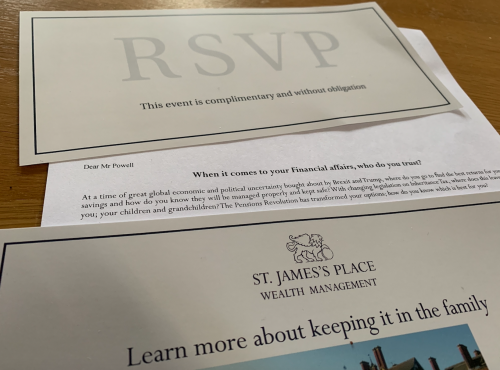

I wrote a few months ago about an invite I received to a “complimentary” event at a country hotel from a firm called St James’s Place Wealth Management. I’m sure I would have enjoyed the setting, as well as the food and drink on offer. But I’m equally sure that the investment advice dispensed that day was of rather more dubious quality.

Generally speaking, these sorts of events are best avoided. But it’s especially important, in my view, to steer clear of firms like St James’s Place.

My reasoning was very well articulated in a piece by Jim Coney in the Sunday Times (21st July 2019), The title tells you everything you need to know: St James’s Place is a money-making machine — for itself.

A new client every ten minutes

St James’s Place, or SJP for short, is Britain’s biggest wealth management firm. In 2018 the company signed up a new customer about once every ten minutes and made an operating profit of more than £1 billion.

Why such a big profit? Because, in short, having your money managed by SJP is staggeringly expensive. In a separate article, in the same edition of the Sunday Times, Ali Hussain spelled out the eye-watering effect of fees and charges on an investment of £1 million, growing at 6% a year.

“The client,” claimed Hussain, “would lose a whopping 43% (£340,743) if they held the firm’s most popular balanced portfolio. Over 20 years, the client would lose 45% (£993,658).”

Yes, you read that correctly. To invest £1 million with SJP, you’re paying almost another £1m over 20 years. It’s completely bonkers. Remember, it’s your money. You provide 100% of the capital, you take 100% of the risk, and yet, in that particular example, you’re giving up almost half of your returns in costs.

Who’s paying for the drinks?

“Think about this,” writes Coney, “the next time you see your friendly SJP adviser ordering a round of drinks at the golf club. When he slaps you on the back and says, ‘I’ll pay for these,’ you may want to point out that he isn’t paying. You are.”

St James’s Place is an example of what’s called a vertically integrated wealth manager. As well as by charging for advice, it also makes money from the fact that its advisers recommend SJP’s own products.

It’s a highly lucrative business model. The more the adviser persuades clients to invest, the more he or she is paid.

If that sounds to you very much like the advice industry in the 1980s, then you’re right, it is. Advisers, in those days, were paid commission for selling investment products. Commissions were banned in the UK as part of the Retail Distribution Review, or RDR, which came into effect at the end of 2012. But, you could argue, at firms like SJP, commissions still live on in all but name.

Another example of a vertically integrated investment firm is Hargreaves Lansdown. Over 20 years, the Sunday Times calculates, investing £1 million with Hargreaves Lansdown means losing 29% of your returns in fees and charges. No, it’s not as expensive as SJP, but £643,728 is still a vast sum of money to have to forgo, just for having your money managed. Can anyone honestly call that a fair return?

How much should you pay for good customer service?

In fairness to both St James’s Place and Hargreaves Lansdown, both are renowned for providing a high level of service. But no matter how good the service is, does it really warrant paying hundreds of thousands, and perhaps millions, of pounds more than you need to over the course of your investing lifetime?

Come on. It’s time to wake up the smell the coffee. This isn’t the 1980s any more. You can invest nowadays, in a broadly diversified, low-cost index fund, for less than a quarter of one per cent a year. Just think what you could do with all that money you’ll save.

The original version of this article was published on the Fair Return blog.

Picture: Yutacar via Unsplash