Diversification, as we’ve said over and over again, is hugely important. But how can investors find out how well diversified a fund is? As ANDREW CAIN from Global Systematic Investors explains, more stock names doesn’t necessarily mean a higher level of diversification.

Summary

— No single measure fully captures how well a portfolio is diversified.

— The number of individual stock positions in a portfolio can sometimes be misleading as a measure of diversification, even ignoring correlations.

— A useful additional metric is the effective number of stocks which takes into account how weights are distributed in a portfolio.

Investors benefit from diversification. In equity portfolios the number of companies in a fund is used as an indicator of the fund’s diversification. The raw number, however, can be an incomplete measure. No single measure fully captures how well a portfolio is diversified and any stock-level measure generally ignores the degree to which stock returns are correlated. However, it is still useful to have a sense of how the weights in a portfolio are diversified, not just the simple number of positions held.

The effective number of stocks

A useful metric that captures this is the effective number of stocks, which accounts for the dominant effect of large holdings in a fund as compared to small holdings in the fund.

What is diversification? In the context of an equity portfolio diversification is the allocation of investment across a range of companies in order to reduce the effects of risks specific to each company. Diversification is a powerful tool with which to manage risk.

Although the idea is simple, the topic can be quite complex. It is not the purpose of this note to dig into the mathematics of how diversification works or its effect on portfolio performance. What is important is to understand that equity investors are almost always better served in the long-term through investment in well-diversified portfolios.

How does an investor judge whether a fund is diversified or not? Is there some measure of diversification that is commonly used? Interestingly, despite diversification being so important, there is no requirement to assign a standard measure of diversification to a fund. This means that there is no commonly used measure. Instead firms use a proxy measure.

The proxy measure can be misleading

The proxy measure used is the number of companies in the fund. The assumption is that a fund investing in 1000 companies is more diversified than one investing in 100 companies. In most cases this may be true but is it ten times more diversified? How does it work?

Unfortunately, while the number of companies is a rough guide to a fund’s level of diversification, it can sometimes be misleading and often significantly overstates it.

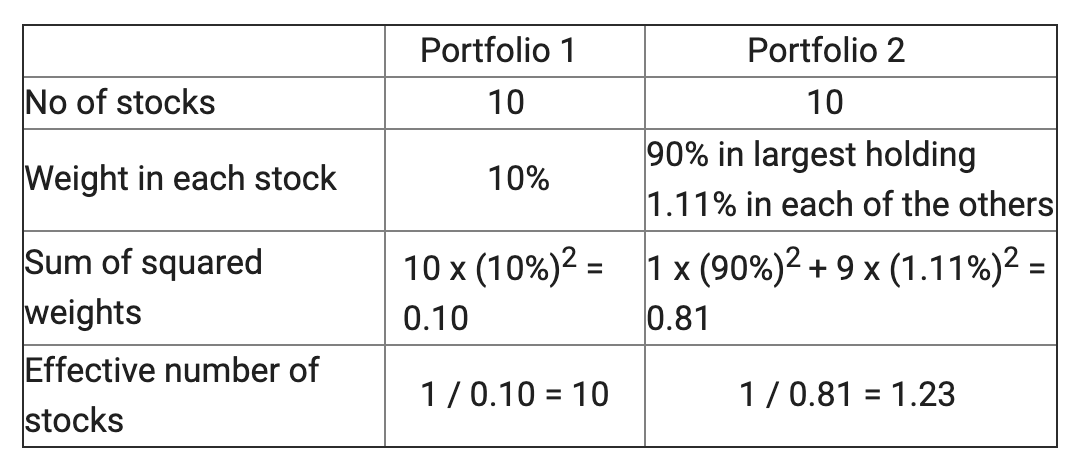

As an example, compare two portfolios, each holds investments in the same ten companies. Portfolio 1 has an equal weight in each company – i.e. there is 10% of the portfolio invested in each of its investments. Portfolio 2, however, has 90% of its assets in one company with the remaining 10% invested equally in the other 9 companies.

Both portfolios have investments in ten companies, but which is the more diversified? Clearly Portfolio 1 is more diversified. Portfolio 2 is effectively an investment in a single company with only a small proportion of its assets invested elsewhere.

There is a simple measure that takes this difference into account. This is the “effective” number of companies in a portfolio. This is derived from a metric called the Herfindahl measure of concentration. The Herfindahl measure is the sum of the squares of the weights in a portfolio. The effective number of stocks is the inverse of the Herfindahl measure – i.e. 1 divided by the Herfindahl measure. The following table compares this for our two hypothetical portfolios:

The effective number of stocks clearly differentiates Portfolio 1 from Portfolio 2. It is a better indicator of diversification than simply looking at the number of stocks in each portfolio.

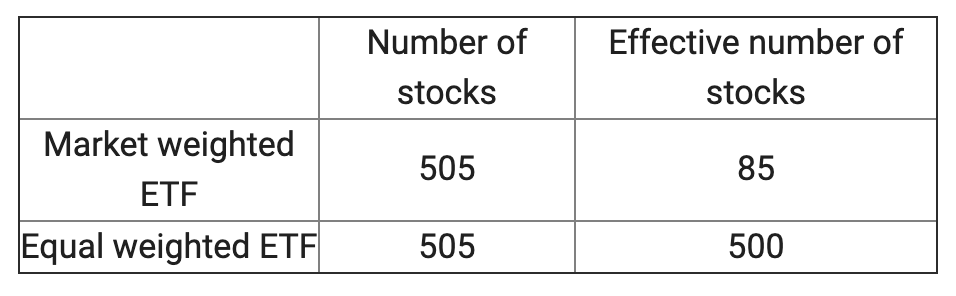

Now we can look at a real-life example. Let’s compare the effective number of stocks in an S&P500® market weighted ETF against an S&P500® equal-weighted ETF. The funds used for this comparison are (i) the iShares S&P500® core ETF; and (ii) Invesco S&P500® Equal Weight ETF using holdings as at 28 April 2020. Information on these ETFs can be found on their websites.

Despite having the same number of stocks in the funds, the effective number of stocks in the equal weighted ETF is nearly six times the effective number in the market weighted ETF.

Other factors affect diversification too

At this point we could start to get complicated and have a discussion on other factors that affect diversification and how this determines the risk of the portfolio. In our simple two-portfolio illustration there was no mention of the relative sizes of the companies. What if the largest company was nine times the size of each of the remaining nine. A market capitalisation weighted approach would allocate holdings closer to that of Portfolio 2. In which case, is the more diversified Portfolio 1 more or less risky than Portfolio 2? What about correlations between stocks, allocations to different sectors?

As mentioned at the beginning, the purpose of this article is not to delve too deeply into the complexities of diversification and its relationship to portfolio risk. It is to highlight that the number of stocks in a fund can be a misleading measure of a fund’s diversification. A useful additional measure, though still imperfect, is the effective number of stocks, which accounts for weight differences across holdings.

ANDREW CAIN is Managing Partner of Global Systematic Investors, a London-based which combines factor investing with an ESG approach.

Picture: Annie Spratt via Unsplash