“Would you like to invest in a way that helps to combat climate change and generally makes the world a better place?”

Faced with that question, most people, I suspect, would want to say Yes. The only logical reason I can think of for saying No is the perception that sustainable, or ESG, investing means having to settle for lower returns. It is a common assumption that investors looking for the highest returns are better off putting their conscience to one side.

But what if you knew that, by investing sustainably, you would end up over the long term with something close to, if not slightly better than, the market return? Why wouldn’t you want to do it?

Having your cake and eating it

Don’t get too excited. There are very few, if any, guarantees when it comes to investing. But we may be reaching the point where sustainable investors really can have their cake and eat it.

There is, in fact, growing evidence from academics and from the likes of Morningstar that there is no systematic performance penalty associated with sustainable investing. The challenge for investors is to find a cheap and efficient way to do it, which is where sustainable indexing comes in. (OK, that’s probably not an official term, but it’s what I’ve chosen to call it.)

Sustainable indexing pioneers

Garrett Quigley and Bernd Hanke are sustainable indexing pioneers, and I’ve known them for several years. Garrett enjoyed a long career as a senior portfolio manager with Dimensional Funds Advisors in London, while Bernd headed the international quantitative equity research team at Goldman Sachs in New York.

The two have spent the last few years devising evidence-based investment strategies for their firm, Global Systematic investors, and they’ve recently recruited Max Tennant as Managing Partner of GSI’s Advisory Services division. Max, who runs the Bristol-based financial planning firm IFAMAX, was one of the speakers at The Evidence-Based Adviser, a conference that TEBI held in conjunction with RockWealth last week in Birmingham.

I ought to say at this stage that although sustainable investing is an area I’m very interested in, it’s not yet part of my expertise. But I found Max’s presentation fascinating and, on first impressions, GSI’s flagship fund, the GSI Global Sustainable Value fund, appears to offer an attractive value proposition.

Max Tennant speaking at The Evidence-Based Adviser in Birmingham, 20th March 2019

The value of values

Max began his presentation (we’ve embedded his slides at the foot of this article) by telling his personal story. He recalled his time on the highly-regarded adviser coaching programme run by John Bowen’s CEG Worldwide, where he learned the importance of establishing the client’s personal values. A key question advisers need to ask their clients, argues John, is “What do you want for society and the world at large?”

This set Max thinking and, over the years, with the help of another former Dimensional employee, Sam Adams, he developed a sustainable investment strategy at IFAMAX. It proved so popular that he decided to make it an integral part of the service and to require clients to opt out if they didn’t want it.

The next step on Max’s journey was meeting Garrett and Bernd, who at that stage hadn’t explored applying evidence-based principles to the ESG space. Academics have demonstrated over the years that by tilting a portfolio towards different risk premiums such as size, value and profitability, you can achieve higher long-term returns than the broader market. What would happen, Max asked them, if you tilted towards key risk premiums but then added a sustainability overlay?

Weighting by ESG score

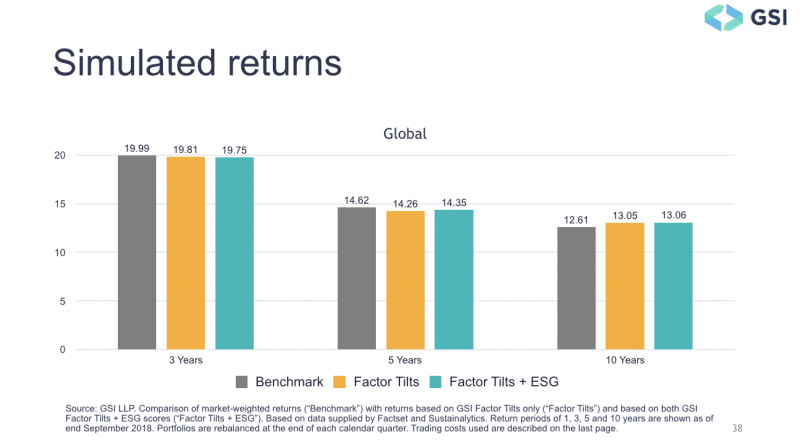

Garrett and Bernd set to work on finding an answer. Using data supplied by Factset and Sustainalytics for the ten-year period up to the end of September 2018, they built and backtested a number of different portfolios. For each portfolio they began with a market-cap-weighted index fund, and then added different factor tilts. They then systematically added a sustainability factor, giving larger weightings to firms with higher ESG scores and smaller weightings to those with lower scores.

Finally they compared the simulated returns of a benchmark portfolio with factor tilts on their own and then factor tilts with an ESG overlay. As you can see from the chart below, the returns over three, five and ten years, are remarkably similar. Over ten years, the ESG portfolio produced slightly higher returns than the other two, and with a marginally better risk and return trade-off.

Exciting development

Look, I realise backtests are anything but foolproof. Just because something has worked in the past, that doesn’t mean it’ll work in the future.

But this is an exciting development nevertheless. I know from their painstaking attention to detail that Garrett and Bernd wouldn’t be putting this out there if they weren’t completely sure of the data.

I studiously avoid recommending specific investment products and I’m not going to make an exception in this case. But for an on-going charge of 50 basis points, and no entry or exit charges or performance fees, this fund does seem far better value to me than those expensive actively managed ESG funds currently being touted in the media.

Like I say, it offers long-term market returns, or even slightly better, combined with the knowledge that you’re being good to the planet and your fellow human beings. Honestly, why wouldn’t you?

Here are the slides from Max Tennant’s presentation at The Evidence-Based Adviser: