By JASON BUTLER

A lot of people find it hard to plan for their long-term financial future, particularly for life after they stop work – i.e. retirement. Humans are wired to favour the here and now, rather than the dim and distant future, and given a choice of spending for an immediate reward – no matter how fleeting and small – or saving money for a future us that we can’t envisage or relate to, spending now is often more appealing.

Learning to save for our future self and spending what’s left, rather than spending on our present self and saving what’s left, is the foundation of good financial planning. Here are five ways to help you become better at planning for your future self’s financial freedom.

Get real on how long you’re likely to live

Most people underestimate how long they are likely to live, and this can cause them to underestimate just how much they need to save for their older self. This calculator from the ONS will give you a good idea of your life expectancy so you can do something about saving for it before it’s too late.

Get to know the future you

Studies have shown that people who regularly looked at an aged version of themselves saved more and spent less than people who had not. Apps like FaceApp will show you what you might look like at a future age and might help you spend now in a way that is kinder to your future self.

Change your language

Retirement is not a very inspiring word for most people, as it conjures up images of being old, alone and no longer having any purpose. I find the concept of making work optional is a much more inspiring aspiration for most people. Working because you want to, not because you must, is something most people would be excited to achieve.

Think in terms of pay days, not years

If you think of pay days, you make planning to make work optional both more tangible and more achievable. There are three sets of paydays to know: how many you’ve had, how many you have until you want work to be optional, and how many your money will have to fund until you die.

For example, let’s say you are 37 and have been working since 21. You hope to achieve financial freedom by age 67 and expect to live until you are 89. Your payday numbers will be as follows – paydays already had: 192; paydays left: 360; and paydays to fund after work: 264.

Know your number

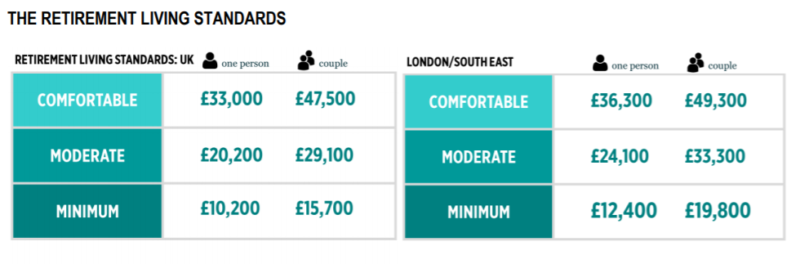

Most people have no idea how much they need to have saved to fund a comfortable life after work. The Pension and Lifetime Savings Association (PLSA) recently commissioned research to identify cost of different levels of retirement lifestyles as shown below.

Source: Developing Retirement Living Standards October 2019, Matt Padley and Claire Shepherd, Centre for Research in Social Policy, Loughborough University

Comfortable is the ideal situation because it doesn’t just enable you to afford the little extras that make life more varied and fun, but it gives you financial freedom to do more and worry less.

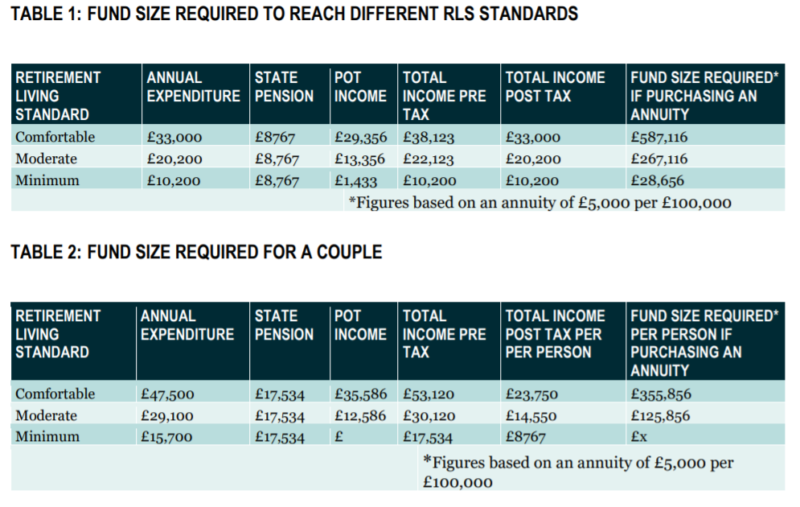

But how much will you need to have saved to support that level of income? Well, the PLSA has calculated that, if you qualify for a full state pension and use your fund to buy a guaranteed annuity at a rate of 5%, the amount you’ll need to have accumulated by the time you stop work will be as shown below.

Source: How to estimate likely Retirement Living Standards (2019), Pension and Lifetime Savings Association (https://www.retirementlivingstandards.org.uk/How-to-estimate-likely-RLS.pdf)

The more you save, the longer it’s invested; and the higher returns you achieve, the more likely you’ll be able to accumulate enough funds to have a comfortable post-work lifestyle.

Planning for life after work is your most expensive financial goal and it isn’t optional; so make it easier by saving enough of each current payday, so you can spend on fun stuff now without feeling guilty about the future – post-work – you.

JASON BUTLER is a former financial adviser, based in Suffolk. He is a personal finance columnist for the Financial Times, and is Head of Financial Education at Salary Finance. You can find out more about him on his website.

Jason has written a number of articles for TEBI. Here are a few you may have missed:

If you don’t ask, you don’t get

Match your spending with your values

An emergency fund is a necessity, not a luxury