By PRESTON McSWAIN

Stock market news was not good yesterday. Stories like this have been circulating like crazy:

Stocks Plunge as a War Deepens

If Your Pension is Invested in the Stock Market, You Lost Big Today

World’s Richest Lose $117 Billion in One-Day Market Meltdown

The war that I mentioned above is trade related. It does not involve tanks and bombs, but it is troubling, no doubt.

When reading such headlines, though, try to keep this cartoon in mind.

Cartoon by Michael Ramirez

I’m not suggesting that today’s issues are a small matter or that they are going to go away quickly. And, even though prognosticators are busy today, no one has a crystal ball.

What I am saying — again — is that market shocks occur much more often than many people might realise.

As an example, the second headline that I quoted above is from a post that I wrote in 2015.

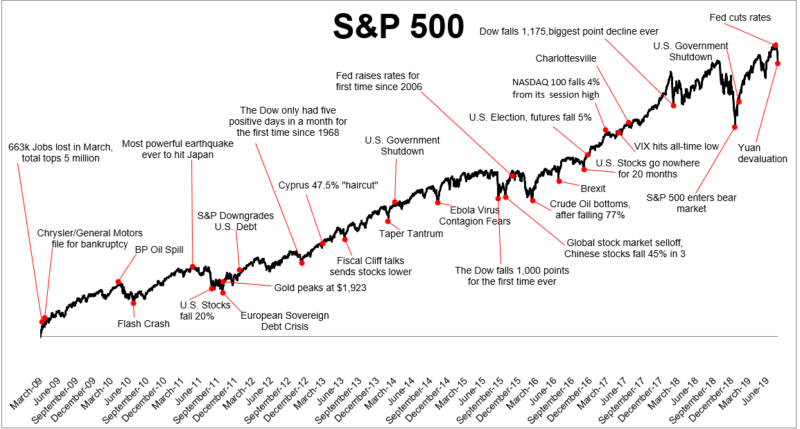

To help drive this home I’m including a chart that was sent around today by Michael Batnick, who kindly gave me permission to use it.

Chart by Michael Batnick

Something will always create headlines that make us feel uncomfortable, but note above how they tend to not last that long.

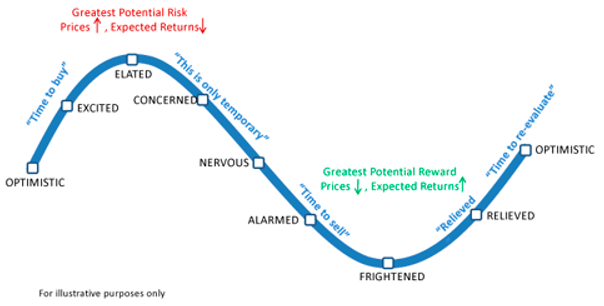

What they do — well — is to create the emotions in the chart below over and over again.

Chart by Preston McSwain

Yes, I’ve posted this chart many times before and I’m not immune to these feelings myself. I’ve never met a human who is. It is why I have this chart on my office wall.

It’s also one of the many reasons that we work hard to Keep a Steady Hand on the Tiller and, as we just did a little over a week ago, trim equities when the market is up by a larger than normal amount.

We didn’t make these moves ahead of the recent market drop because we are good at making predictions (no one is – particularly related to down markets).

We did it because we stick to investment policy plans that we have developed for clients, which create a disciplined process of taking chips off the table after strong runs.

Focus on your long-term plan

As I wrote in the Steady Hand post that I mentioned above, our simple message remains the same.

Conditions are often out of our control and can change rapidly. Be prepared and stay broadly diversified. Don’t reach for returns.

Keep focused on your long-term plan, not the models or predictions of others, and don’t be sold the next hot investment strategy – especially when emotion is running high.

Yesterday brought a market storm and, as they have many times before, market conditions might continue to generate concerning stories.

Six things to remember

When (not if) they do, and the stock market news looks bad, try to stay anchored on the following, which is The Normal:

— Stocks are risky

— Markets experience shocks from time to time, and can produce short-term — periods of low or even negative returns

— Normal markets include ups and downs, and the swings can be large — when too much emotion gets involved

— No one can forecast the future, especially when emotion is involved

— Over long-term periods the stock market has consistently produced — positive returns and long-term investors have been rewarded

— Long-term is ten years or more

Not every day will be a good one in the stock market or in life.

Investors, however, have been consistently rewarded with good returns when they stay focused on their long-term plans.

PRESTON McSWAIN is Managing Partner of Fiduciary Wealth Partners, based in Boston, Massachusetts.

If you’re anxious about the markets, you might also find the following posts helpful:

Six steps to staying the course

Perspective on the market wobble

Markets fall. Nobody knows why, and you shouldn’t care