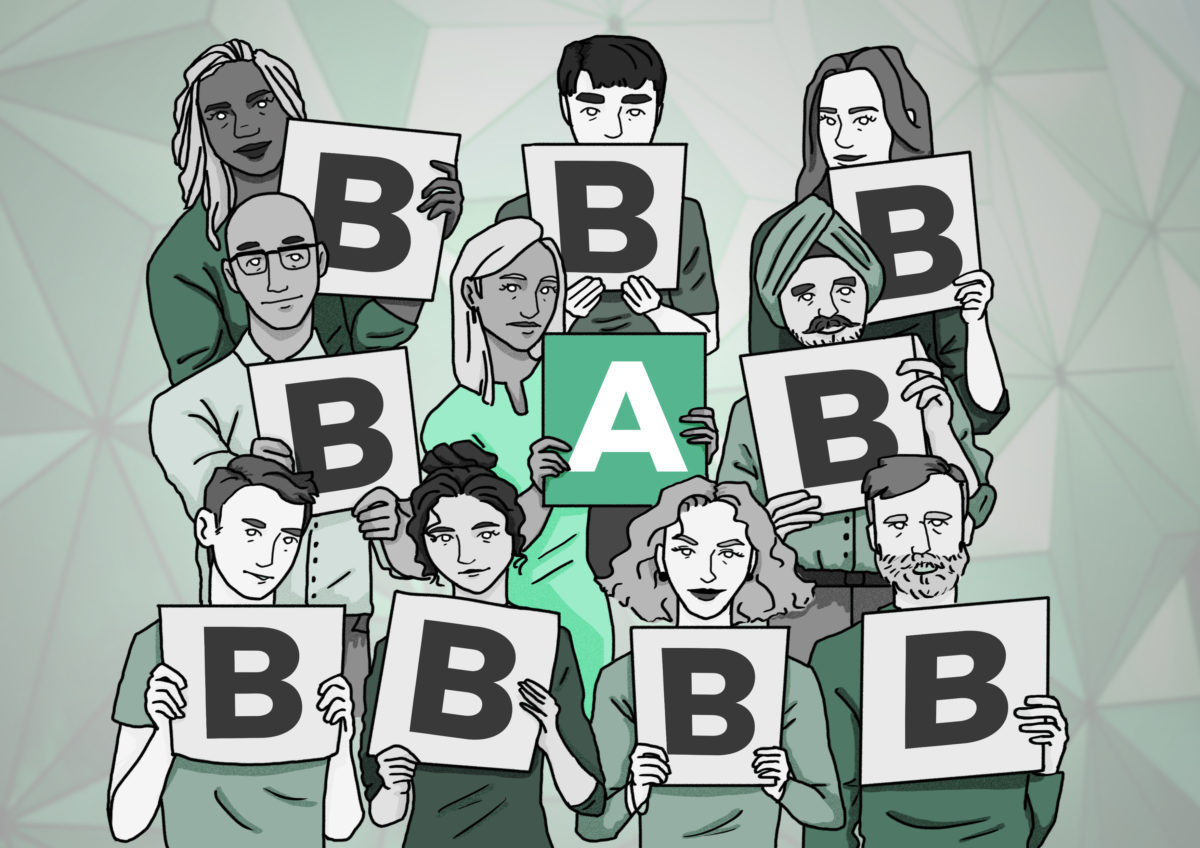

When talking about the wisdom of the crowd, a studio audience is a good example. They might not all be right, but together they will be right the vast majority of the time. In this image, the audience all vote for the same answer with the exception of one person.