Robin writes:

To be honest, part of me groans when another SPIVA report comes out. It’s not that they don’t tell us something very important. They do, every time. No, it’s that the investing industry routinely ignores them.

Actively managing other people’s money is awesomely lucrative. If you can charge one per cent or more every year for doing so, of course you’re going to disregard the evidence that the vast majority of investors are better off in very much cheaper index funds or passively managed ETFs.

No wonder the industry doesn’t like talking about SPIVA, or the Morningstar equivalent, the Active/ Passive Barometer, whose findings are very similar.

But, as Aldous Huxley, once wrote, “facts do not cease to exist because they are ignored”. And those of us who can see what’s going on and who want to help investors keep more of their returns for themselves have a duty to keep repeating those facts.

Here, then, is a summary from the authors of SPIVA’s Year-End 2022 scorecard for the United States. You can download the full report here:

SPIVA U.S. Scorecard Year-End 2022

FT subscribers may also like to read this excellent analysis from Trillions author Robin Wigglesworth:

Yeah, about that active comeback…

The S&P 500 finished 2022 with a -18% total return, its worst performance since 2008, and fixed income markets offered little diversification benefit: the iBoxx $ Liquid Investment Grade also fell 18%. Both asset classes suffered as yields rose in response to a surge in domestic inflation, accompanied by an aggressive series of rate hikes by the U.S. Federal Reserve.

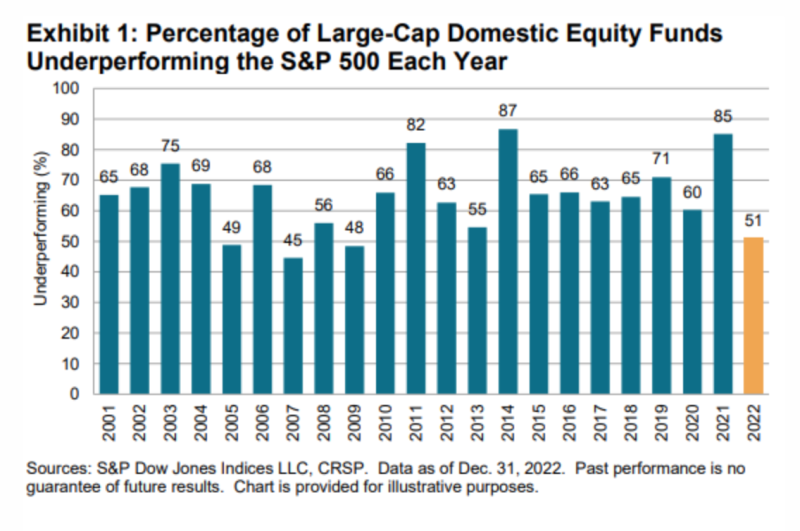

Declining markets can make active management skill more valuable, and our 2022 scorecard identifies several fund categories in which a majority of active managers outperformed. However, in the largest and most closely watched category, U.S. large-cap equities, a slim majority underperformed. On the positive side, this was the lowest underperformance rate since 2009 and the fourth best across more than two decades of our annual SPIVA Scorecards. Less positively, 2022 was characterised by several specific and unusual active tailwinds that may not persist.

In contrast to the near coin-flip chances of finding an outperforming large-cap manager, 63% of mid-cap funds underperformed the S&P MidCap 400 and 57% of small-cap funds underperformed the S&P SmallCap 600 in 2022. The lowest underperformance rate among domestic equity categories was in Small-Cap Core, in which 40% of active funds underperformed. At the other end of the spectrum, the Real Estate and Mid-Cap Growth categories saw the highest annual underperformance rates of 88% and 91%, respectively.

In international equities, a majority of actively managed funds underperformed in every category during 2022. However, in relative terms, managers in the International Small-Cap category continued to outshine their peers, with just 60% underperforming in 2022 compared to 69%, 68% and 76%, in the Global, International and Emerging Markets categories, respectively.

The 2022 completion of the merger between IHS Markit and S&P Global brought a new range of fixed income indices to the S&P DJI family and — as introduced in our most recent mid-year scorecard—the 2022 edition of our year-end U.S. scorecard presents a new range of fixed income comparison indices as well as several new fixed income categories.

The performance of actively managed fixed income funds was generally more creditable in 2022, with just 6% of Core Plus Bond funds and 21% of General Investment Grade funds underperforming. However, we report majority underperformance in 11 out of 17 fixed income categories, topping out at 95% for actively managed Government Intermediate funds.

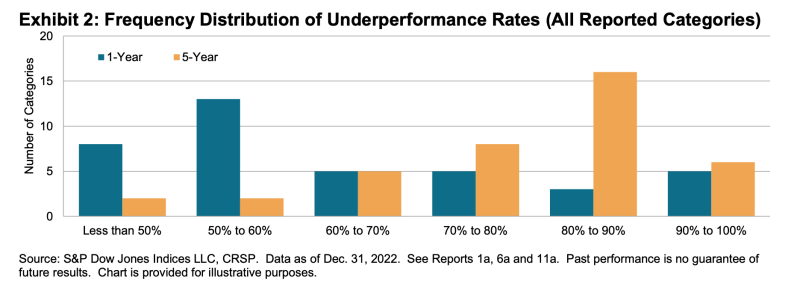

Echoing a frequent theme of SPIVA scorecards over the past 20 years, underperformance rates generally rose with the length of the period over which they were measured. Of 39 reported categories, eight displayed majority outperformance over a one-year horizon, falling to just two categories over a five-year horizon.

PREVIOUSLY ON TEBI

Your true net worth is not about money

#How2Fund shortlisted for Business Book of the Year

Nearing retirement? Invest in friends, not just the markets

INVESTING EXPLAINED — WITHOUT THE MARKETING SPIN

When it comes to investing, there is a dizzying number of complex options available.

How to Fund the Life you Want by Robin Powell and Jonathan Hollow is a new book designed to provide clear, objective guidance that cuts through the jargon, giving you control over your financial future.

The authors strip away the marketing-speak, and through simple graphs, charts and diagrams, provide investment evidence that you can use again and again. They also alert you to myths and get-rich-quick schemes everyone should avoid.

The Book is published by Bloomsbury and is primarily intended for a UK audience.

You can buy the book on Amazon, on Bookshop.org, and in all good bookshops. There are eBook and audio book versions as well.

© The Evidence-Based Investor MMXXIII