By STUART RITCHIE

These are uncertain times. Nearly everyone has had their lives disrupted in some way or other. We’ve seen huge swings in the markets, and you may be feeling uneasy, confused, and uncertain about how this impacts your financial future. Market volatility, like we’ve seen recently, can test even the most confident investors.

For some, though, this is an opportunity. Of course, I’m aware not everyone can afford to invest right now. Some people may be focussed on paying the bills and establishing an emergency fund, and that’s okay. But for those with spare cash and long-term investment horizons, investing now when shares are on sale just makes absolute sense.

Remember the global financial crisis

In 2008, when global stocks were falling, Warren Buffett said:

“The financial world is a mess, both in the United States and abroad. Its problems, moreover, have been leaking into the general economy, and the leaks are now turning into a gusher. In the near term, unemployment will rise, business activity will falter and headlines will continue to be scary. So … I’ve been buying American stocks.”

Had you purchased a simple S&P 500 index fund on the very same day Buffett did, you would be up more than 220% right now – and that includes the recent sell-off.

But what about today?

Now you may argue that markets could fall even further, so why invest now? Why not wait?

It’s certainly possible that stocks will continue downward, especially in the short-term, but no one knows for sure. No investor has ever had complete clarity about the path markets will take. There are simply far too many variables at play.

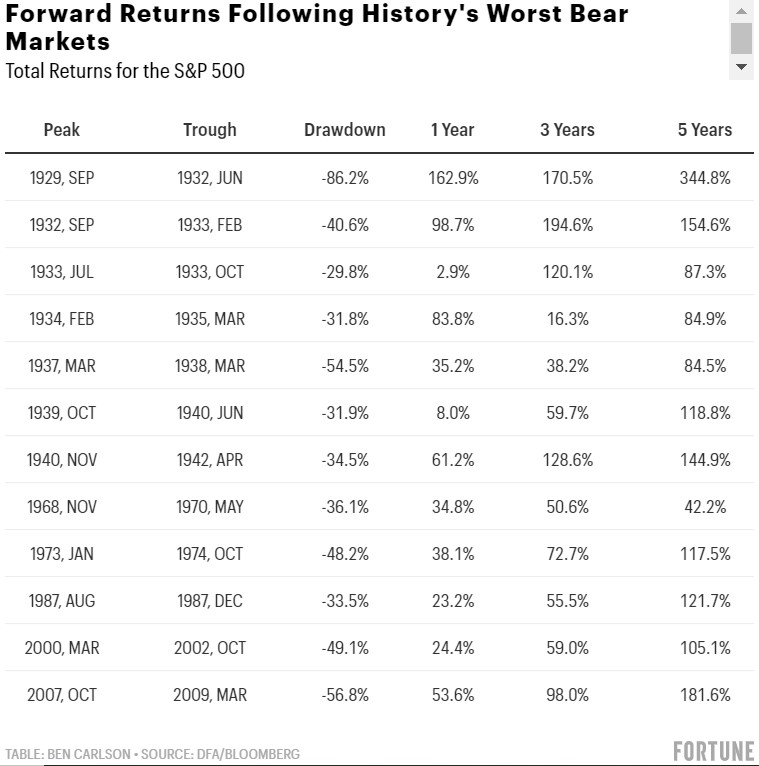

U.S. stocks experienced the fastest bear market in history recently, falling 20% in just 16 trading sessions, and closing down on 30% just two trading sessions later. For the purposes of this post, let’s assume the markets continue to tumble, and we hit a bear market of more than 30%. That would make it one of the worst bear markets in history.

Considering half the world is currently in lockdown and millions of businesses are halted, things are not likely to drastically improve any time soon. But eventually, they will recover. Financial markets will bounce back and the economy will mend itself. As we’ve seen before, returns following a bear market will be good if you remain disciplined and patient.

Those who persevere will come out stronger

This may be a difficult time for you personally, and as an investor, it is understandably challenging to watch the market’s uncertainty. Market volatility can be very unsettling. But nothing worthwhile has ever come easily. Also, those who persevere will come out stronger than ever before.

And if you’re finding it difficult to ride out the storm alone, this is where a good financial adviser should show their value. They’ll keep you focussed on your financial goals, and provide the reassurance you need.

STUART RITCHIE is Director of Wealth Advice at AES International, an evidence-based financial planning firm, based in Dubai, and serving English-speaking expats around the world.

Read our previous article from AES International:

How should investors react to coronavirus?

Picture: Javier Allegue Barros via Unsplash