By JACON SCHROEDER

To make better choices and build wealth, have you tried investing time with the works of Shakespeare?

Our relationship with money is forged by experience. Why wouldn’t we then want the broadest experience possible to help us make important financial decisions? Experience by proxy is one of the values literary fiction offers.

Reading can be more than just a way to accumulate knowledge. Some of the most useful money skills you won’t acquire from traditional personal finance and investing books. Qualities such as self-discipline, self-awareness, creative problem-solving, empathy, adaptiveness, among others. All of which science suggests can be honed by losing yourself in a novel.

It is why, when people ask the timeless question, What are the best finance books to read?, I’m likely to recommend the names of Tolstoy, Hemingway and Morrison, alongside those of Bogle, Graham and Hill.

Many notable business and finance personalities are voracious readers. Famously, Bill Gates releases an annual reading list and Warren Buffett often name-drops books in his Berkshire Hathaway shareholder letter. But rarely do high-profile people in these industries recommend literary fiction. The attitude is seemingly reminiscent of a character in the movie Sideways who disparages fiction by saying: “There is so much to know about the world that I think reading a story someone just invented is kind of a waste of time.”

Research, however, shows that reading fiction is very much a worthwhile activity. It can help us develop the abilities to manage our emotions and behaviours and plan for the future. Two necessary traits for good financial decision-making.

Here’s the story of how.

Conflict: We don’t recognize our future selves

In a study published in Social Cognitive and Affective Neuroscience, psychologists wanted to understand why Americans were not saving enough for retirement.

After conducting a series of brain scans, they determined that people’s brains were most active when thinking about their present selves and least active when thinking about some other present person (a co-worker, the UPS driver, etc.). No surprise, there. What was revealing is that when study participants thought of their own future selves, their brain activity closely mirrored the times during which they thought about other people.

This suggests that we tend to consider our future selves as another person. From a financial perspective, we mentally treat saving money for our future selves as if we were giving money to our boss or a Starbucks barista. No wonder we struggle with saving for retirement.

Successfully balancing immediate desires with long-term financial goals that feel far out of reach — like retirement, funding higher education or purchasing a home — requires forward thinking and a deep sense of self-control.

These are the kinds of thought processes necessary for making good financial decisions — and that can be exercised by reading fiction.

Resolution: Reading fiction can improve your decision-making

Reading fiction essentially gives us practice in working out what characters are thinking and feeling in sometimes familiar but more often foreign situations. When we’re fully immersed in a good story, it can feel as if we’re actually experiencing that fictional world.

In the words of Fran Lebowitz:

“A book is not supposed to be a mirror. It’s supposed to be a door.”

That immersive quality is why reading fiction is shown to make people more empathetic. You gain a higher capacity for understanding and feeling what other people feel. But also a better understanding for how you would feel under certain circumstances, be it tragic, horrific, embarrassing, humorous or surreal.

Additional research has found that reading fiction can improve a person’s theory of mind. This is an important social-cognitive skill that involves the ability to attribute mental states, including emotions, desires, beliefs and knowledge. It helps us predict and interpret the behaviors of people, including ourselves.

Fiction isn’t all about feelings and imagination. It is the process of connecting new and old ideas, forming questions and seeking answers, and reevaluating our prior beliefs. Which explains why close reading is linked to sharper critical-thinking skills.

Put simply, reading fiction is an effective way to develop a deeper sense of self and the ability to see things from different viewpoints. This is what non-fiction, which typically feeds us black-and-white answers, often fails to do.

So, what’s all this got to do with money?

On a personal level, reading fiction may provide a useful resolution to our difficulty reconciling our current selves with our future selves. We can better empathise with the future selves that we treat as an “other”.

Thinking about the future, or a “future orientation”, is incredibly important when it comes to managing money. A stronger tendency to consider future consequences leads to a willingness to delay gratification in favor of our long-term goals.

We become better at self-regulating, the process by which we control our thoughts, feelings and behaviours. After all, being aware of our financial motivations and having the ability to critically analyse our decisions is also important.

For example, when determining how much risk you’re comfortable investing with, it is hard to imagine a stock market crash if you’ve never experienced one. But with a higher sense of self-awareness, you may have a better sense on how you would react and can properly invest your savings accordingly.

Or consider retirement planning. How well can you imagine retirement that becomes boring? What would life feel like if your spouse dies before you? Will you regret not spending money on lifelong dreams out of caution? These questions are better answered when you can truly imagine yourself in those situations.

On a larger level, fiction helps us make sense of the world around us. We become adept at processing disparate information. With a higher sensitivity to motivations of others, we can see beyond the simplistic narrative of events and avoid costly mistakes.

You could make a case for parallels between the Wallstreetbets/Robinhood saga and a book like Game of Thrones, in which all players have dubious motivations and everything is more complex than it first appears.

Ralph Waldo Emerson sums it up best:

“Fiction reveals truth that reality obscures.”

As research continues to reveal what reading does to our thinking processes and as the financial planning industry becomes more of a “life-planning” industry, I think we’ll likely see more fiction on those best-of personal finance and investing lists.

Will reading The Remains of the Day by Nobel laureate Kazuo Ishiguro help you pick the right investments, or pay down debt, or set up sustainable retirement account withdrawals? Of course not. What it can do, however, is help you think deeply on the shortness of life and how you may feel in old age, which then inspires you to waste less money on the things that don’t matter while staying patient and committed to building a life where you no longer have to serve your precious, finite time to someone else. It is an indelible sense empathy for your current and future life.

Sometimes it is in watching another person make the journey that we appreciate our journey more and more.

JACOB SCHROEDER works as a financial writer for Kiplinger and for a US-based financial advice firm. This article first appeared on his excellent blog, Incognito Money Scribe, and is republished here with his kind permission.

PREVIOUSLY ON TEBI

How does investor sentiment affect stock and fund returns?

WFH or office — which way will financial services go?

Why do we neglect our financial wellbeing?

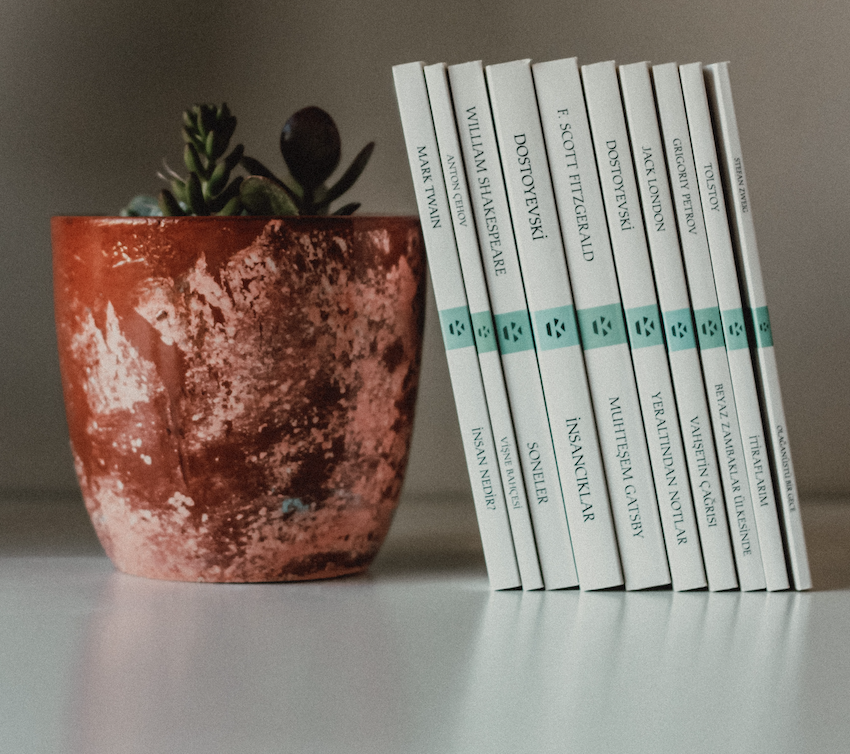

Picture: Sena Aykut via Unsplash

© The Evidence-Based Investor MMXXI