Each year, DIMENSIONAL FUND ADVISORS analyses returns from a large sample of US-domiciled mutual funds. Its objective is to assess the performance of mutual fund managers relative to benchmarks.

This year’s study, Mutual Fund Landscape 2019, has now been published and it updates results through to the end of 2018.

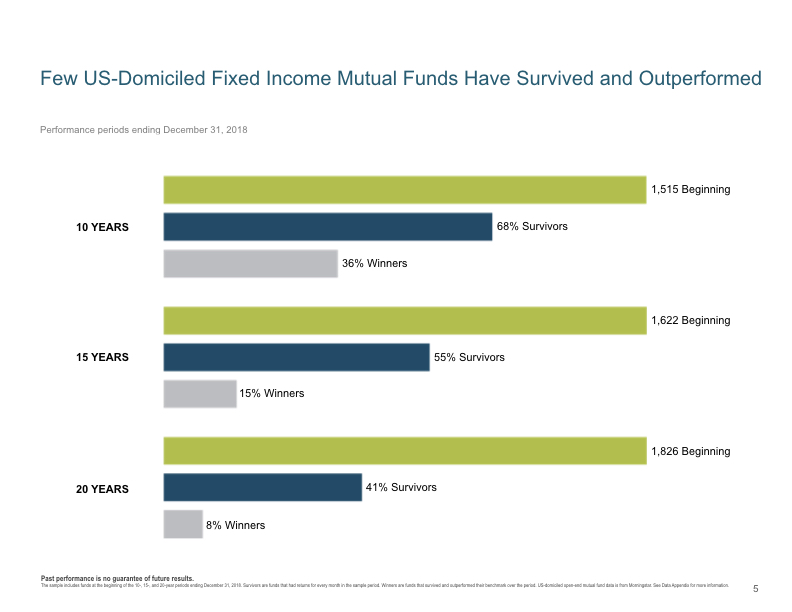

The research, which is based on data provided by Morningstar, shows that a majority of fund managers in the sample failed to deliver benchmark-beating returns after costs. Success rates for fixed-income funds were even lower than they were for equity funds.

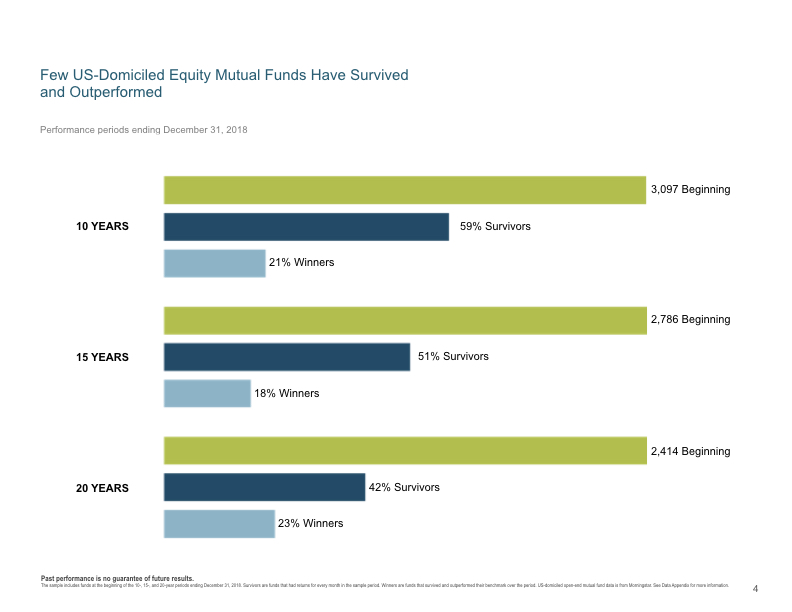

In fact, by the fund industry’s standards, just surviving is an achievement. 41% of funds that existed in 1999 failed to survive 10 years, 49% didn’t last 15, and a majority (58%) of them didn’t make it to the start of 2019.

Surveying the landscape

The global financial markets process millions of trades worth hundreds of billions of dollars each day. These trades reflect the viewpoints of buyers and sellers who are investing their capital. Using these trades as inputs, the market functions as a powerful information-processing mechanism, aggregating vast amounts of dispersed information into prices and driving them toward fair value. Investors who attempt to outguess prices are pitting their knowledge against the collective wisdom of all market participants.

So, are investors better off relying on market prices or searching for mispriced securities?

Mutual fund industry performance offers one test of the market’s pricing power. If markets do not effectively incorporate information into securities prices, then opportunities may arise for professional managers to identify pricing “mistakes” and convert them into higher returns. In this scenario, we might expect to see many mutual funds outperforming benchmarks. But the evidence suggests otherwise.

Across thousands of funds covering a broad range of manager philosophies, objectives and styles, a majority of the funds evaluated did not outperform benchmarks after costs. These findings suggest that investors can rely on market prices.

Let’s consider the details.

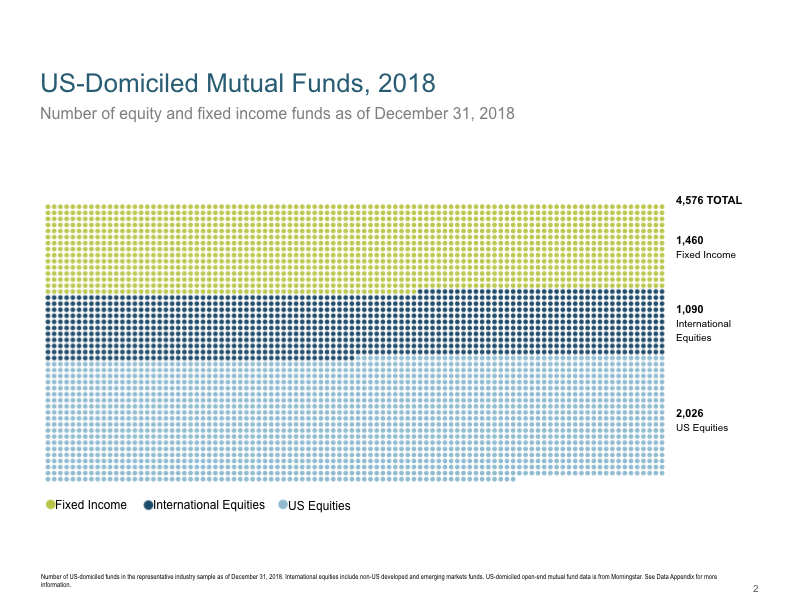

As at December 31, 2018, the sample evaluated in this study contained 4,576 US-domiciled mutual funds. Collectively, these funds managed more than $8 trillion in shareholder wealth.

Disappearing funds

The size of the mutual fund landscape can obscure the fact that many funds disappear each year, often due to poor investment performance.

Investors may be surprised by how many mutual funds disappear over time. More than half of the equity and fixed income funds were no longer available after 20 years.

Including these non-surviving funds in the sample is an important part of assessing mutual fund performance because it offers a more complete view of the fund universe and possible outcomes at the time of fund selection. The evidence suggests that only a low percentage of funds in the original sample were “winners”—defined as those that both survived and outperformed benchmarks.

Survival and outperformance rates were low. For the 20-year period through 2018, 23% of equity funds and 8% of fixed income funds survived and outperformed their benchmarks.

The search for persistence

Some investors select mutual funds based only on past returns. But sometimes good track records happen by chance, and short-term outperformance fails to repeat.

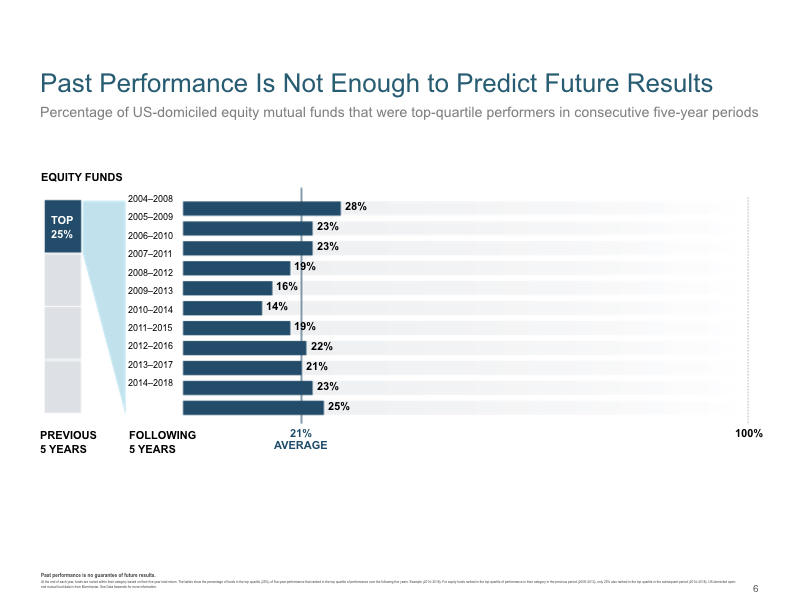

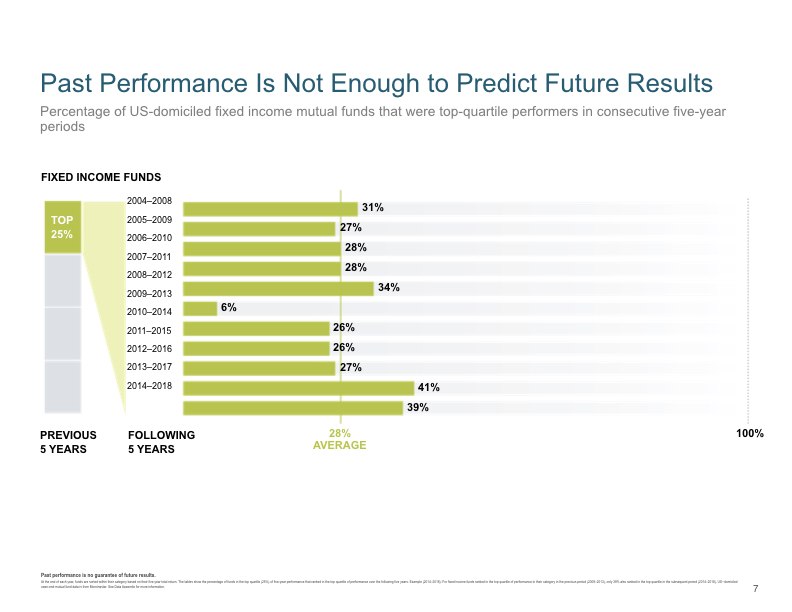

The exhibit shows that among funds ranked in the top quartile (25%) based on previous five-year returns, a minority also ranked in the top quartile of returns over the following five-year period. This lack of persistence casts further doubt on the ability of managers to consistently gain an informational advantage on the market.

Some fund managers might be better than others, but track records alone may not provide enough insight to identify management skill. Stock and bond returns contain a lot of noise, and impressive track records may result from good luck. The assumption that strong past performance will continue often proves faulty, leaving many investors disappointed.

Most funds in the top quartile of past five-year returns did not repeat their top-quartile ranking over the following five years. Over the periods studied, top-quartile persistence of five-year performers averaged 21% for equity funds and 28% for fixed income funds.

The impact of costs

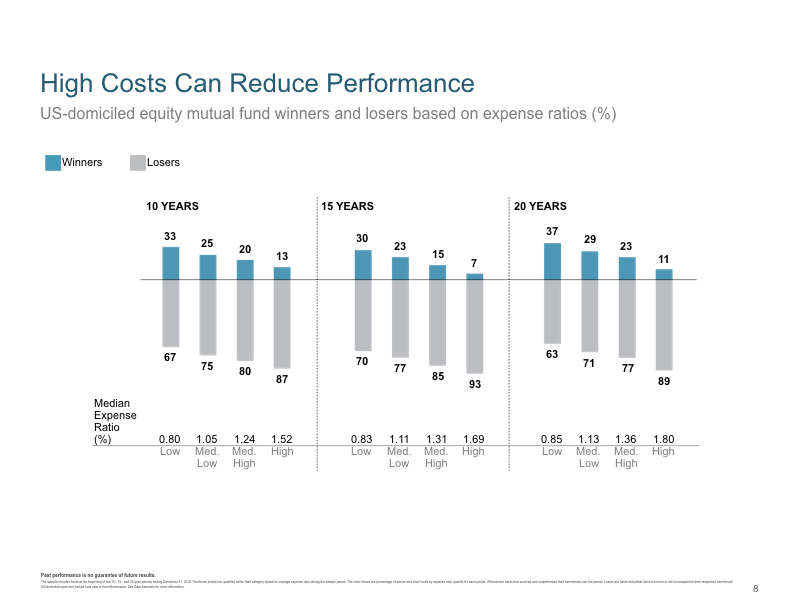

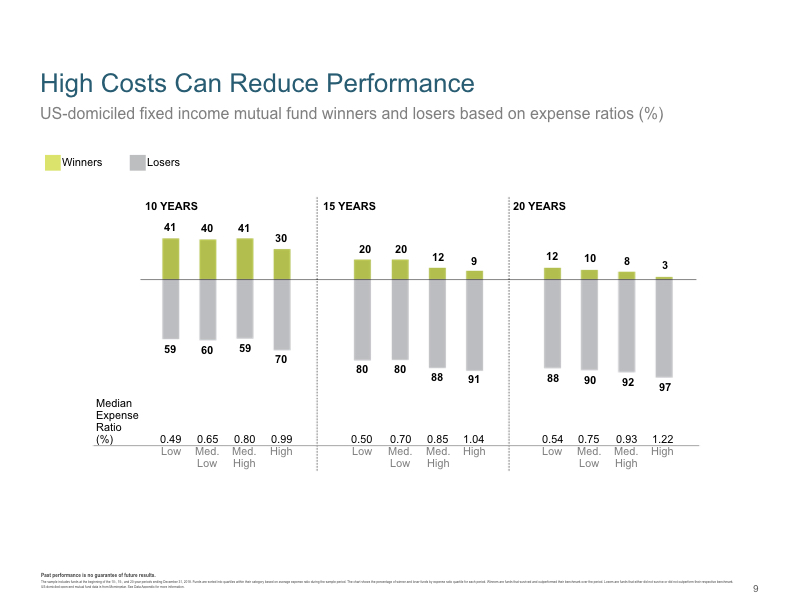

Why do so many funds underperform? A major factor is high costs, which reduce an investor’s net return and increase the hurdle for a fund to outperform.

All mutual funds incur costs. Some costs, such as expense ratios, are easily observed, while others, including trading costs, are more difficult to measure. The question is not whether investors must bear some costs, but whether the costs are reasonable and indicative of the value added by a fund manager’s decisions.

Let’s consider how one type of explicit cost—expense ratios—can impact fund performance. Our research shows that mutual funds with the highest expense ratios had the lowest rates of outperformance. Especially for longer horizons, the cost hurdle becomes too high for most funds to overcome.

High fees can contribute to underperformance because the higher a fund’s costs, the higher its return must be to outperform its benchmark. Therefore, investors may be able to increase the odds of a successful investment experience by avoiding funds with high expense ratios.

Funds with higher average expense ratios had lower rates of outperformance. For the 20-year period through 2018, 11% of the highest-cost equity funds and 3% of the highest- cost fixed income funds outperformed their benchmarks.

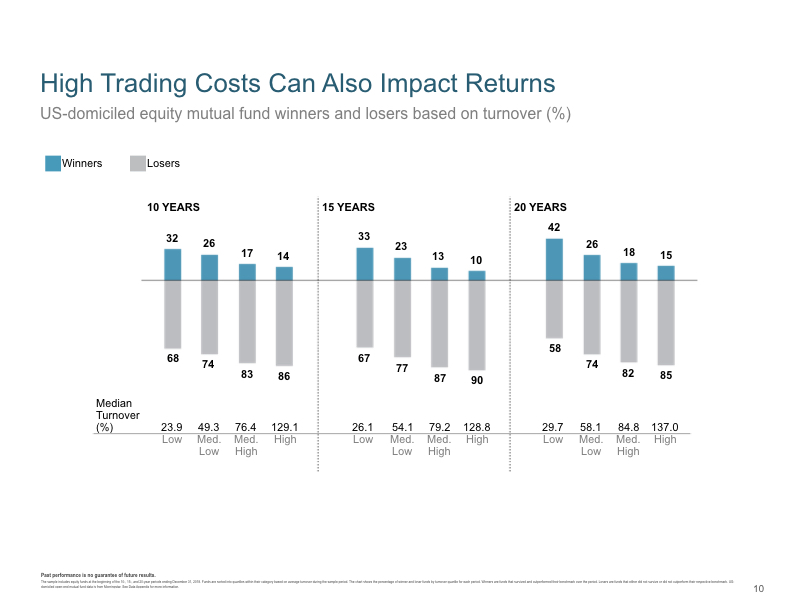

Costly turnover

Other activities can add substantially to a mutual fund’s overall cost burden. Equity trading costs, such as brokerage fees, bid-ask spreads and price impact, can be just as large as a fund’s expense ratio. Trading costs are difficult to observe and measure. Nonetheless, they impact a fund’s return—and the higher these costs, the higher the outperformance hurdle.

Among equity funds, portfolio turnover can offer a rough proxy for trading costs. Turnover varies dramatically across equity funds, reflecting many different management styles. Managers who trade frequently in their attempts to add value typically incur greater turnover and higher trading costs.

Although turnover is just one way to approximate trading costs, the study indicates that funds with higher turnover are more likely to underperform their benchmarks. The reason is that excessive turnover creates higher trading costs, which can detract from returns.

For all periods examined, equity funds in the highest average turnover quartile had the lowest rates of outperformance. For the 20-year period through 2018, 15% of the highest-turnover funds outperformed.

Summary

The results of this study suggest that investors are best served by relying on market prices. Investment methods based on a manager’s ability to outguess market prices have resulted in underperformance for the vast majority of US-domiciled mutual funds.

We believe the research highlights an important investment principle: The capital markets do a good job of pricing securities, which intensifies a fund’s challenge to beat its benchmark and other market participants. When fund managers charge high fees and trade frequently, they must overcome high cost barriers as they try to outperform the market.

Despite the evidence, many investors continue searching for winning mutual funds and look to past performance as the main criterion for evaluating a manager’s future potential. In their pursuit of returns, many investors surrender performance to high fees, high turnover and other costs of owning the mutual funds.

Choosing a long-term winner involves more than seeking out funds with a successful track record, as past performance offers no guarantee of a successful investment outcome in the future. Moreover, looking at past performance is only one way to evaluate a manager.

In the end, eligible investors should consider other aspects of a mutual fund, such as underlying market philosophy, robustness in portfolio design and attention to total costs, all of which are important to delivering a good investment experience and, ultimately, helping investors achieve their goals.

In brief

The performance of US-domiciled mutual funds illustrates the power of market prices. For the periods examined, the research shows that:

Outperforming funds were in the minority.

Strong track records failed to persist.

High costs and excessive turnover may have contributed to underperformance.

The findings are also summarised in this short DFA video:

This article was written, and the charts provided, by Dimensional Fund Advisors.

You can find more from Dimensional Perspectives here:

Do IPO returns match the hype?

Robert Merton: Technology and trust should go hand in hand