Now for the second in our series Investing Fundamentals. In the first part we looked at risk, uncertainly and volatility, and how much risk you should take. Here we ask another question: how predictable or otherwise are stock price movements?

What will happen in the global financial markets tomorrow, next week or over the coming month?

It’s tempting to speculate, isn’t it? Indeed, speculation about the short-term direction of shares, bonds, currencies and commodities represents a good chunk of the output of the financial media every day.

To be fair, people have a natural curiosity about the future, particularly when their money is at risk. This makes it understandable that the media would seek to satisfy that need in its coverage.

The problem is that financial markets are inherently uncertain. Prices move randomly in the short term and there is little to be gained for investors by trying to second-guess them.

What moves prices is news

This point is easier to understand if you reflect on the fact that what moves prices is news. It might be an earnings report involving an individual company, a regulatory ruling affecting an industry, a data release relating to an entire economy or a geopolitical development that affects the whole world.

Prices are always changing as new information comes into the market. And the biggest changes in prices tend to occur on the news that no-one expected. For example, opinion polls might suggest a certain political party is certain to win a major election. Markets will price for that eventuality. But if there is an upset, prices will adjust very quickly.

What this means is that successfully speculating on short-term movements in security prices with any consistency requires an ability to accurately forecast the news. We’re not sure about you, but we’ve yet to meet such a person.

Predicting an event is not enough

But it’s even harder than that! Even if you could forecast the outcome of news events — say a G7 statement or an interest rate change or a merger — you still need to be able to forecast how the market will react.

Now that’s especially tough because what moves prices is the degree to which the news lines up with what’s priced in. You might get a weak employment figure, for instance, but the share market might still rally if the headline figure is not outside the bounds of expectations.

The fiendish difficulty of forecasting markets is also partly because set-piece events that dominate media attention do not tend to occur in isolation. A big economic announcement might have been expected all week, but what if it is overshadowed on the day by a development in the Middle East that upends the oil market and drives equity prices lower?

We like tidy narratives

In fairness, we doubt the media will ever give up on constructing speculative “stories” about markets by linking fundamental news about the economy or earnings to stock price movements. It fills a niche and there’s a real appetite among the public for tidy narratives that link cause and effect.

But for the individual investor it is best to distinguish between the daily noise of news and security price movements from the long-term signal of capital market returns. The latter are more predictable.

We know that over time, there is a return on investment. If capital markets did not ultimately reward investors, there would be no appeal in investment!

But the returns are not there every day, every week or even every year. Timing them is tough. What’s more, we don’t need to know which individual asset classes, markets or securities will deliver the strongest returns next.

No discernible pattern

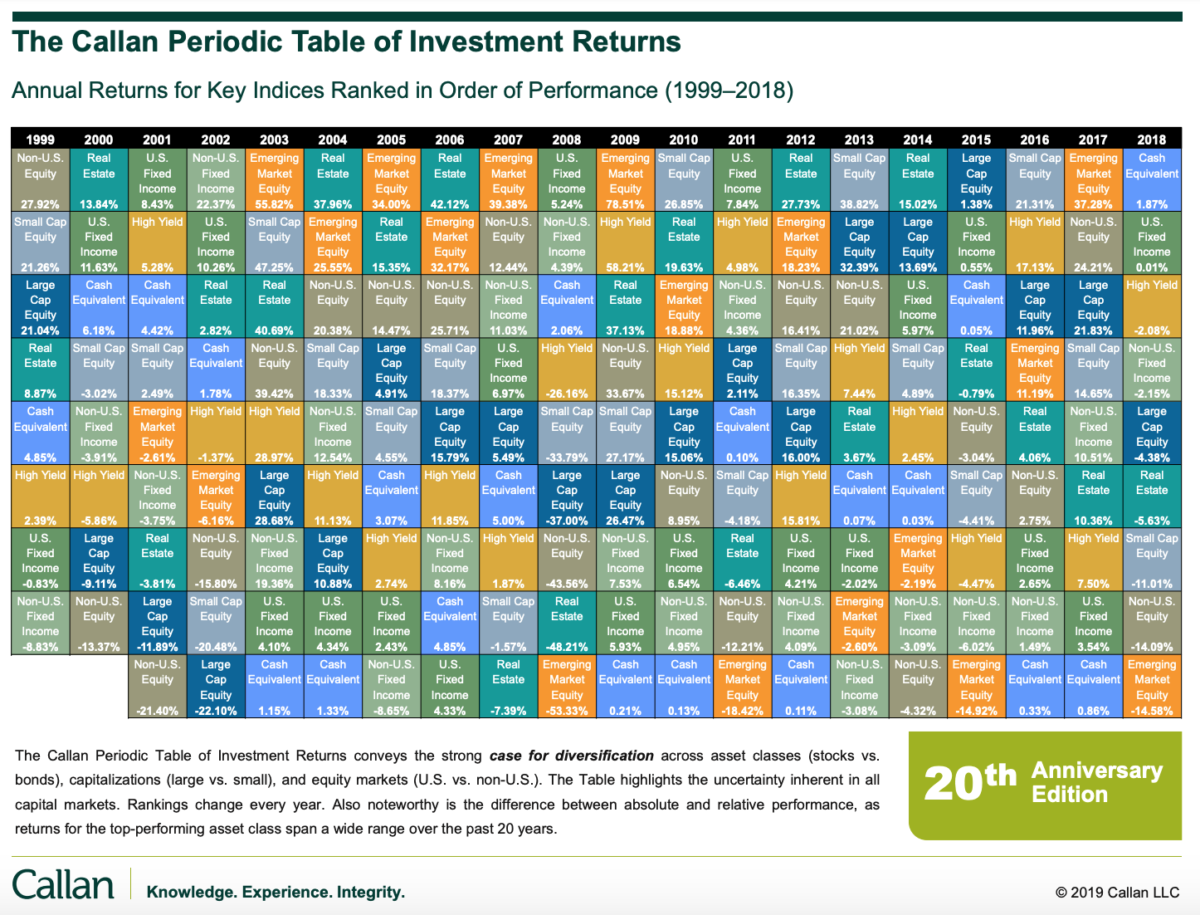

This is best illustrated by the Periodic Table of Investment Returns, from Callan Associates in California, pictured below. This shows the annual returns for various asset classes over 20 years, defined by indexes and grouped by colour.

Each column illustrates the returns for each year. Those with the biggest returns are at the top and those with the lowest are at the bottom. It looks like a patchwork quilt, doesn’t it? In fact, it’s hard to see any pattern at all.

Sometimes, emerging markets will top the table. Other years, it will be cash or bonds or real estate. The long-term premiums from these assets are available, but they are not evenly distributed.

That means to succeed as a long-term investor, you need to take a bigger picture view, focusing firstly on how you allocate your capital across different asset classes like stocks, bonds, property and cash and secondly on ensuring you are diversified within these asset classes.

By having a little bit of all those asset classes, you are guaranteed to reap the returns when they do kick in and you don’t have to worry about market timing.

Stick to your long-term plan

Finally, success over the long-term requires discipline and sticking to the plan that is made for you, attending to what you can control (asset allocation, diversification, cost, taxes and rebalancing) and ignoring as much as you can the daily noise that preoccupies the media.

By the way, this doesn’t mean you shouldn’t take an interest in the news. We all want to know what’s going on in the world after all. But it’s a caution against using daily news headlines to drive your investment strategy.

Stock price movements, like news, are simply unpredictable.

Missed the first article in this series? You can catch up here:

How much risk should you take?

COPYRIGHT

Regis Media owns the copyright to all of TEBI’s content, and republishing any of it without permission is strictly prohibited. We will take appropriate action in the event of any infringements.

Financial advisers may wish to note that we allow selected firms to use our investor education content under licence, and that we also produce original and customised articles and videos. Visit our website for further information.