values

Image: Martin Sepion (via Unsplash)