This tale is part of LARRY SWEDROE’s Investor Tales series. Unless otherwise specified, the tales are hypothetical scenarios, designed to educate the reader on investment principles.

The most costly of all follies is to believe passionately in the palpably not true. —H.L. Mencken

◊

Having started his practice in December 1999, Steve had been a registered investment adviser for more than 20 years and had substantially grown his practice. He was a passionate believer in active portfolio management and used the services of SEI Investments to help him choose which actively managed funds to use when he built portfolios for his clients.

In early January 2020, Steve attended an investment conference at which he heard a speech on modern portfolio theory, the efficient market hypothesis and passive investing. After the talk, he approached the speaker and told him that while he was intrigued by the presentation, he believed the SEI story was a compelling one and asked the speaker to comment.

“SEI are one of the largest firms in the industry,” the speaker said. “They’re a leading global provider of asset management and investment technology solutions. They state that their innovative solutions help corporations, financial institutions, financial advisors and affluent families create and manage wealth. SEI also boast that they aren’t tied to conventional solutions. They create innovative new ways to turn wealth into freedom and provide new answers that help companies unlock their full potential.

“I suggest you check the historical record on their funds to see if their results and the returns your clients have earned stand up to that claim. Given that SEI is a leader in its field, it should also be a good test of your belief that active management is the winning strategy. When you get back to the office, compare the returns of SEI’s funds to those of comparable benchmark indices to see if they have delivered the results for which your clients have been paying fees to you, SEI, and the fund managers.”

Steve promised the speaker he would do just that. He realised the conventional wisdom that active management was the winning strategy was so ingrained in his thinking, he had never bothered to check to see if SEI funds were adding value.

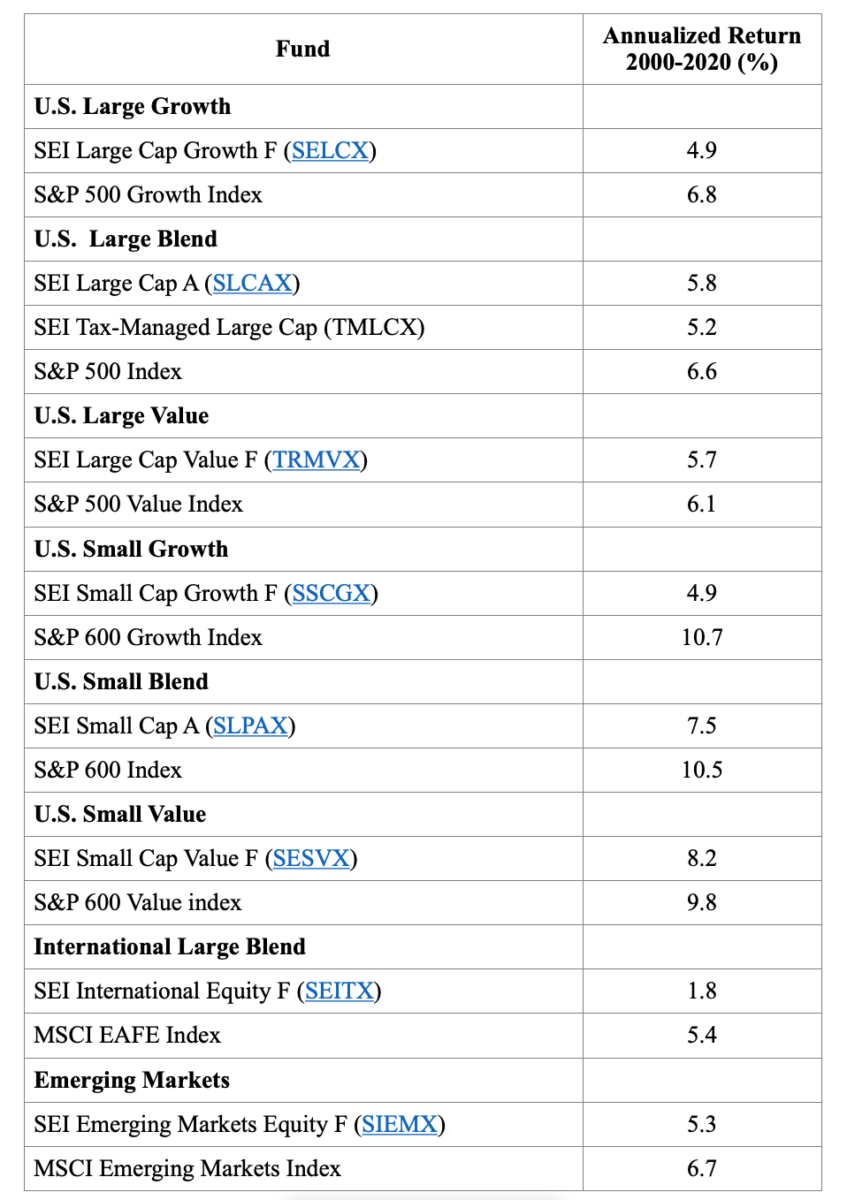

When Steve returned to his office, he went straight to his computer to access Morningstar’s database. He compared the returns of all SEI’s actively managed funds that had existed for the full 21-year period he had been practicing (2000-2020). In every single case, the SEI fund had underperformed the benchmark index for the selected time period.

Steve was shocked at the data. He also had to conclude that poor performance does not come cheap — the expense ratios of the SEI funds were much higher than those of index funds he could have chosen instead.

His clients were paying dearly for poor performance: While the average return of the nine SEI funds was 5.5 percent, the average return of the nine benchmark indices was 7.8 percent, an underperformance of 2.3 percentage points per annum. Index returns don’t include any fees or expenses, but products mirroring these indices (mutual funds or exchange-traded funds) are available at very low cost.

The table below presents the evidence:

Steve concluded that given the vast resources at the disposal of SEI, his findings provided a powerful illustration of the failure of active management to provide superior returns as compensation to investors for accepting the risk of underperformance. He also concluded that if an organisation such as SEI did not succeed, it was unlikely he or anyone else would be able to do so.

Steve decided the only logical conclusion was that his belief in active management as the winning strategy was mistaken. He knew he had a difficult road ahead of him. However, since doing the right thing for his clients was his No. 1 priority, he had to inform them of his findings. He would also have to inform them he was going to change strategies and advise his clients to adopt a passive approach to investing.

Steve sat down to write a letter to all of his clients. He explained he had always provided them with the best advice based on his knowledge at the time. Because he had learned there was a better way to invest, he felt obligated to provide them with this knowledge. Just as doctors change prescriptions when a more effective drug becomes available, he was changing investment strategies now that he believed the evidence was clear that passive investing was likely to produce the best long-term results.

While he knew there might be some difficult conversations ahead, he also knew his clients would continue to trust him as long as he did the right thing.

The moral of the tale

There are actually two morals to this tale. The first is that if you are using actively managed funds, you should compare them on a regular basis to the alternative: a low cost, tax efficient, index fund/ETF, or a similar low-cost structured portfolio that provides exposure to the factors (such as small and value) that you desire.

The second moral is that while it may be difficult to admit being wrong, even the smartest people make mistakes. Only fools, however, keep repeating them.

Important Disclosure: The opinions expressed by featured authors are their own and may not accurately reflect those of the Buckingham Strategic Wealth®. This article is for general information only and is not intended to serve as specific financial, accounting or tax advice. While reasonable care has been taken to ensure that the information contained herein is factually correct, there are no representations or guarantees as its accuracy or completeness. No strategy assures success or protects against loss. The story about Steve is hypothetical and should not be interpreted as representative of any individuals actual experience. In addition, my firm recommends Dimensional funds in constructing client portfolios. LSR-21-4

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of numerous books on investing.

ALSO BY LARRY SWEDROE

The definition of investor insanity

Social trading platforms are bad for your wealth

How predictable are government bond returns?

A lost decade for endowment returns

Why would anyone want a hedge fund ETF?

Victory belongs to the patient

WHAT TO READ NEXT

If you found this article interesting, we think you’ll enjoy these:

Is your star striker really a “top investor”?

The biggest investment lesson from 2020

The problem with stocks like Tesla

Ten market predictions to count on in 2021

The most over- and under-hyped benefits of ETFs

Coming soon — a Darwinian cull of active management

Transparency is good for business for asset managers

OUR SISTER BLOGS

If you’re a financial adviser or planner and you enjoy TEBI’s articles, why not try our sister blogs, Adviser 2.0 and Evidence-Based Advisers?

© The Evidence-Based Investor MMXXI