All of the mid-year SPIVA scorecards from S&P Dow Jones Indices are now in. The reports summarise the performance of domestically focused active funds around the world over the 12-month period ending in June 2021. So, what do the results tell us? SHERIFA ISSIFU, who is part of the SPIVA team, has been taking a look.

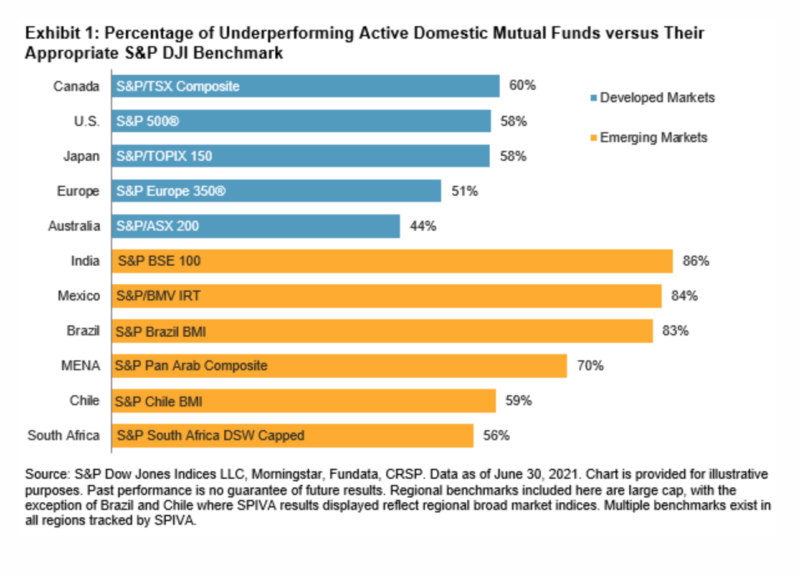

S&P DJI has just released the final regional edition of our S&P Index Versus Active (SPIVA) Mid-Year 2021 Scorecards. The semiannual reports cover the performance of actively managed funds in the U.S., Canada, Latin America, Europe, South Africa, India, Japan, Australia, and our newest regional addition, the Middle East and North Africa (MENA). SPIVA Scorecards offer a wealth of insights into the performance of active funds globally, including the percentage of all the available actively managed funds that underperformed an appropriate S&P DJI benchmark over various time horizons. Exhibit 1 summarises the performance of domestically focused active funds across the various regions over the one-year period ending in June 2021.

In every region apart from Australia, most active funds underperformed. Intriguingly, although we often hear that index-based strategies “don’t work” as well in Emerging Markets, the rate of underperformance was generally higher in those markets: 86% of Indian active managers failed to beat the S&P BSE 100, with similar underperformance among Mexican and Brazilian funds. This speaks to the shrinking alpha that is often seen as markets increasingly professionalize; put simply, it becomes harder and harder to remain “above average.”

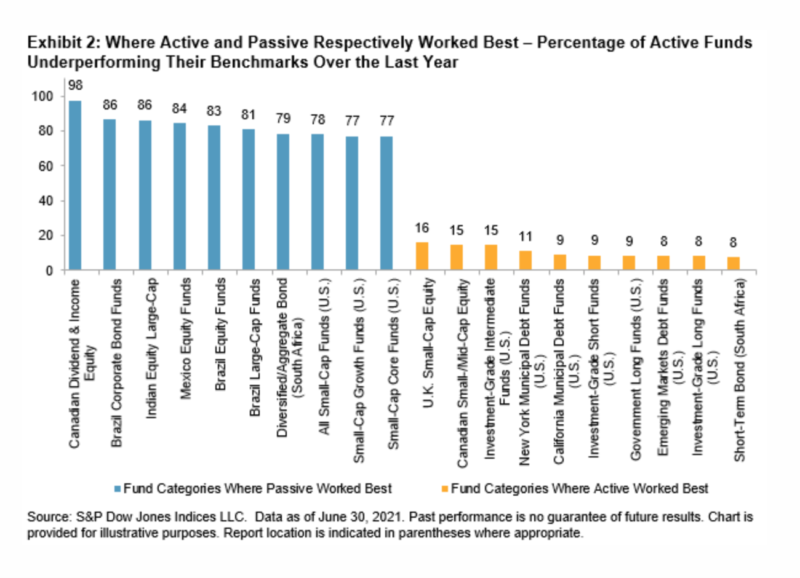

Beyond the headline figures, the biannual reports dig into a wide range of specialised equity and fixed income fund categories and, as usual, the latest reports identify a few pockets where active managers had more reason to boast, and those markets where outperformance was hardest to find. Exhibit 2 shows the top underperforming and outperforming fund categories across all our regional reports. Canadian Dividend & Income Equity funds had the largest rate of underperformance, with more than 98% of funds underperforming the S&P/TSX Canadian Dividend Aristocrats. At the other end of the spectrum, U.S. bond fund managers, in particular, stood out for their benchmark-beating returns (although the excellent 12-month record in the Government Long, U.S. Government/Credit Long, and Emerging Markets Debt fund categories is qualified by close to 100% underperformance over a 10-year horizon). The most extreme case of outperformance was among South African Short-Term Bond funds, with only 8% of active managers underperforming the STeFI Composite.

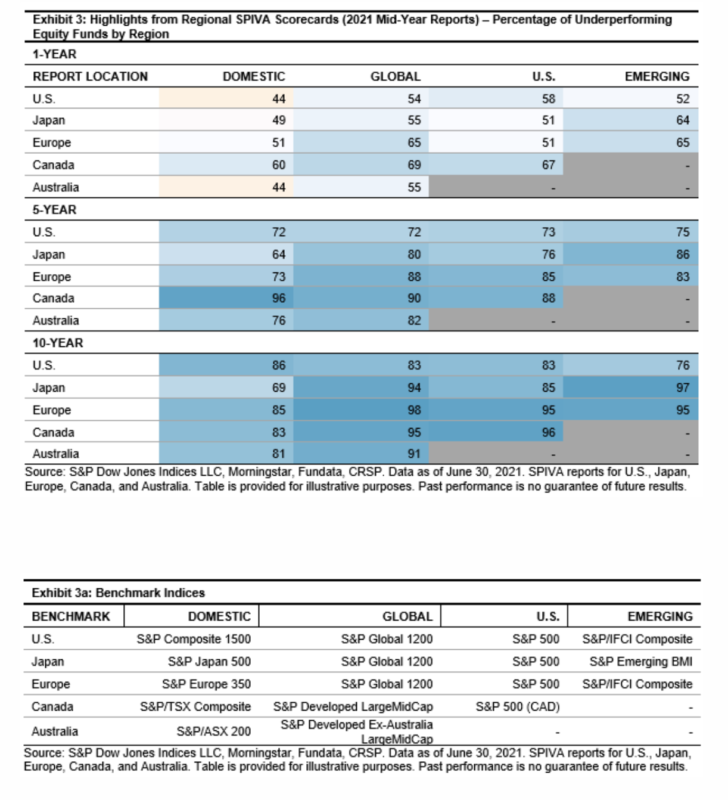

Turning to cross-region comparisons (summarised in Exhibit 3), the best active U.S. equity managers over the one-year period ending in June 2021 were, perhaps surprisingly, more likely to sit on a different continent than the stocks they managed, with 51% of Japanese and European active U.S. equity managers underperforming the S&P 500, versus the U.S.’s 58%. However, over the long run, U.S. active managers did achieve a better outperformance rate than other regional managers, not only in U.S. equities, but also across Global and Emerging Market equity market categories, too.

Explore the latest SPIVA scorecards at https://www.spglobal.com/spdji/en/research-insights/spiva/.

Read legal disclaimers here.

SHERIFA ISSIFU is an Index Investment Strategist at S&P Dow Jones Indices, specialising in emerging markets.

This article was first published on the Indexology blog.

MORE FROM S&PDJI

For more valuable insights from S&P Dow Jones Indices, you might like to read these other recent articles, or visit the Indexology blog:

How index investing can help tackle climate change

Emerging markets: what investors need to know

© The Evidence-Based Investor MMXXI