Understanding risk is a crucial part of successful investing. The problem is, it seems that everyone has their own definition of risk. For COSMO DeSTEFANO, it’s all about our spending goals — in other words, our ability to meet future liabilities and expenses. Of course, those goals will be different for each of us. But the true definition of risk, in the context of financial planning, is the risk of failing to achieve those goals, whatever they may be.

The future is the worst thing about the present.

— Gustave Flaubert

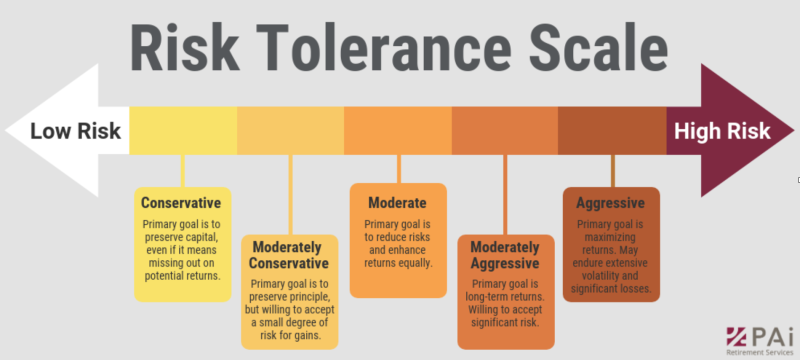

The traditional approach to assessing your investment risk tolerance would have you complete a questionnaire about your investing experience and your rational response to some hypothetical questions, many of which are based on volatility. Tally up your score and you find yourself plotted along a continuum that might look something like this five-point scale:

The problem is, you may answer the questions on some random Saturday afternoon when the sun is shining and the stock market is closed. Now answer the questions when the stock market has been falling for five straight days and the talk of recession is flashing all over the financial news… Do you think you might vacillate over these same questions?

Calculating “risk” based on volatility is an interesting theoretical analysis, but when mixed with emotions, it can provide an investor with a misleading and sometimes erroneous answer.

Modern Portfolio Theory

A lot of the investing concepts generally discussed for the wealth accumulation stage are grounded in Modern Portfolio Theory (MPT), which seeks to deliver the highest possible returns for the level of risk yu are taking.

[NOTE: Harry Markowitz introduced the world to MPT in 1952 and his principles have influenced generations of financial thinking. In 1990, Markowitz shared the Nobel Prize in Economics for his efforts around MPT].

Finding this optimal balance of return and risk is what Markowitz describes as investing along the efficient frontier. MPT has been successfully used for decades by institutions such as endowments, pension plans, and large trust funds, etc. The traditional approach to retirement planning has taken the principles of MPT and adapted them to individual investors.

But here’s the rub: large institutions, like an endowment, have an infinite time horizon without an overall drawdown stage. Institutions are effectively in a perpetual accumulation stage. They do not need to plan for and manage through a significant and finite withdrawal stage, but you do.

If you want something you’ve never had, you must be willing to do something you’ve never done.

—Thomas Jefferson

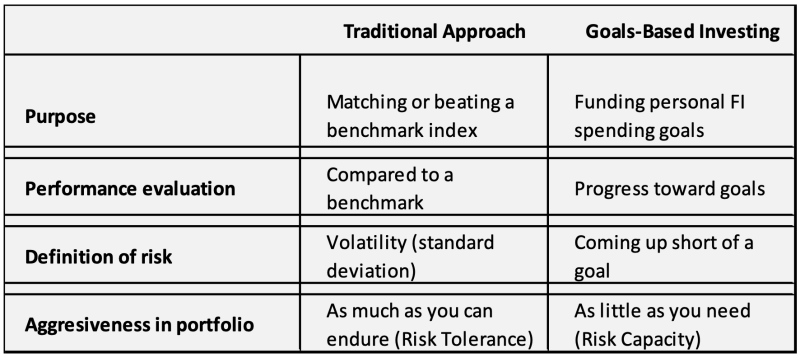

Enter: goals-based planning. With origins going back decades, goals-based planning gained in popularity after the 2008-09 financial crisis. It seeks to refocus our goals away from obtaining abstract market return rates, and towards meeting specific personal goals (e.g., our monthly spending needs).

As such, we should similarly reframe our risk profile, moving away from focusing on the volatility of market prices. Technical definitions of market risk include such terms as standard deviation, alpha, beta, R-squared, and Sharpe ratio (That’s a lot to digest). Alternatively, we can look at our plan and describe our risk in a simpler, more holistic way: our principal risk is the chance that we fall short of our spending goals.

Volatility is opportunity not risk

Volatility is not a good measure of risk for us because on its own, it is simply a probability statistic. Volatility needs to be linked with a consequence to provide us a practical and useful measure of risk.

If a meteorologist says there is a 90% chance of rain tomorrow, it is a risk to you only if you plan to be outdoors. If you will be at home all day it will still likely rain, but your risk of getting wet goes to zero. Similarly, the fundamental risk in your portfolio is not asset prices moving around (volatility), but rather not having the cash, when you need it, to cover your expenses.

I generally don’t shy away from an investment because its price might be volatile, but I will stay away if I think there is a relatively high probability that I’ll permanently lose my money. For the long-term investor, volatility is more opportunity than risk. Volatility can provide opportunities to invest in assets at depressed prices. But remember to always evaluate the probability of a good investment outcome against the consequences of being wrong.

The true definition of risk

If an adviser says to you (or you tell yourself) that you failed to beat the market last year, your response should be, That’s an interesting factoid, but underperforming the market is not a risk I worry about. Much more importantly, Where am I relative to my goals? And do I need to course-correct?

A goals-based approach to planning can help make the risk more tangible. We take measured, personally defined risks, and don’t endlessly ponder esoteric volatility measures of risk. Goals-based planning is focused on optimising a limited pool of financial assets, by matching assets and income with future liabilities and expenses (i.e. future spending needs).

If, for example, you can meet all your cash flow needs with a 5% return, then why take on a greater risk of loss to try and achieve a higher return? Why risk losing what you have and need to chase what you don’t have and don’t need? Your goals, not your risk tolerance, should drive investing decisions. During the withdrawal stage, income and capital preservation become more important than stretching for out-sized returns.

While your focus on goals-based planning and making course-corrections to your dynamic financial plan, don’t take as much risk as you can tolerate; take as little risk as you need.

COSMO DeSTEFANO is a retired CPA and tax partner based in Massachusetts. He is the author of a new book called Wealth Your Way: A Simple Path to Financial Freedom.

ALSO IN THIS SERIES

Don’t miss out on your only free lunch

Market cycles teach us, but do we learn?

LISTEN TO ROBIN POWELL SPEAK IN LONDON

TEBI founder Robin Powell and his co-author Jonathan Hollow will be speaking about the murky world of investment fees and charges in London at 5.30pm on Wednesday 17th May 2023.

They’ll be explaining you may be paying for a nice retirement for people you don’t even know, and what you can do start funding YOUR dream life instead.

The event is free, but places are limited, so book early to avoid disappointment:

FIND AN ADVISER

Investors are far more likely to achieve their goals if they use a financial adviser. But really good advisers with an evidence-based investment philosophy are sadly in the minority.

If you would like us to put you in touch with one in your area, just click here and send us your email address, and we’ll see if we can help.

© The Evidence-Based Investor MMXXIII