We’re still waiting for the SPIVA data on how active funds fared in 2021. But, once again, performance was disappointing. As ANU GANTI, index investment strategist at S&P Dow Jones Indices, explains, conditions were particularly tough for active managers.

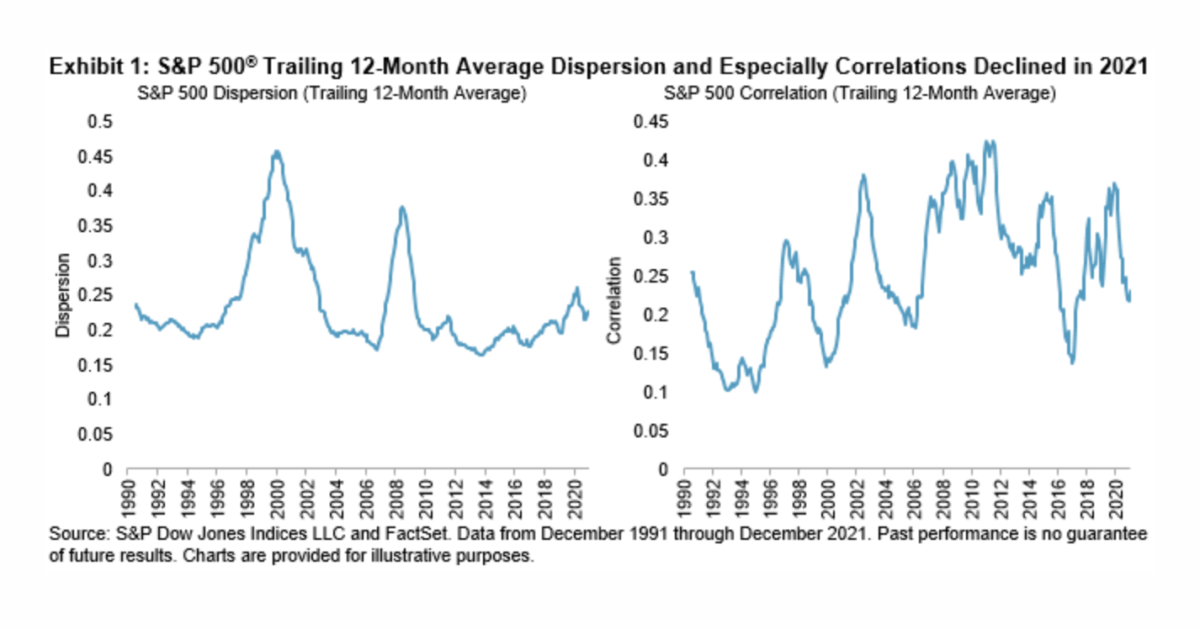

We can use volatility and its components dispersion and correlation to analyse stock selection conditions globally. Most active managers run less diversified, more volatile portfolios than their index counterparts. Active managers should prefer above-average dispersion because stock selection skill is worth more when dispersion is high. The role of correlation is more subtle. While counterintuitive, the benefit of diversification is less when correlations are high. Therefore, they should prefer above-average correlations because it will reduce the opportunity cost of a concentrated portfolio. We observe in the U.S. that while 12-month average dispersion declined slightly, we saw a dramatic decline in correlations in 2021 compared to 2020.

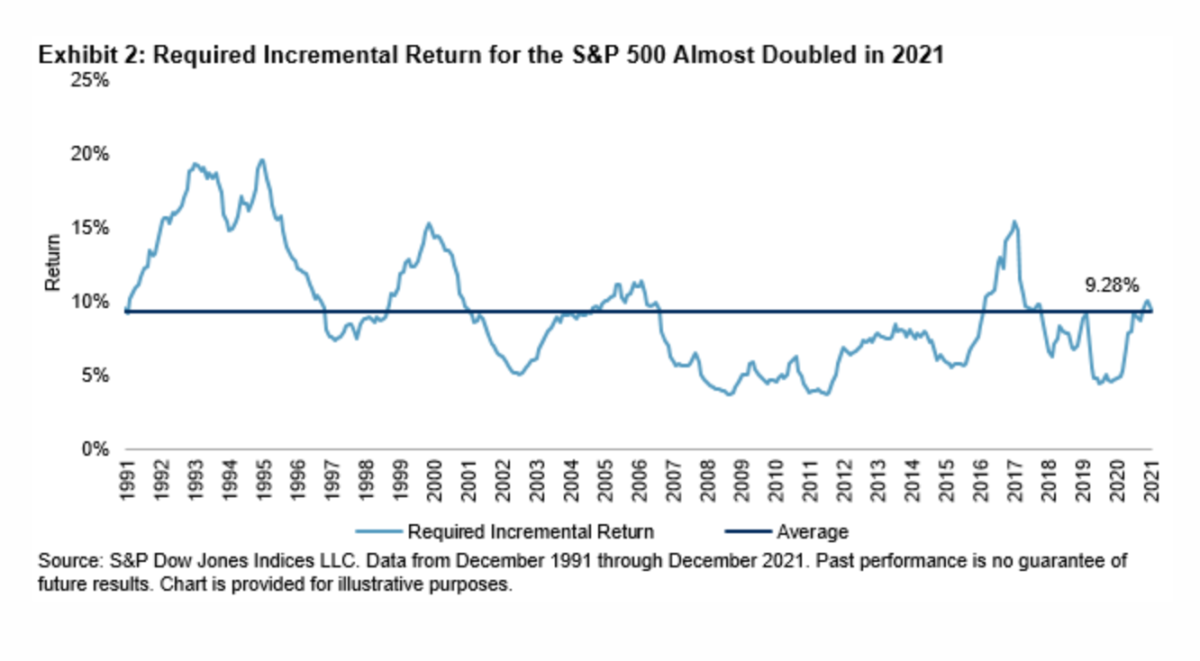

Two years ago, we conceptualised the cost of concentration, defined as the ratio of the average volatility of the component assets to the volatility of a portfolio. A higher cost of concentration implies a larger foregone diversification benefit, translating into a higher hurdle for active managers to overcome.

How much higher do returns have to be to justify the additional volatility active managers take on? By multiplying the cost of concentration by a rate of return consistent with the market’s historical performance (e.g., 10% for the S&P 500), we arrive at the required incremental return shown in Exhibit 2 for the S&P 500. Driven by the lower correlations seen in Exhibit 1, this measure almost doubled last year, indicating that active managers gave up a larger diversification benefit in 2021 than in 2020.

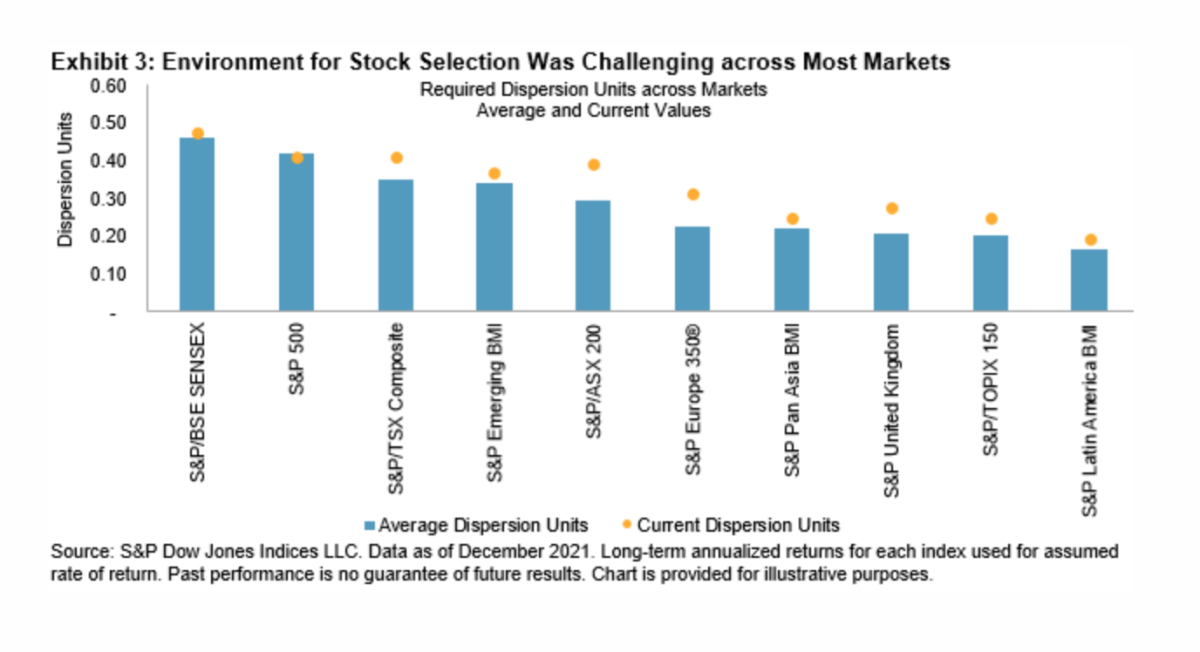

Finally, to understand how difficult it is to earn this incremental return, we divide the required incremental return by dispersion to translate the measure into dispersion units. We can interpret a higher number of dispersion units to mean more challenging conditions for active management.

The bars in Exhibit 3 indicate the average value of the required incremental return in dispersion units for several indices across regions. As dispersion and correlations were generally lower, we observe a relatively more difficult environment for active management across most markets.

The challenging environment for stock selection is not unique to the U.S. 2021 stands in stark contrast to 2020, when both dispersion and correlations rose globally. Despite those relatively favorable conditions for stock selection, most active managers still underperformed, proving that true stock selection skill is rare. When SPIVA results for 2021 become available, it would not be surprising if we saw dreary global active management performance once again.

ANU GANTI is Senior Director, Index Investment Strategy, at S&P Dow Jones Indices.

MORE FROM S&P DJI

For more valuable insights from S&P Dow Jones Indices, you might like to read these other recent articles:

Is today’s market conducive to successful active management?

Reasons for optimism post COP26

How will a strengthening dollar affect emerging markets?

How should an infallible vaccine for Omicron be priced?

Australia the only exception as fund managers flop again

How index investing can help tackle climate change

Picture: Keenan Constance via Pexels

© The Evidence-Based Investor MMXXI