By MURRAY COLEMAN

Active fund managers tout how much “alpha” they can deliver for investors. Besides representing a Greek letter, this terminology in finance represents how much “excess” return a fund makes relative to a comparative index.

But a host of academic and professional research serves as a giant red flag for such claims. Now comes a new study by S&P Dow Jones Indices providing even more evidence that alpha is elusive at best.

In Fleeting Alpha: The Challenge of Consistent Outperformance, analysts Berlinda Liu and Andrew Cairns build on research methodologies developed for the SPIVA Scorecard as well as S&P’s Persistence Scorecard.

The SPIVA series examines the percentage of actively managed funds that outperformed the most appropriate S&P benchmarks over one-, three-, five-, 10- and 15-year periods. Meanwhile, the “Fleeting Alpha” research takes a look at the fund managers who did outperform their respective benchmarks in a given time period, then digs through that data to find those who outperformed in subsequent years.

The idea is to quantify how persistent fund managers are in terms of beating their benchmarks. In other words, this alpha series tries to answer the question: Did any “winning” performance by active funds come more as a result of luck rather than skill?

The latest “Fleeting Alpha” study is based on Lipper classification data. First, analysts screened for funds that beat the benchmarks based on three-year annualized returns and net of fees. Then, they examined whether these funds — i.e., the “winners” — continued to outperform during the next three-year periods.

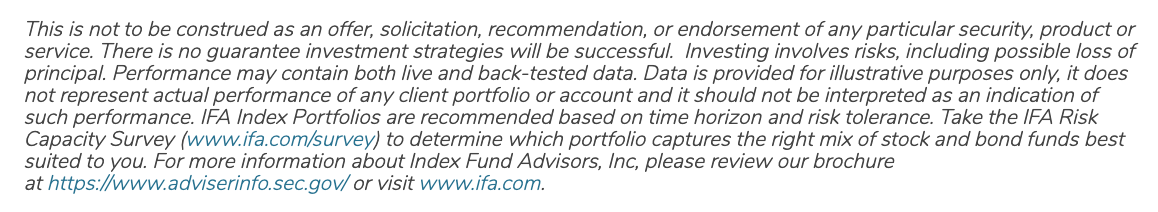

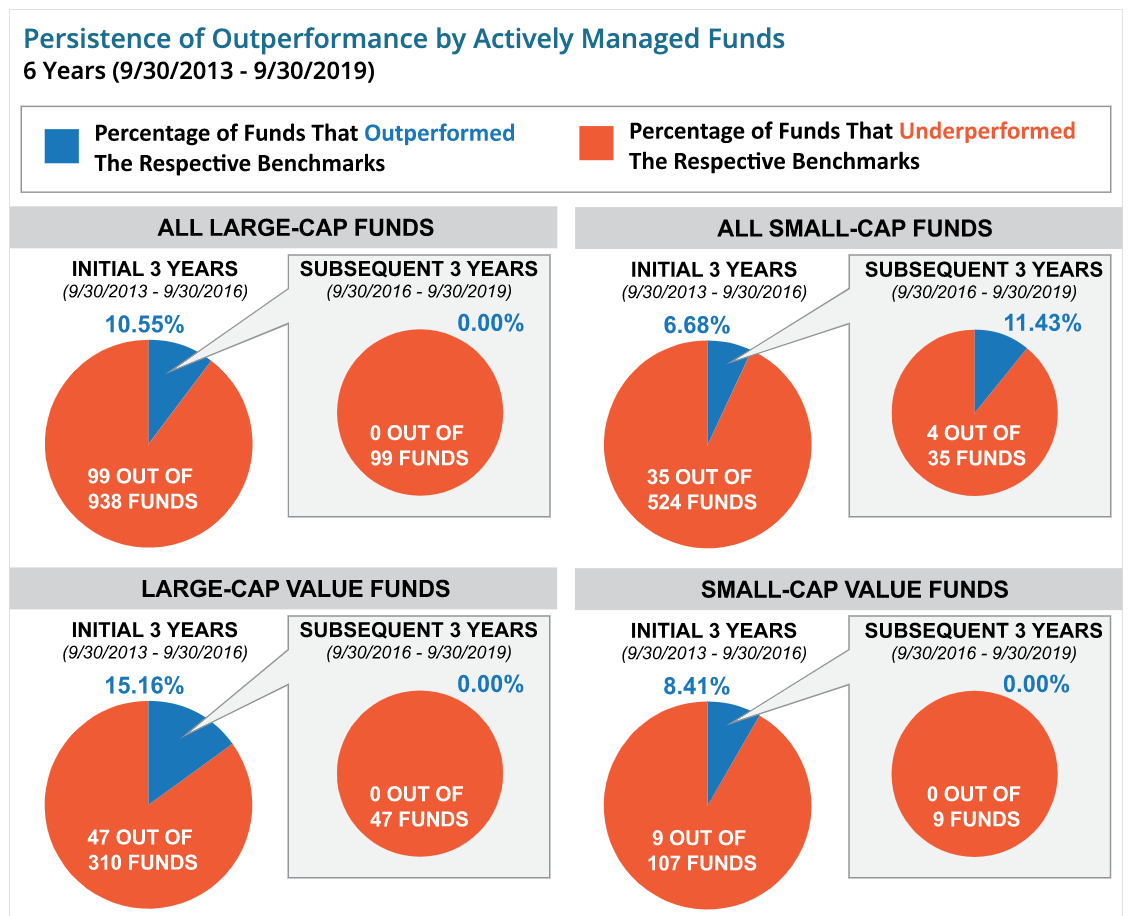

The pie charts below depict this report’s findings for major equity asset classes in the most current set of three-year periods studied. For example, 10.55% of all active large-cap stock fund managers were able to outperform their respective benchmarks over the three years through 2016’s third-quarter. At the end of September 2019, however, none of those 99 funds were able to continue such index-beating persistence.

“Our results show that among equity funds that beat their benchmarks over the three-year period ending Sept. 30, 2016,” the authors summarised, “the performance persistence among domestic and international equity categories in the following three years was worse (in general) than a random draw.”

In their fresh alpha study, S&P’s researchers also break down data by rolling three-month periods over 16 and a half years (March 31, 2003 to Sept. 30, 2019). The idea was to study how consistent — or, more to the point inconsistent — active management performance turns out to be over longer periods.

At first glance, this longer-term picture made active managers appear to fare “slightly” better at the beginning, according to S&P’s analysis. However, these researchers point to an inverse relationship between the level of persistence and time horizon — namely, persistence declined in each subsequent year.

The drop-off was so overwhelming from a statistical standpoint, the report concluded, that it should stand as a stark warning to fund investors who think they can use alpha to distill future winners. Even more to the point, they found that a higher level of outperformance by active managers in one year generally resulted in reduced odds they would be able to repeat such results in subsequent years.

Considering that persistence of active managers’ performance to beat their benchmarks too infrequently matches the level of “throwing darts” at a board, the S&P researchers caution that investors need to reconsider chasing “hot hands” or picking managers based on past performance.

“While some market participants may believe selecting among recently outperforming active mutual funds provides a way to better identify persistent alpha,” the S&P analysts note, “this report shows recent outperformers found it challenging to maintain their status in the (relative) winners’ cohort.”

A veteran financial journalist, MURRAY COLEMAN works as an investment writer for Index Fund Advisors, an evidence-based financial advice firm with headquarters in Irvine, California.