By LARRY SWEDROE

The dramatic increase in interest in environmental, social and governance (ESG) investing has been accompanied by increased attention from researchers attempting to explain the sources of returns of ESG investment strategies. Specifically, researchers have sought to determine if the returns to ESG strategies can be explained by existing asset pricing models such as the Fama-French five-factor (market beta, size, value, profitability and investment) model.

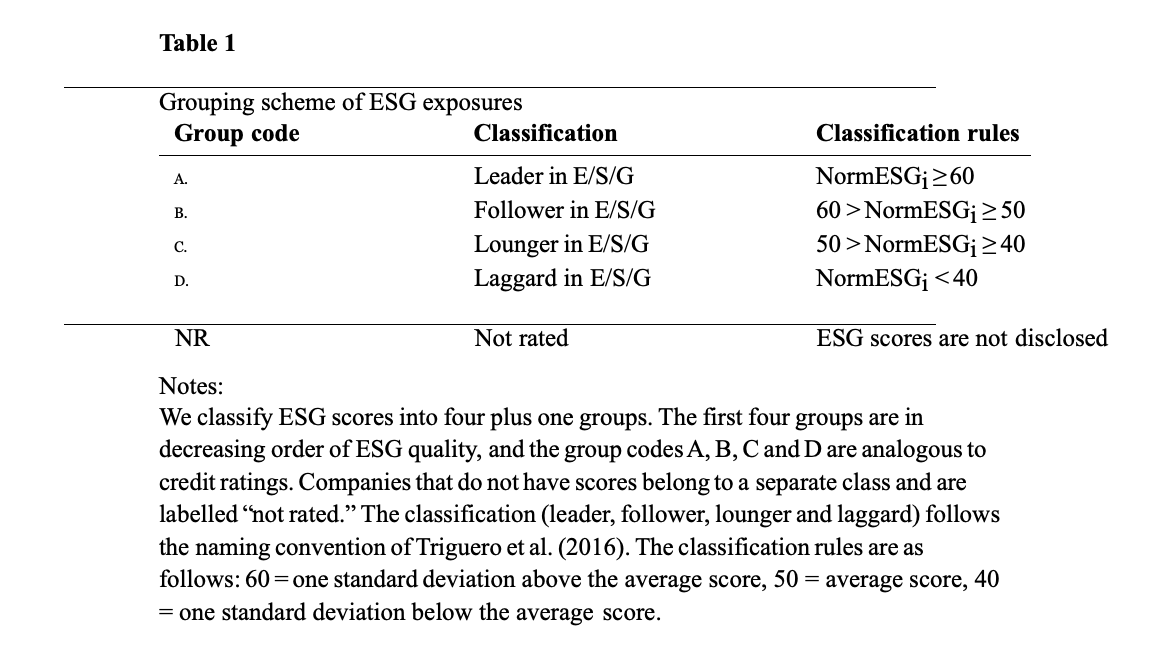

Helena Naffa and Máté Fain contribute to the sustainable investment literature with their study A Factor Approach to the Performance of ESG Leaders and Laggards, published in the January 2022 issue of Finance Research Letters, in which they introduced a factor methodology to quantify the impact of ESG alignment on investment performance. They constructed “pure ESG equity factor portfolios (PFP),” rated on a five-point scale (see Table 1 from the study below).

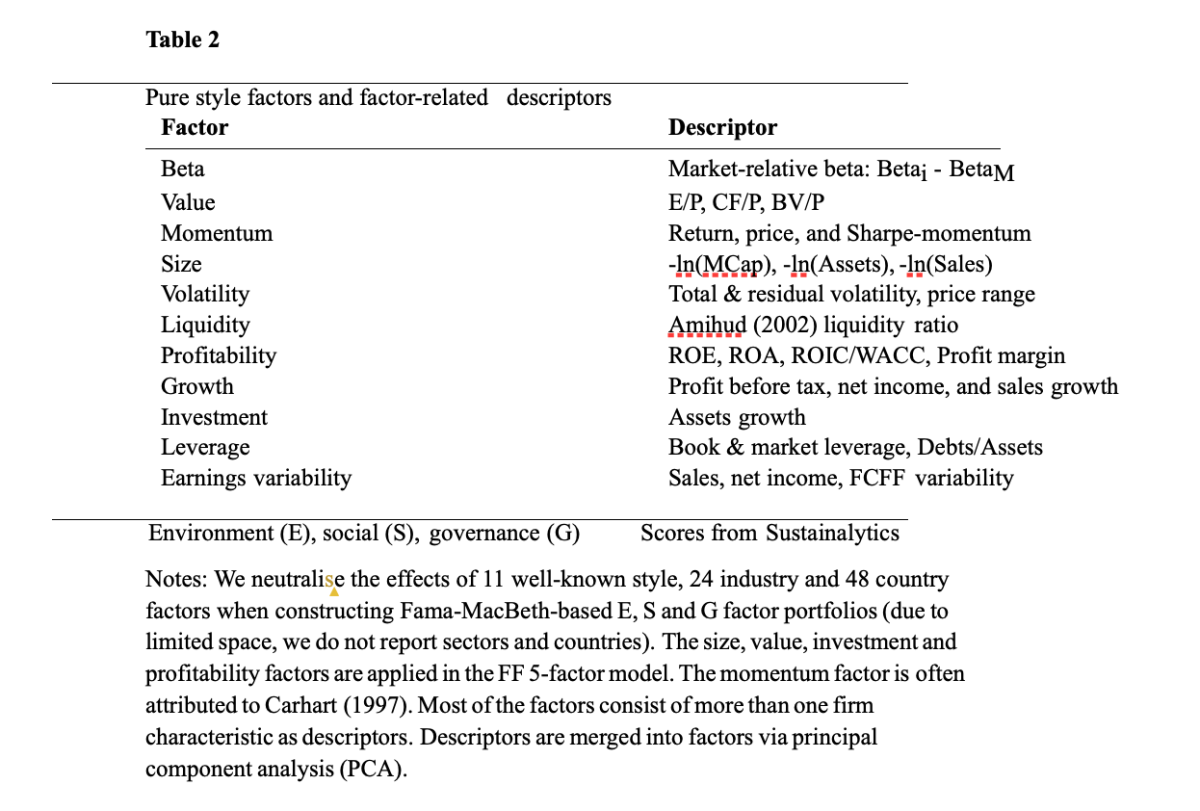

The style factors they analysed were beta, value, momentum, size, volatility, liquidity, profitability, growth, investment, leverage, earnings variability and ESG (see Table 2, also from the study, below).

They then measured the risk-adjusted performance of the pure ESG factors. Their data sample covered the style factors plus 24 industry and 48 country exposures over the period 2015-2019. Given the short sample period, they used weekly (instead of monthly) data from Bloomberg to increase the number of data points. Following is a summary of their findings:

- ESG portfolios did not generate statistically significant alphas during the sample period of 2015-2019. There were no statistically significant performance results, whether looking at industry leaders, followers, flounders or laggards.

- There was no sufficient evidence for ESG factors to complement the Fama-French five-factors — the low t-statistics do not justify them as complementary new factors.

- Pure ESG factor portfolios may serve as ESG indices to quantify investment portfolio sustainability risks via performance attribution of the ESG factor tilt.

Naffa and Fain’s findings are consistent with those of other research studies. For example, the 2019 study Carbon Risk, the 2020 study Valuing ESG: Doing Good or Sounding Good?, and the 2021 studies Honey, I Shrunk the ESG Alpha’: Risk-Adjusting ESG Portfolio Returns and Toward ESG Alpha: Analyzing ESG Exposures through a Factor Lens examined how ESG attributes are linked to common equity factors. They all reached the conclusion that common factors do a good job of explaining the performance of ESG strategies — ESG outcomes are correlated with style factors used in asset pricing models. The research has also found that when you select funds with high ESG scores, those funds will tend to have significant factor and sector exposures that differ from the market as a whole.

Investor takeaways

Differences in factor exposures can lead to tracking variance regret, and the abandonment of even a well-thought-out plan, when the returns to those factors are negative. However, to the extent that factor exposures are desired, they may, over the long run, provide higher returns associated with the factor premiums. However, if the exposures are not desired, investors will need to adjust their portfolios while trying to maintain their ESG goals. This highlights the importance of performing deep due diligence when selecting funds for an ESG-oriented portfolio.

The above findings should not lead to questioning whether ESG strategies can offer substantial value to investors. Instead, they suggest that investors who look for value-added through outperformance are looking in the wrong place — ESG strategies should be considered for the unique benefits they can provide, such as hedging climate or litigation risk, aligning investments with norms and making a positive impact on society. In addition, investors get an added benefit by employing ESG strategies that tend to tilt toward factors with higher expected returns (specifically, profitability and investment) — a strategy employed by the sustainable investment funds of Dimensional.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data which may become outdated or otherwise superseded. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Buckingham Strategic Wealth and Buckingham Strategic Partners recommend Dimensional in client accounts. The above mentioned of Dimensional is for informational purposes only. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability, or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, confirmed the accuracy, or determined the adequacy of this article. The opinions expressed by featured authors are their own and may not accurately reflect those of the Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. LSR-22-230

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of numerous books on investing.

ALSO BY LARRY SWEDROE

Is there an opportunity cost of responsible investing?

Deep value: three reasons to be cheerful

Is hedge fund alpha shrinking?

The rise of corporate green bonds

Weighting scheme design: what investors need to know

CONTENT FOR ADVICE FIRMS

Through our partners at Regis Media, TEBI provides a wide range of high-quality content for financial advice and planning firms. The material is designed to help educate clients and to engage with prospects.

As well as exclusive content, we also offer pre-produced videos, eGuides and articles which explain how investing works and the valuable role that a good financial adviser can play.

If you would like to find out more, why not visit the Regis Media website and YouTube channel? If you have any specific enquiries, email Robin Powell, who will be happy to help you.

© The Evidence-Based Investor MMXXII