2022 was a very tough year for portfolio managers. It was largely a case of limiting the damage. Unusually, it was supposedly cautious that were hardest hit. But closer inspection of the returns delivered by different managers in the UK shows a large disparity between the returns produced by apparently similar strategies.

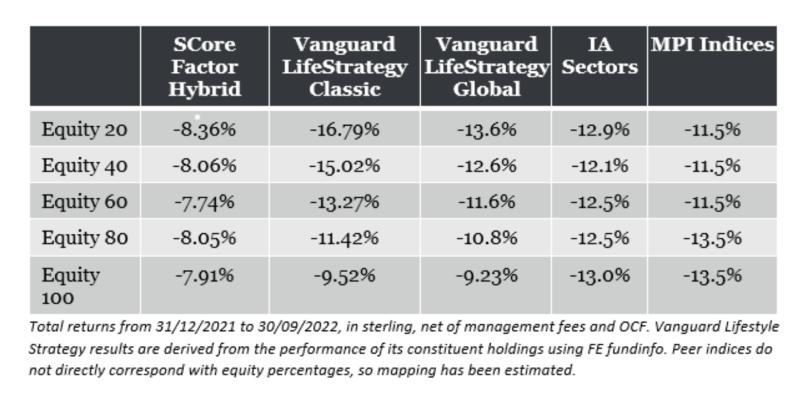

For example, Vanguard’s UK-tilted LifeStrategy Equity 20 and Equity 40 funds fell 16.79% and 15.02% respectively. But the equivalent funds from another passive provider, Sparrows Capital’s SCore MPS Factor Hybrid portfolios, fell 8.36% and 8.06% respectively.

So why such a big difference in outcomes? As Sparrows Capital’s YARIV HAIM explains, it was down to five differences in the way the SCore MPS portfolios are constructed.

In the last quarter of 2022, Citywire published an article outlining the torrid effect of the September Gilts sell-off on Vanguard’s LifeStrategy Classic portfolios.

2022 was a difficult year for investors who were expecting bonds to soften losses in multi-asset portfolios in turbulent times. Any portfolio holding fixed income during a period of rising interest rates will experience price falls as bonds reprice to new market levels. The size and speed of government rate hikes and associated bond market repricing meant that even inflation-linked bonds recorded losses in an environment of rising inflation.

Changing market and economic conditions provide a useful opportunity to review the performance drivers within portfolios, to reflect on how different design inputs behave in different market environments, and to examine any unexpected outcomes.

Portfolio construction varies considerably, and both advisers and investors should ensure that they are aware of the design subtleties when making investment decisions.

Similar investment approaches produced very different outcomes in 2022 and, with a few exceptions in lower-risk portfolios, passive approaches outperformed active — in some cases by a substantial margin. Most notably, supposedly low-risk portfolios struggled in a rising rate environment.

The table above highlights the variability of outcome across three broadly similar evidence-based MPS ranges We have focussed on the first nine months of 2022, being the peak-to-trough of the recent turbulence.

While all three strategies comfortably outperformed the IA and MPI peer indices at the equity level, differences in construction led to wildly varying outcomes as the equity percentage reduces.

What are the key design elements that might contribute to this divergence?

1. Investment philosophy

Performance will vary between active managers, and even more so between active and passive managers. But the Vanguard and Sparrows Capital models all follow an evidence-based investment approach; portfolios are constructed strategically, funds are selected and held over a long period of time and intervention is normally limited to rebalancing events. Nevertheless, substantial differences in construction and performance can arise.

At the equity level, all three passive implementations substantially outperformed the peer indices. There are two components at play here: firstly, and counter-intuitively (since it is intended to improve investor outcomes), the tendency of active managers, who make up the bulk of the peer group, to intervene in troubled markets; and secondly, the tendency of active managers to implement home bias.

2. Risk characteristics

Performance needs to be reviewed against risk. It is informative to review the history of a given portfolio in terms of both volatility and Sharpe ratio, to establish whether performance differences over time relate to different risk characteristics. Graphical comparisons from ARC, MPI, the lang cat and Morningstar can be very helpful in this regard.

Comparing these three portfolios in FE fundinfo, we see that the equity-only portfolio in Sparrows Capital’s SCore Factor range exhibited an annualised volatility of 13.02% in the first three quarters of 2022, while the Vanguard Classic 100 counterpart recorded an annualised volatility of 13.93% and Vanguard Global came in at 16.61%.

On the fixed income side, the SCore Factor Equity 20 portfolio recorded an annualised volatility of just 5.50%, reflecting its relatively short duration, while its Vanguard equivalents came in at 8.54% (Classic) and 8.11% (Global) respectively.

This underlines the significance of relative volatility in identifying differences in construction and risk in both the equity and fixed-income element of the portfolios. It also demonstrates that equity percentage should not be relied on as the sole indicator of portfolio risk when matching portfolios to a given attitude to risk.

3. Home bias

Many professionally managed investment portfolios are heavily skewed to their home market. Whilst the UK economy accounts for around 2.9% of world GDP, most domestic investors hold a far greater exposure to UK assets than this figure would suggest. It is a well-documented fact that home bias tends to detract from performance, regardless of where an investor is based.

Sparrows Capital’s evidence-based approach excludes home bias at the design phase. We deliver global portfolios within which UK assets are held proportionally. This protects portfolios from idiosyncratic domestic risk, such as we saw with the Truss / Kwarteng mini-budget.

Confusingly, there is relatively little performance differential between Vanguard’s Classic and Global MPS portfolios in 2022 at the 100% equity level. We would have expected the increased home bias in the Classic portfolios, with its associated market and FX implications, to have produced a return closer to the peer group, but this is not the case.

In the first nine months of 2022, the real difference in outcome was on the fixed income side. While duration is one major driver of performance differential, there is also a clear distinction between the results of the Vanguard Classic and Global constructions, driven by the heavier use of UK gilts in the former.

While interest rate rises have been a global phenomenon this year, the UK has suffered particularly badly, largely through government attempts at self- immolation. This experience clearly demonstrates the risks of home concentration within a portfolio.

4. Currency

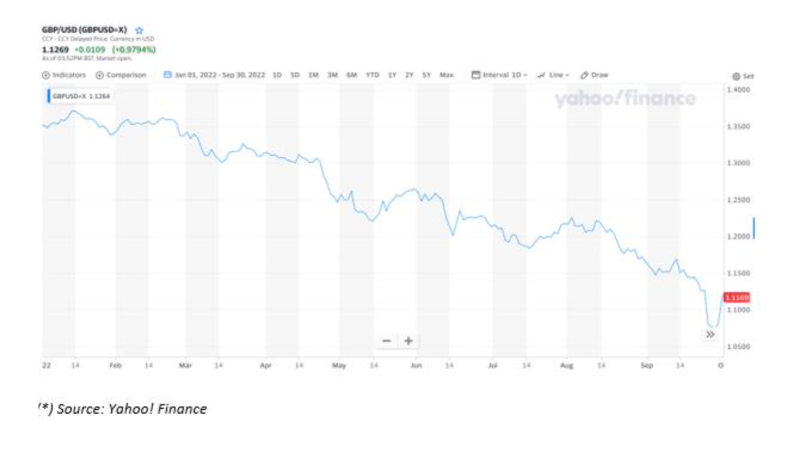

A key element of design and driver of performance is FX exposure. Sterling fell sharply against the US dollar during the first three quarters of 2022:

At the turn of the year 1 pound sterling would have bought 1.3522 US dollars. As of September 30th, the same pound would only buy 1.1169 US dollars, a swing of some 21% (sterling has, of course, recovered considerable ground since then). Unhedged dollar-denominated assets in a portfolio that reports its performance in pounds benefited from that same swing in currency values, reducing the effect of the global bear market.

Drawing on the academic literature, Sparrows Capital’s SCore MPS follows a mixed approach to currency exposure. Global fixed income exposure within the portfolios is hedged to sterling while equity exposure is unhedged.

The decision is designed to eliminate currency volatility within the lower-risk defensive component of the portfolio while accepting FX volatility and drift in the risk component (equities).

In the first three quarters of 2022, this allowed the equity losses in the SCore portfolios to be largely offset by currency movements; the difference in performance relative to the peer indices underlines the tendency of UK managers to implement home bias, with a consequent inherent reduction in FX exposure relative to a strict global portfolio.

5. Bond duration

The prices of long-dated bonds are more sensitive to changes in interest rates than short-dated bonds. When creating portfolios, a manager must decide the duration of any fixed-income component.

When designing the SCore portfolios, Sparrows Capital chose to keep the duration relatively short.

Our approach reflects our view of the purpose of fixed-income holdings. We regard bonds as a marginally productive asset in which to place non-equity risk for the purposes of calibrating portfolio risk to an end investor’s risk tolerance.

Bonds also add diversification, and in many cases, their price behaviour can be negatively correlated to equities, although that was emphatically not the case during the period under review.

Our view of fixed income as a defensive asset leads us to focus on short-dated bonds and to access risk premia mostly through equities and equity factors.

6. Credit risk (issuer)

Alongside duration, portfolio design involves decisions about credit risk in the fixed-income portfolio.

Domestic government bonds are regarded as less risky than foreign bonds, as it is unusual for a sovereign borrower to default on domestic debt. Corporate and high- yield bonds bring the added dimension of business risk into the equation.

Analysis shows that credit risk in a fixed-income portfolio is highly correlated, in price terms, to equity risk, with the additional complication of unreliable liquidity characteristics.

Sparrows Capital’s view of fixed income as a defensive asset class leads us to broadly exclude credit risk from the portfolio by focusing on developed market sovereign bonds.

Evidence-based investing is disarmingly simple in concept but quite complex in execution. Model portfolios, whether evidence-based or actively managed, can vary substantially, and the manager’s approach to risk and portfolio design can significantly affect future performance.

This article focuses on a short timeframe under very specific market circumstances to highlight the effect of portfolio construction techniques. Over the longer term, in positive trending markets, the spread of potential outcomes might be narrower and the relative performance quite different.

Our purpose is to highlight the importance of advisers understanding how the portfolios they recommend are designed and being aware of how their chosen strategies might behave in different market scenarios.

IMPORTANT INFORMATION

Past performance is not a guide to the future and clients may receive back less than their investment. The income generated by investments may fluctuate and their value may be affected, positively or negatively, by movements in exchange rates. All data used in this document is believed by Sparrows Capital Limited to be reliable but no warranty of such is provided.

YARIV HAIM is the founder and CEO of Sparrows Capital.

PREVIOUSLY ON TEBI

UK investors are still too heavily concentrated in UK assets

Light green or dark green? Most of us are in between

Study sheds light on cognitive dissonance in active management

© The Evidence-Based Investor MMXXIII