I’m usually wary of making predictions, but here are two things I can predict with absolute certainty. The Values-Based Adviser.

Ten years from now:

— independent, peer-reviewed evidence will play a much bigger part in investment decisions than it does today, and

— most investors will invest at least some of their assets in sustainable funds.

Yesterday I saw a glimpse of the future at The Values-Based Adviser, an event in Leeds I organised with the help of Global Systematic Investors.

It was aimed at financial advisers who have an evidence-based investment philosophy, but who also want to help their clients to invest in a way that reflects their personal values.

Although I’m a a staunch advocate of sustainable investing, I’ll admit it’s a subject I’m still getting to grips with. Here are five things I learned at the event in Leeds.

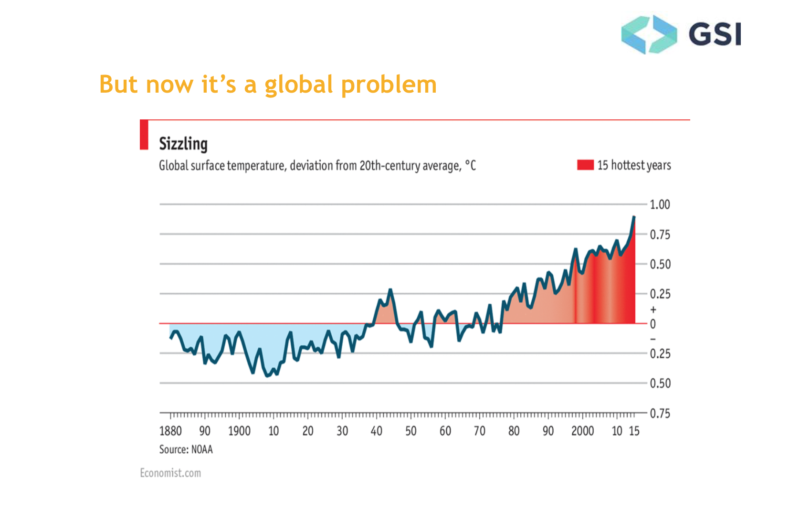

The last five years, 2014–2018, rank as the five warmest years on record

Let’s face it, we hear warnings about climate change all the time, and they often go in one ear and out the other. We should all take time to read the evidence and let it sink in. The chart below is based on data from the National Oceanic and Atmospheric Association in the United States. According to the NOAA, nine of the ten warmest years since record began in 1880 have occurred since 2005. The last five years, 2014–2018, rank as the five warmest years on record.

Social enterprise is one of the one of the fastest growing sectors of the UK economy

As well as sustainable investing, we also learned about the closely related field of impact investing. Grace England from the impact investment firm Resonance discussed the work that she and her colleagues are doing with social enterprises. As well as generating returns for investors, Resonance is helping to tackle pressing social problems such as unemployment, homelessness and social isolation. I must say, I didn’t realise quite how huge the social enterprise sector is. A report published in September 2018 showed there there are more than 100,000 social enterprises in the UK, contributing £60bn to the economy and employing two million people.

Grace England from Resonance

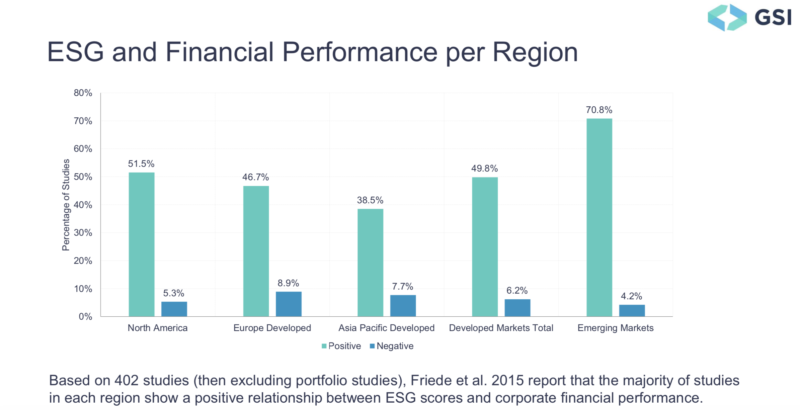

Most academics agree that high ESG scores and financial performance are positively correlated

It’s fair to say the jury is still out among the academic community as to whether sustainable investing produces higher or lower returns than mainstream investing. There is, however, growing evidence that firms with high ESG scores — i.e. firms with good corporate governance that act in a socially and environmentally responsible way — tend to perform better financially than those with lower scores. GSI’s Garrett Quigley used the chart below to explain how the vast majority of serious studies on the subject confirm this positive correlation, which holds true for every region of the world.

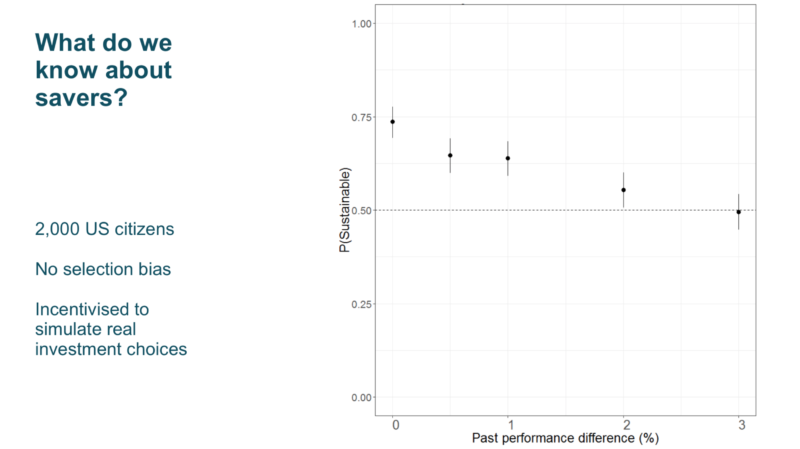

Investors are willing to pay a performance penalty for investing with their conscience

The most eye-opening statistic of the day came from Dr Jake Reynolds, Executive Director of the Cambridge Institute for Sustainability Leadership. A study that he has conducted in conjunction with Cambridge University’s Psychology Department shows that investors would prefer to invest in a sustainable fund even if it cost them between 2 and 3% in annual returns. Of course, compounded over decades of investing, that sort of performance penalty would make a huge difference, and I will be interested to read the details when the research is published in October. But even if that statistic isn’t entirely accurate, the study certainly confirms the notion that, for sustainable investors, financial returns are not the be-all-and-end-all.

Advice clients offered the option to invest sustainably usually take it

Finally, it seems that when financial advisers give them the option to invest sustainably, clients tend to take it. Or at least that’s the experience of Max Tennant, Managing Director of Ifamax Wealth Management in Bristol. Max has been asking clients about their personal values for many years, and in 2015 he decided to move all his clients over to a sustainable investment strategy. At the same time he gave them the option to opt out and stick with a mainstream investment portfolio. How many clients chose to opt out? None. Even the clients who Max expected might raise objections were happy to embrace a sustainable approach.

If you missed out on The Values-Based Adviser in Leeds, you may like to know that we’re holding a follow-up event in London on 25th October. We’re going to be releasing details in the next few days, so watch this space.

In the meantime, you can find out more about Global Systematic Investors and Resonance, the sponsors of these events, by visiting their websites:

You can find more on Sustainable Investing here:

Can the UK become a global champion in impact investing?

Should sustainable investors own or avoid “irresponsible” stocks?

Do sustainable investors behave better?