The years between 2017 and 2021 were a frustrating half-decade for value investors. The S&P 500 Growth Index advanced at a compound annual rate of 24.1%, more than double the 11.9% return of its Value counterpart. Despite occasional (and sometimes prematurely celebrated) periods of success, Value underperformed Growth in four years of the five (and its win in 2019 was close).

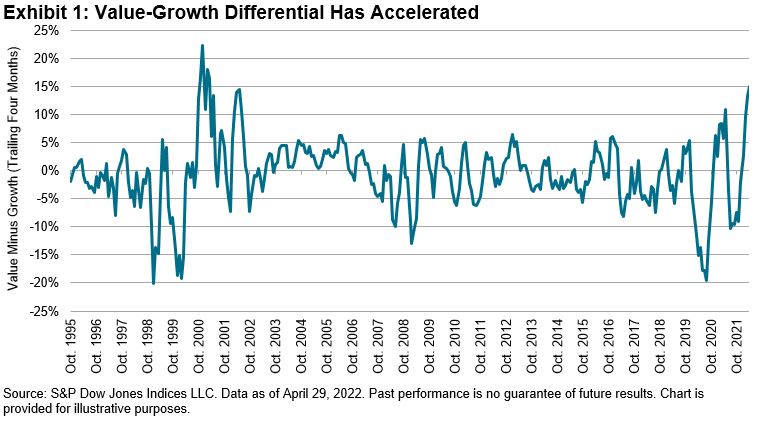

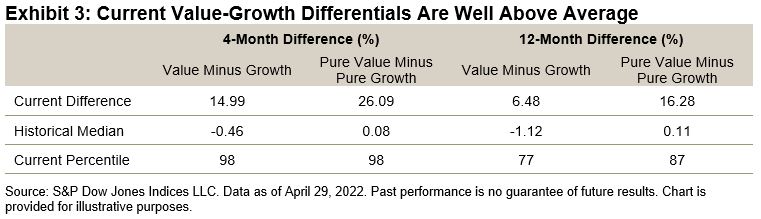

In the first four months of 2022, however, the style winds shifted, as Value (-5.0%) dramatically outperformed Growth (-20.0%). Exhibit 1 puts this difference in historical context, comparing January-April 2022 to all other trailing four-month intervals in our database. The 15% gap between Value and Growth is obviously high by historical standards, and represents a dramatic reversal from recent trends. (As recently as nine months ago, the gap favoured Growth by more than 10%.)