It struck me the other day quite how big the mindfulness industry has become. Browsing in WH Smith at Euston Station, I was amazed at many books and magazines there were on the subject. There was even a wide selection of mindfulness colouring books.

I’ll admit, I’m not as convinced as many are about the life-changing nature of mindfulness. I can see that some people find it very helpful. I’ve read a fair amount about it and I’m still working (possibly too hard!) on my technique. But I haven’t found it easy.

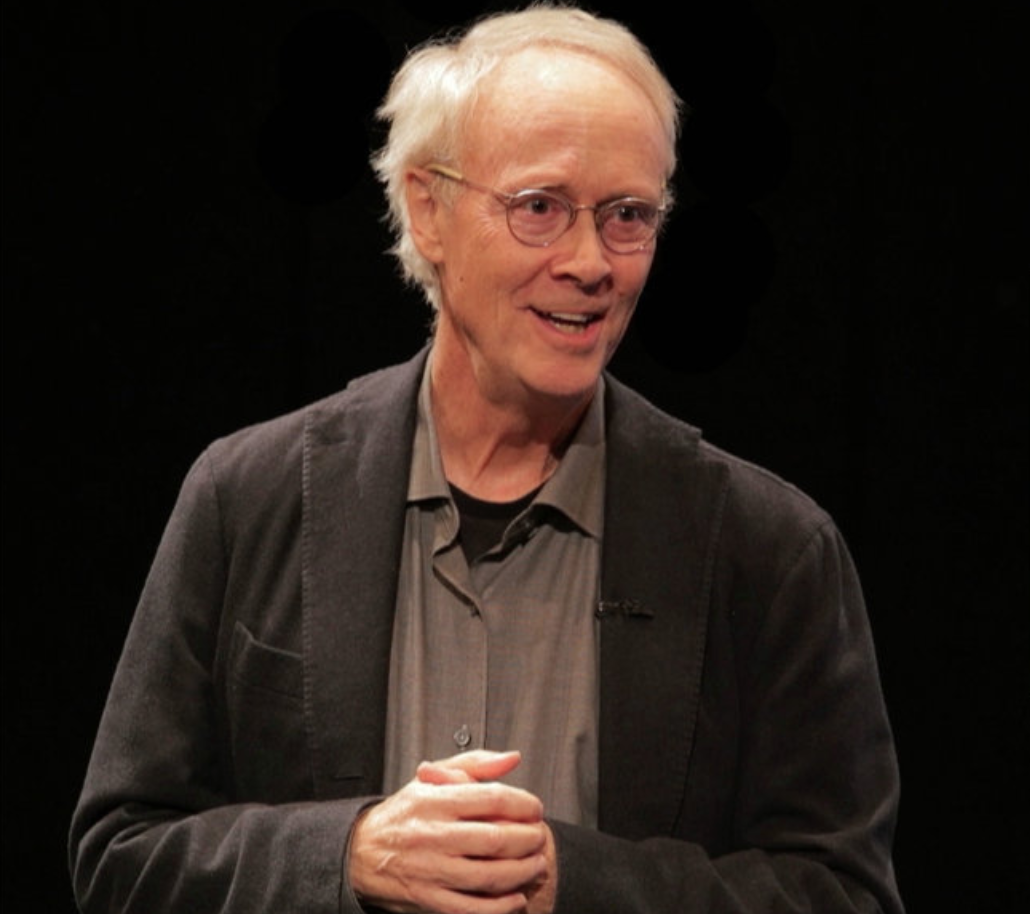

The most enthusiastic advocate of mindfulness I know is George Kinder. George, better known as the father of the financial life planning movement, has practised mindfulness for most of his life and written books about it.

In the latest TEBI Podcast, George explains how mindfulness can help investors achieve better outcomes and live more fulfilled lives.

“The primary practice that is taught in meditation,” he tells me, “is to focus on the present moment. What that does is, it makes you much quicker in the moment, much clearer, and much more capable at a moment’s notice to focus and be present. So you’re really much more alert.”

Greed and fear

So how can that specifically help from an investing point of view? The answer, George Kinder says, is that it can help them to maintain their discipline.

“The most common pattern in investing,” he explains, “is that we all buy high, when everyone’s enthusiastic, and we sell low, when everyone’s pessimistic. That’s driven by greed and fear. What mindfulness does is, it creates more patience, more equanimity, more quietness, less reactivity. So you’re more able to be present.”

In the same podcast, George discusses the thinking behind financial life planning, and how it differs from the traditional, product-led approach to financial advice.

Where the power lies

“All the power and all the money in the industry is in the product companies,” he says. “That money is geared towards profit, towards selling things.

“The people that just pay attention to finance and don’t really care about you, don’t really listen to you and aren’t concerned about your issues, are going to be salespeople. Their main aim is making a profit for their own business.”

We also discuss the future of asset management and financial advice. In George’s view, it’s time for financial professionals to take a step back and reflect, just as he did himself during the global financial crisis.

“When the banking crisis hit in 2008, he recalls, “I was personally devastated. I questioned everything that I’d done. What have I been doing for 40 years? How could this be happening?”

What’s needed more than anything, he argues, is a cultural change that puts the interests of clients first.

Impeccable integrity

“There should be a wall,” he says, “between advice and products, between advice and large institutions, and between our regulators and large institutions. We need an integrity that is impeccable.

“Until we actually institute a way of bringing good heart, great integrity and a fiduciary relationship that is sustainable into the industry, we are going to fail.

“We have to make this change, and we have to make it now.”

You can listen to my interview with George Kinder here:

The TEBI Podcast is available on Soundcloud and iTunes. If you enjoy the latest episode, please leave a review.