One of the arguments often used by active managers to justify the fees they charge is that active funds can protect investors from the full extent of market falls in a bear market.

But, as we’ve explained many times, there is a big difference between the potential for outperformance and the actual likelihood of it. Historically, active funds have tended to fall just as far as index funds in a bear market — if not further.

So what happened in the recent market downturn? How did British fund managers fare? Did they provide their investors with any “downside protection”?

ALAN MILLER and BARNABY BARKER work for the fund manager SCM Direct, whose investment strategy is an active-passive hybrid. It makes active calls but almost exclusively uses passive ETFs.

Alan and Barnaby have just analysed the first-quarter performance of 627 UK-domiciled active funds with combined assets under management of £301 billion. Here are their findings.

It will come as no surprise that not a single equity market has recorded a positive weekly gain since the middle of February 2020. While some are predicting the worst is yet to come, there have been glimmers of hope as coronavirus death rates in Italy, Spain and Germany begin to decline.

Last week markets this week pulled back some of their yearly losses, and whilst the V-shape economic recovery may not occur, markets may still recover rapidly as they anticipate the eventual impact of the unprecedented stimulus by governments across the world.

A depressing anticipated outcome of the economic impact of the pandemic is that many smaller, long-established private companies will not have the financial resources to stay the course when the lockdown ends. The British Chambers of Commerce recently estimated that 16% of companies had less than a month’s worth of cash reserves left, while 6% have already exhausted their reserves. It may well be that these firms’ customers end up in the hands of larger competitors, many of which will be publicly quoted. This positive effect on quoted companies will help offset the negatives that they will eventually have to repay stimulus measures, with various corporate taxes likely to rise going forward.

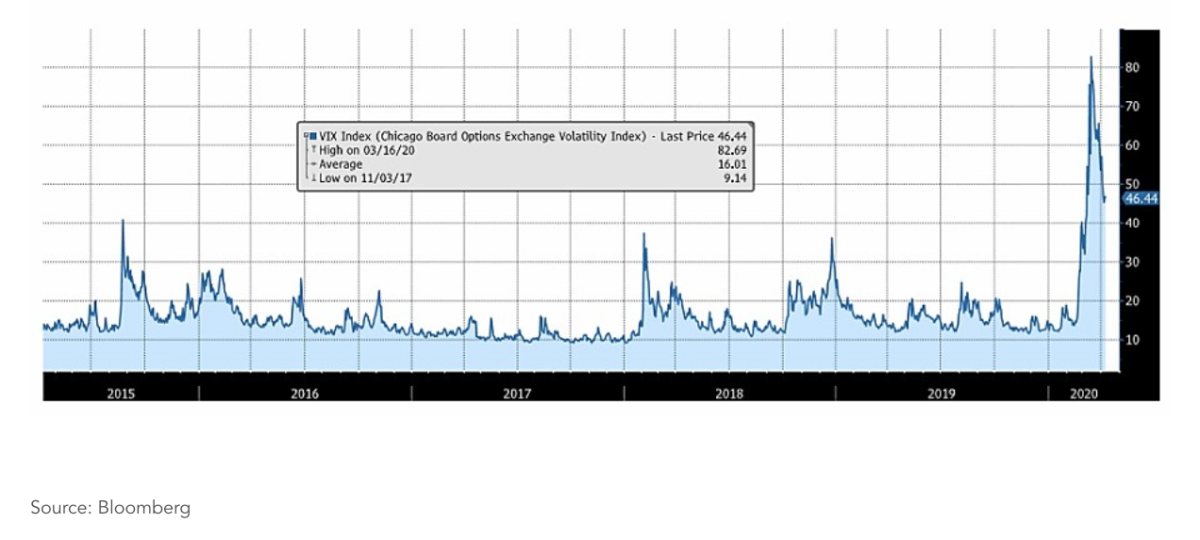

Levels of market fear, as measured by the VIX Index which records the volatility implied by options on the S&P 500 index, have fallen recently from their elevated levels of mid-March, which signals market confidence is gradually being restored:

But how have actively managed funds fared in the recent downturn compared to passively managed funds? Have the active managers protected your investments in a falling market?

The argument of the active fund management industry is that unlike passive index funds, they can move into defensive securities and cash, thereby protecting investors from substantial loss during a downturn, by utilising vigorous technical and fundamental research. They claim that passive index fund investors have to sit on their hands and soak up losses from stocks and sectors worst hit within an index.

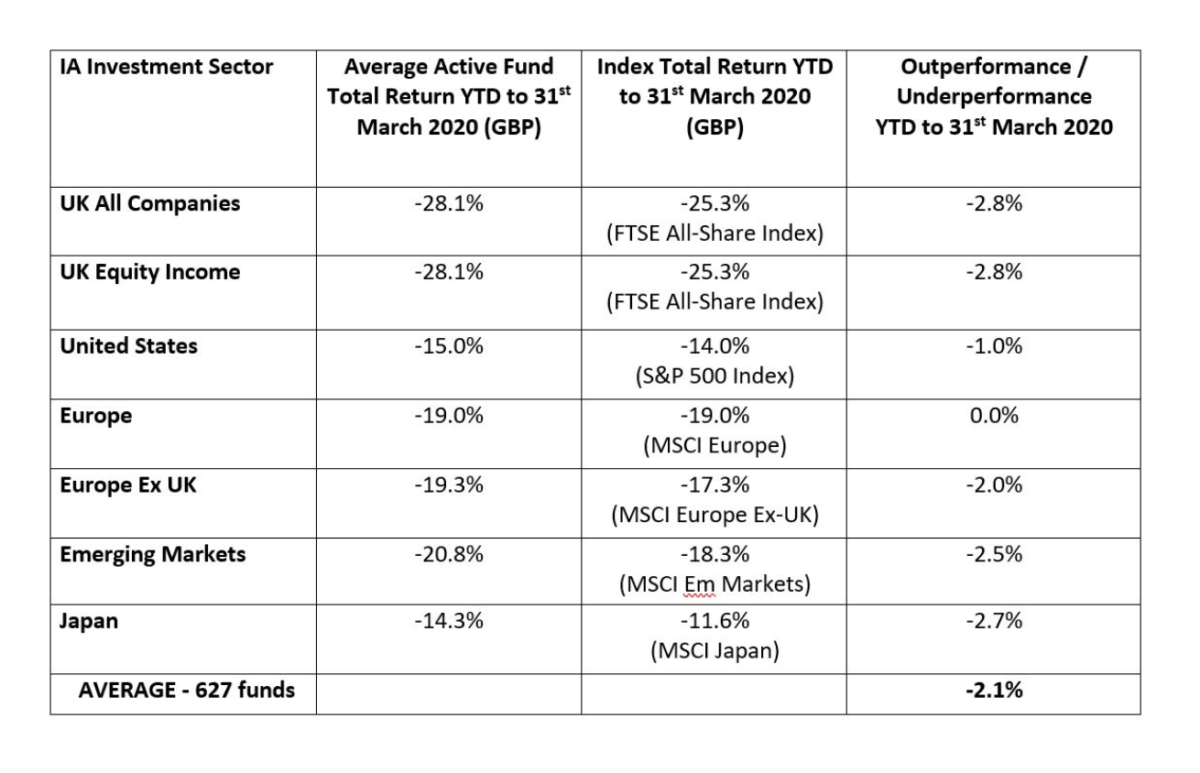

The SCM team interrogated the UK active fund industry and their performance year-to-date to the end of March 2020. We found that a significant number of active managers have not protected investors as might have been assumed.

Based on an analysis* of 627 non-index funds with combined AUM of £301bn, SCM analysed the performance of the primary GBP share class after fees. We found that across these broad equity sectors, the average active equity fund underperformed the index by 2.1% in the first quarter of 2020 (to 31st March 2020). There were no sectors analysed where the average active fund added value against the index.

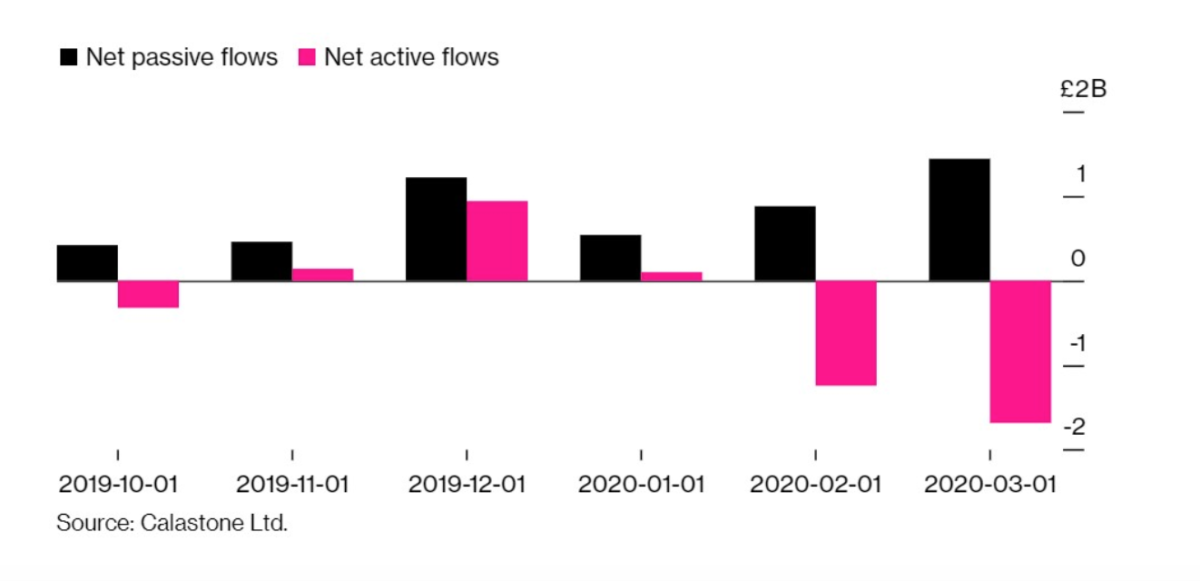

This may explain why investors are voting with their feet and ignoring the traditional active fund management spin claiming that active management will protect investors in any downturn. Investors seeking to take advantage of low valuations, are investing via index funds as they have substantially lower costs and greater diversification.

This trend continued into March; active funds experienced a £1.7 billion outflow, whereas index-tracking passive funds received £1.4 billion.

SCM Direct was founded on a hybrid actively passive investment strategy. We use passive instruments known as Exchange Traded Funds (ETFs) to build portfolios based on fundamentals. We do not take positions on specific companies and we do not short stocks, but we are still active managers using these vehicles. As an example, earlier this year we significantly increased the US$ exposure within the SCM Portfolios but once the US$ hit almost 35 year highs against the £, predominantly due to the mid-March panic and flight to safety, we decided to reverse this switch.

Similarly, the Japanese Yen benefited from the same flight to safety. On 23 March we switched several of our US$ and Yen equity fund exposures into identical or similar GBP hedged funds. Since our recent switch, the Japanese hedged equities fund bought has outperformed the non-GBP hedged fund sold by 5.9% and the US Value GBP hedged fund bought has outperformed the non-GBP hedged fund sold by 12.8%.

This illustrates that even in periods of panic and pessimism, investment opportunities do present themselves.

*Funds selected are UK registered and priced in Sterling. They are non-index funds and have been categorised using the Investment association (IA) classifications. For the UK All Companies and UK Equity Income sectors, SCM analysed those funds whose primary prospectus benchmark was the FTSE All Share Index.