The first draft of an agreement setting out how countries will cut emissions to reduce global warming has been published. The document lays out what negotiators hope will be the outcome of the COP26 summit in Glasgow. In particular, it encourages richer nations to step up support for poorer ones. But what about investors? What can they do to help combat climate change? JASPREET DUHRA from S&P Dow Jones Indices sees an important role for investing, and index investing specifically.

1.5°C, net zero emissions, COP, Glasgow, Paris, carbon offsets, stranded assets… Or, as Greta might say, “blah blah blah.”

With so much information, it’s easy to tune out to the noise of climate change.

From the heatwaves of California, to the climate protesters in London, to the floods in Bangladesh, climate change is affecting everyone.

For 25 years, the U.N. has been bringing together almost every nation on Earth for global climate summits, which are known as “COPs” (Conference of the Parties). This year is the 26th annual summit — giving it the name COP26. The summit is in Glasgow, with the U.K. as host and president.

Delegates from nearly countries gathered at COP26 to detail how they will achieve the goals of the Paris Agreement to limit global warming to well below 2°C and pursue efforts to limit it to 1.5°C. This requires hitting net zero emissions by 2050, meaning the emissions produced by humankind would be balanced by emissions removal.

Committing to net zero reduction targets by 2050 may seem like a relatively easy target to agree to, given it’s almost 30 years away — but it isn’t. Long-term targets require short-term milestones. One of the key asks at this year’s COP is that countries come forward with ambitious 2030 emission reductions targets.

Curbing emissions in the next ten years inevitably means there will be widespread impacts on all of us sooner — the way we travel, live, eat — almost no aspect of our lives will be untouched.

What’s the role of indices?

“To achieve our climate goals, every company, every financial firm, every bank, insurer and investor will need to change.” – UN Climate Change Conference UK 2021

There are many reasons for investors to align their portfolios with net zero, from concerns about climate risks in their portfolios to seeking investment opportunities. Likewise, there are many ways to align portfolios with a net zero scenario, for instance increasing exposure to companies aligned with 1.5°C or reducing exposure to the worst climate polluters. Climate investing is a complex and multi-faceted field.

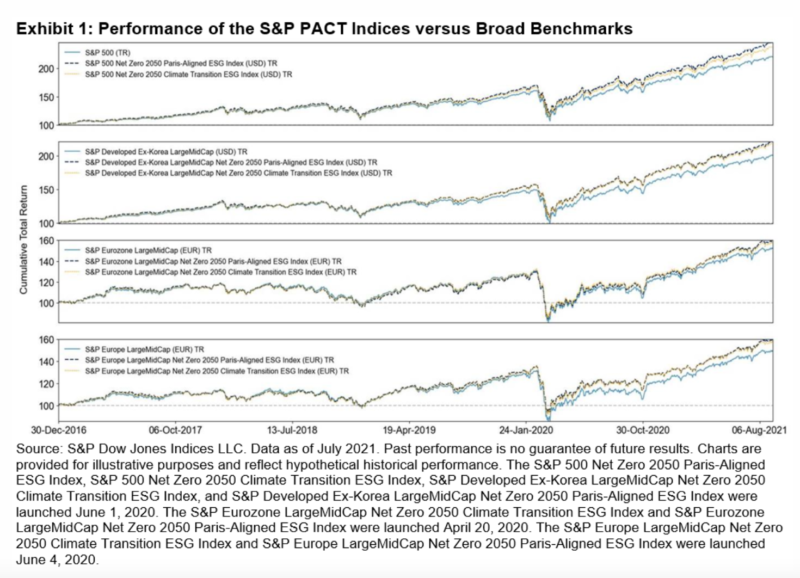

At S&P DJI we have created a series of rules-based indices that are designed to select a hypothetical portfolio of companies that collectively align with a 1.5°C scenario: the S&P PACT Indices (S&P Paris Aligned & Climate Transition Indices). Aligned with the ambitions of COP, these indices apply constraints for today, as well as with a 2050 outlook. There are immediate relative carbon footprint reductions of 30% or 50% relative to the benchmark, along with an ongoing requirement for the indices to decarbonise at a rate of 7% year-on-year. The indices are based on the latest climate science with the rate of annual decarbonisation in line with, or beyond, the decarbonisation trajectory from the IPCC’s 1.5°C scenario.

Our methodology produces broad and diverse indices while intending to meet the minimum standard for EU Climate Transition benchmarks and EU Paris-Aligned benchmarks, and it aligns with the Taskforce on Climate Related Financial Disclosures (TCFD).

See S&P’s dedicated Net Zero page for more information and resources.

JASPREET DUHRA is Global Head of ESG Indices at S&P Dow Jones.

This article was first published on the Indexology blog.

MORE FROM S&PDJI

For more valuable insights from S&P Dow Jones Indices, you might like to read these other recent articles, or visit the Indexology blog:

Emerging markets: what investors need to know

Relative returns vs absolute performance

© The Evidence-Based Investor MMXXI