By LARRY SWEDROE

My May 7, 2021, Evidence-Based Investor article, Spac or Spam?, warned investors about investing in special-purpose acquisition companies (SPACs), presenting evidence demonstrating that SPACs were highly likely to be losing propositions to their shareholders due to the unfavourable incentives built into the SPAC structure that result in the SPAC sponsors doing well even if SPAC shareholders experience substantial losses. The article made the case that it was difficult to believe this was a sustainable arrangement, as at some point SPAC shareholders would become more skeptical of the mergers that sponsors pitch. In other words, SPACs were a bubble that likely would burst. Forewarned was forearmed.

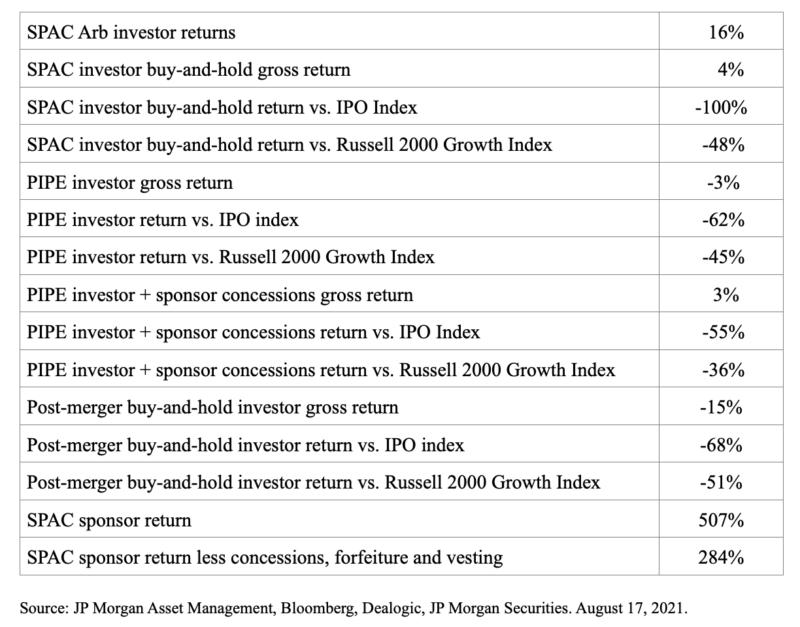

Thanks to JP Morgan, we now have more evidence on just how poor an investment SPACs have been for their shareholders. The table below provides a return analysis for investors in SPAC companies brought public or liquidated from January 1, 2019, to March 5, 2021, with the median cumulative returns through August 17, 2021:

JP Morgan noted: “These sub-par outcomes are not just the case with 2019-March 2021 SPACS. We ran the same analysis for the 85 SPAC mergers since March 2021, and the same patterns hold: enormous returns for SPAC sponsors, low positive absolute returns for SPAC Arbitrage investors and negative returns for everybody else.”

They added: “Institutional ‘PIPE’ [private investment in public equity] financing has dried up, forcing sponsors to allocate more of their economics to securing institutional commitments that are guaranteed to fund at closing; and increased risk that SPACs do not find a merger partner before their two-year lifespan, in which case the SPAC would be unwound, SPAC investors would receive their capital back and sponsors would lose all of their upfront investment.”

And finally, they added this caution: “SPACs may be an exaggerated preview of what lies in store for other overpriced assets unsupported by earnings growth.” Again, forewarned is forearmed.

One of the benefits of working with a good wealth adviser is that they prevent you from investing in products that were meant to be sold, never bought.

Important Disclosure: The information presented here is for educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured author are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. LSR-21-145

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of numerous books on investing.

ALSO BY LARRY SWEDROE

Book-to-market: Is its explanatory power declining?

Tactical asset allocation vs static indexing: Who wins?

Why aren’t women more involved in household financial decisions?

Does market power create systemic risk?

A duration-based explanation for equity factors

Factor drift: what it is and how to tackle it

PREVIOUSLY ON TEBI

Is Australia’s affordable advice dream fading?

Why young investors should embrace EBI

Which country will outperform next is irrelevant

The Great Wealth Transfer: Are you ready for it?

If I can give up meat, you can too

How do bad advisers manage their own money?

CONTENT FOR ADVICE FIRMS

Through our partners at Regis Media, TEBI provides a wide range of high-quality content for financial advice and planning firms. The material is designed to help educate clients and to engage with prospects.

As well as exclusive content, we also offer pre-produced videos, eGuides and articles which explain how investing works and the valuable role that a good financial adviser can play.

If you would like to find out more, why not visit the Regis Media website and YouTube channel? If you have any specific enquiries, email Sam Willet, who will be happy to help you.

© The Evidence-Based Investor MMXXI