By LARRY SWEDROE

Machine learning (ML) is a field of inquiry devoted to understanding and building methods that “learn”—methods that leverage data to improve performance without human intervention. It is seen as a part of artificial intelligence, or AI. ML algorithms build a model based on sample data, known as training data, in order to make predictions or decisions without being explicitly programmed to do so. They are used in a wide variety of applications, such as in medicine, email filtering, speech recognition and computer vision, where it is difficult or unfeasible to develop conventional algorithms to perform the needed tasks.

While algorithmic trading has been widely applied for a long time to optimise and automate order submissions and executions, AI could also be used to make decisions in the earlier stages of portfolio formation. Given the potential rewards, it is no surprise that the investment management industry has explored using AI to manage portfolios. The potential advantages of AI include:

- Superior computational power to analyse mass data in a short period of time.

- Avoidance of cognitive biases to which humans are susceptible — AI is more rational.

There is also the hope that AI could “rescue” the active management industry, which, as Andrew Berkin and I demonstrated in The Incredible Shrinking Alpha, has seen a persistent decline in the ability to generate alpha — since the new millennium, only about 2 percent of active managers have been able to demonstrate statistically significant alphas even on a pretax basis.

The first AI-powered public fund, AIEQ, which uses ML technologies to actively select stocks in a portfolio, was launched on October 18, 2017, and raised more than $70 million within a few weeks. As of August 9, 2022, its assets under management were about $120 million.

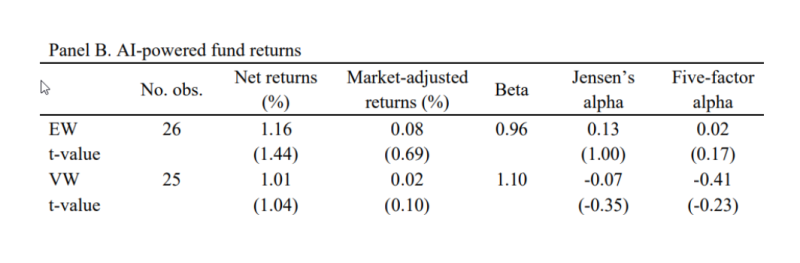

The performance of AI funds

Rui Chen and Jinjuan Ren, authors of the study Do AI-Powered Mutual Funds Perform Better? published in the August 2022 issue of Finance Research Letters, evaluated the performance of AI-powered mutual funds. Their data sample was from the CRSP Survivor-Bias-Free U.S. Mutual Fund Database and covered the 26-month period November 2017-December 2019. They labelled AI-powered funds (15) as those that use machine learning technologies to actively select stocks in portfolio choice; quantitative funds (300) as those that use fixed rules and numerical methods to generate computer-driven models and make investment decisions; and discretionary funds (611) as those traditional funds that select stocks and make investment decisions mainly through human judgment. Following is a summary of their findings:

- The performance of AI-powered funds was statistically indistinguishable from the aggregate market in 25 out of the 26 months in the sample period.

- AI-powered mutual funds did not generate significant risk-adjusted returns and showed only marginally superior stock-selection skills (only by equal weight) and no market timing skills.

- AI-powered mutual funds did outperform their human-managed peers due to lower turnover—31 percent versus 72 percent—resulting in lower transactions costs and marginally superior stock selection skills.

- AI funds held fewer stocks (149 versus 197)—their portfolios were more concentrated.

- AI-powered funds avoided some prevalent behavioral biases (such as the disposition effect).

Investor takeaways

While recognising that the data sample is short, Chen and Ren demonstrated that while AI-powered funds did outperform actively managed funds run by humans (due mainly to lower trading costs and the ability to avoid cognitive biases), there was no statistically significant evidence that they were able to outperform the collective wisdom of the market on a risk-adjusted basis. Of course, hope springs eternal. However, investment strategies should be based on evidence, not hope.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively known as Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined, or confirmed the adequacy of this article. LSR-22-369

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of numerous books on investing.

ALSO BY LARRY SWEDROE

New study highlights 20 years of failure for active managers

Identifying winning funds ex ante: Is it possible?

The impact of uncertainty on investor behaviour

Is democracy good for stock market returns?

How have hedged mutual funds performed since the GFC?

Picture: Possessed Photography via Unsplash

© The Evidence-Based Investor MMXXII