Leave alpha to the daredevils

Comments Off on Leave alpha to the daredevils

Robin writes:

The American columnist Marilyn vos Savant once wrote: “Skill is successfully walking a tightrope over Niagara Falls. Intelligence is not trying.” It’s a truth that every investor should take to heart.

Of course, if you’re a professional tightrope walker — funambulist, I’m told, is the technical term — this isn’t addressed to you. If you can do it, want to do it or need to do it, grab your pole and go ahead. No, I’m talking about the rest of us who can only marvel at your skill and bravery.

It’s also extremely difficult to beat the stock market — or, in the industry jargon, generate alpha — on a consistent basis. But the good news is, as NICK MAGGIULLI explains, you simply don’t need to try. The only people who have no choice are professional fund managers, whose highly paid jobs depend on outperforming the market every now and again.

As Warren Buffett says, we should all aim to stay within our sphere of competence. Risk comes from not knowing what you’re doing.

So, know your limitations. And remember, the smarter you try to be, the worse you do.

Since quarantine started, I have been doing a lot of cooking at home. I am guessing you probably have been too. In the course of trying to become a better home cook, I came across Adam Ragusea’s YouTube channel.

Ragusea is a journalism professor turned amateur cook/ YouTuber whose sharp wit and high quality videos teach practical cooking skills to other wannabe home cooks like myself. Some of his most popular videos include how to make NY style pizza at home, why seasoning your cutting board is better than seasoning your steak, and using your oven to make ultra-crispy french fries. I’m getting hungry just typing this out.

However, it was Ragusea’s video titled You don’t need knife skills — just walk, don’t run that caught my attention. In the video Ragusea dispels the myth that you need to have great knife skills in order to be a successful home cook. The premise of his argument is simple: Knife skills only matter if you have to use your knife a lot.

For example, as a home cook you might need to chop up one onion, a handful of carrots, or a few cloves of garlic to feed yourself or your family. But, as a professional chef, you would need to chop up 50 onions, 10 pounds of carrots, or 100 cloves of garlic. Your knife technique and how quickly you can chop definitely matters in the latter case, but not in the former.

Simple arithmetic

The reasoning is simple arithmetic. If better knife skills can save 30 seconds when chopping a single onion, this will have little impact on you spend your day. However, multiply that 30 second savings by 100 onions and now, your poor knife skills have caused you to spend an additional hour chopping onions. Now that’s something to cry about.

Bad jokes aside, this is the difference between professional chefs and amateur cooks like you and me. The professionals need proper technique to be efficient because their jobs depend on it, but the amateurs can get by with far less sophistication.

Alpha is completely unnecessary

This same argument can be easily translated to investing where professional investors seek out market-beating performance (“alpha”) that is completely unnecessary for retail investors like us. The difference here is that professionals have billions of dollars they are trying to manage, while you and I only have money in the thousands to millions range.

For an asset manager with $10 billion, every additional basis point (0.01%) in annual return generates $1 million in additional assets. For a retail investor with $100,000, every additional basis point only generates $10 in new assets.

Very few fund managers actually do it

Of course, those basis points can make a difference if they are compounded over decades. But how many people have earned alpha (net of fees) consistently for multiple decades? Conservatively, I would say there have been a couple of hundred throughout history.

Being one of those people (or trying to select them ahead of time) is near impossible.

What good would it do anyway?

More importantly, how much will that alpha change your financial life even if you do happen to acquire it? For a little bit of annual alpha, the answer is very little.

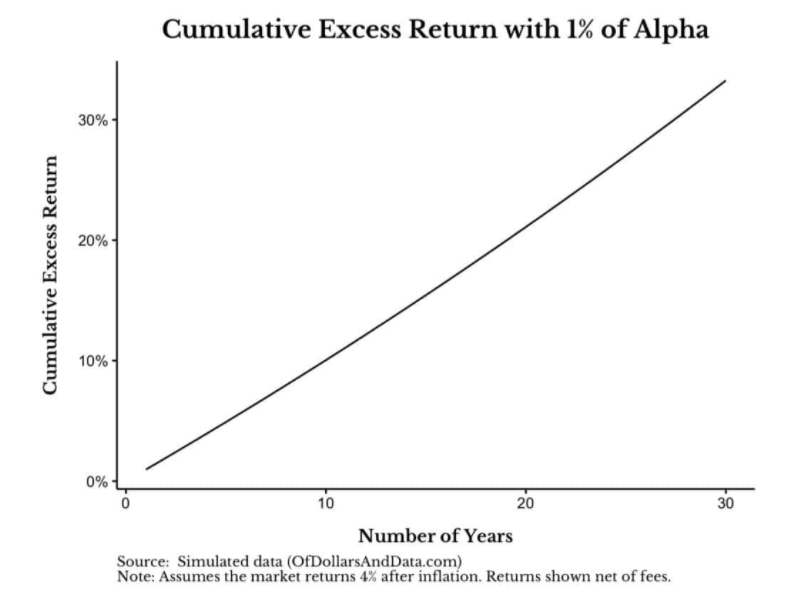

For example, let’s assume that the market will return 4% a year (after-inflation) going forward and you can earn 1% above this (net of fees) over the next 10 years. How much more money would you have 10 years from now? About 10% more:

After 20 years, you’d have about 20% more and after 30 years, you would have a little over 30% more.

Of course, having 10%, 20%, or 30% more is great, but it’s not going to transform your retirement. You won’t go from living in a low-cost city in the U.S. to living off the beach in Monaco. You just won’t.

However, in trying to chase that alpha, you do run the risk of underperforming… or worse.

What really matters

So what really matters for your financial goals for the next few decades? How the overall market does. It’s all in the “beta”.

Don’t believe me?

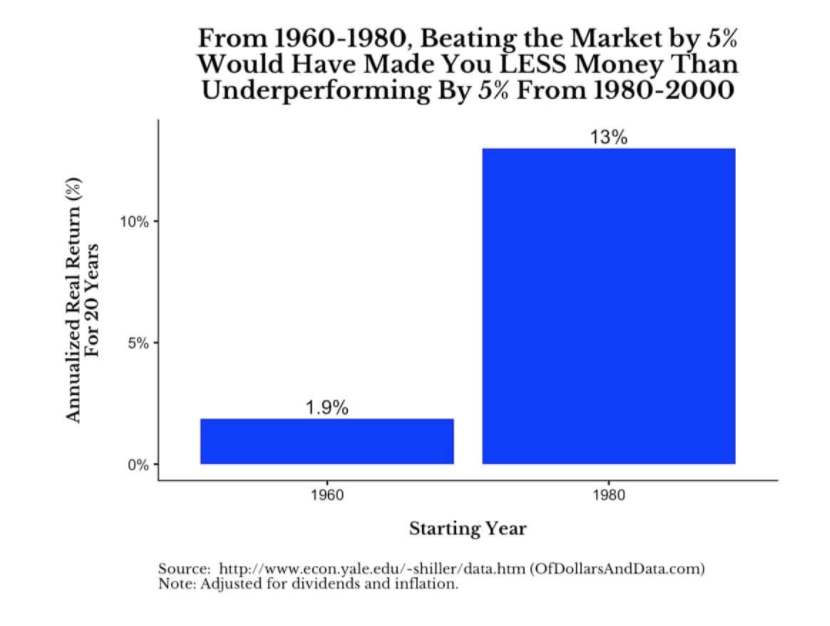

Consider one of the most surprising things I have ever discovered on this blog. If you had beaten the market by 5% a year from 1960-1980, you would have made less money than if you had underperformed the market by 5% a year from 1980-2000:

Think about how insane that is. Someone at the top of their game in 1960-1980 made less money than a complete fool from 1980-2000. Yes, this is the most extreme form of cherry picking, but it’s true nonetheless.

It goes to show that even for the people who chase alpha, they need beta too. For example, if the stock market returns -2% a year for the next decade, having alpha of 1% still means you lost 1% annually! No one wants that outcome.

Still, many retail investors worship at the temple of alpha when they really should be praying for beta.

We focus on the wrong things

The problem is that they are focusing on the wrong things. There was a 2011 article that found that 74% of retirement success can be attributed to savings rate. The other 26% was explained by asset allocation among other things.

Therefore, the best financial advice I can ever give you is also the most obvious: save more money and worry far less about your investment returns.

But we all don’t have that luxury. For someone who just started saving for retirement at age 55, they do need alpha and lots of it. Otherwise, they are unlikely to amass any serious amount of wealth before their retirement in the next decade. Sad, but true.

What’s good for the pros isn’t good for amateurs

I understand that I am preaching to the choir when I say that “you don’t need alpha,” but the message is far bigger than that. Our society has a tendency to say that what is good for the professionals is good for amateurs. But that’s almost never true. Just because Usain Bolt can eat chicken nuggets and then win a gold medal, it doesn’t mean that you can.

The same is true in investing. Buffett, Soros, and every other professional money manger chasing after alpha, are playing a completely different game to you and I. Yet, financial commentators will compare your investment performance to theirs without considering your goals or motivations.

What worked for one person may not work for you

Quantification and comparison in finance is easy, but comparison without context can be damaging. I tried stressing this when comparing net worth by age and education level and I will stress it again here: what worked for one person may not work for you. This is especially true when we are comparing people with vastly different life experiences and skill sets.

So, leave the alpha to the dare devils and focus on the more important things in life.

NICK MAGGIULLI is a data scientist working with Ritholtz Wealth Management in New York City. This article first appeared on his blog, Of Dollars and Data, and is republished here with his kind permission.

Here are some of Nick’s other recent articles:

Why are so many young people trading stocks?

Understanding imposter syndrome

Why failed predictions are soon forgotten

What’s the worst that could happen?

Here are some recent articles you may have missed:

Stop admiring your successful trades

Three truths about ESG investing

Hedge fund fees are much worse than you thought

Should you invest with Baillie Gifford?

Is there such a thing as a “normal” stock market?

Active or passive — which is more volatile?

Picture: Ryan Tauss via Unsplash