By ROBIN POWELL

The scores from SPIVA Europe are in, and, if you’re a British active fund manager you might want to avert your eyes.

SPIVA, just to remind you, is an on-going scorecard of active fund performance around the world, produced by S&P Dow Jones Indices. It began in 2002, and although it initially covered just the US, it has since been extended to Australia, Canada, Europe, India, Japan, Latin America, South Africa and the Middle East & North Africa.

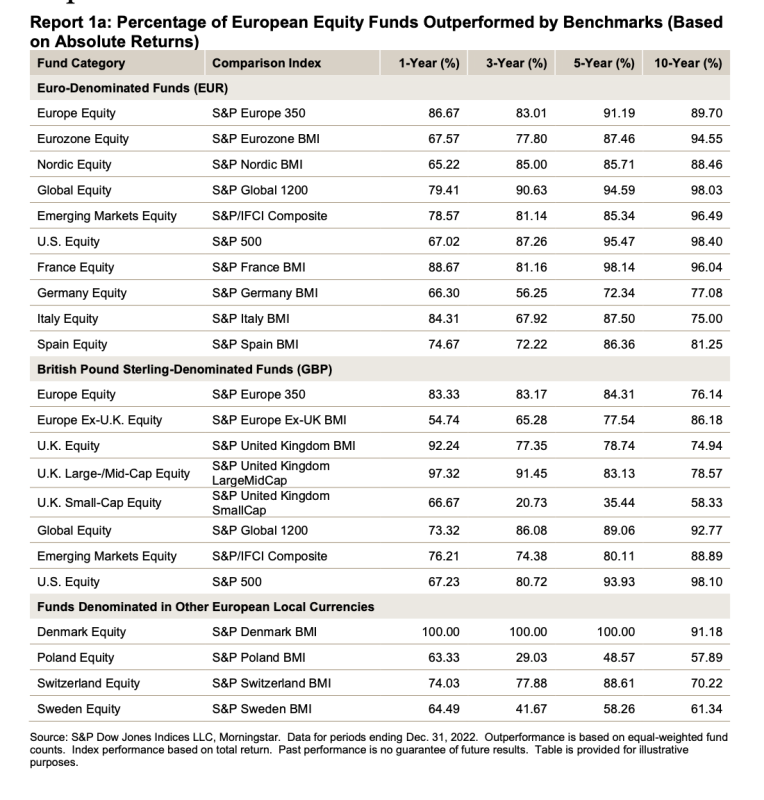

First published in 2014, the semi-annual SPIVA Europe Scorecard reports on the performance of actively managed funds domiciled across Europe. The Year-End 2022 report has just been published and shows that 2022 was a challenging year for active managers in European equities, with the Pan-European Equity category recording its highest annual underperformance rate since the scorecard’s inception.

Active fixed income managers had a better year in relative terms, with the majority outperforming in five of 11 categories over a one-year time horizon. Across both asset classes, however, underperformance rates increased to a similarly high average over a ten-year horizon.

But the main headline is the appalling performance of active fund managers in the UK. As you can from the chart below, a whopping 92% of large-cap funds and 97% of mid-cap funds underperformed their benchmarks in 2022 — the worst performance by fund managers in any country in SPIVA history.

I don’t want to rub UK fund managers’ noses in it. There’s nowhere in Europe where active managers performed well in 2022, and no doubt some other country will be the worst performer in 2023.

But these latest figures surely put to bed the notion that UK fund managers are somehow exceptional. When I first started writing about the shortcomings of active management more than a decade ago, a senior figure at Hargreaves Lansdown told me that active underperformance was a US phenomenon. UK managers, he said, do add value, citing Neil Woodford as an example. We all know how that story ended (although, of course, it still hasn’t ended for hundreds of thousands of investors who entrusted Woodford with their savings).

Apologies to those who think I raise these issues too often, but I’ll continue to do so until investors finally the message. The UK fund industry spends a fortune advertising actively managed funds, and journalists win awards for helping to promote them. But the data clearly tell us that the vast majority of active funds destroy wealth and we’re better off avoiding them.

You can download the latest SPIVA Europe report here:

You might also like to watch this new video in which S&P’s Craig Lazzara discusses SPIVA and what it tells us in more detail.

WHAT TO READ NEXT

If you found this article interesting, we think you’ll enjoy these too:

Don’t miss out on your only free lunch

Do concentrated active managers produce higher returns?

The Big Shortcoming: a dismal decade for active large-growth

FIND AN ADVISER

The evidence is clear that you are far more likely to achieve your financial goals if you use an adviser and have a financial plan.

That’s why we offer a service called Find an Adviser.

Wherever they are in the world, we will put TEBI readers in contact with an adviser in their area (or at least in their country) whom we know personally, who shares our evidence-based investment philosophy and who we feel is best able to help them. If we don’t know of anyone suitable we will say.

We’re charging advisers a small fee for each successful referral, which will help to fund future content.

Need help? Click here.

© The Evidence-Based Investor MMXXIII