Growth stocks have outperformed value stocks over the past decade. But as this article from DIMENSIONAL FUND ADVISORS explains, history shows is that the pendulum can swing quite quickly.

There’s a misconception in the markets: value stocks have lost their vigour.

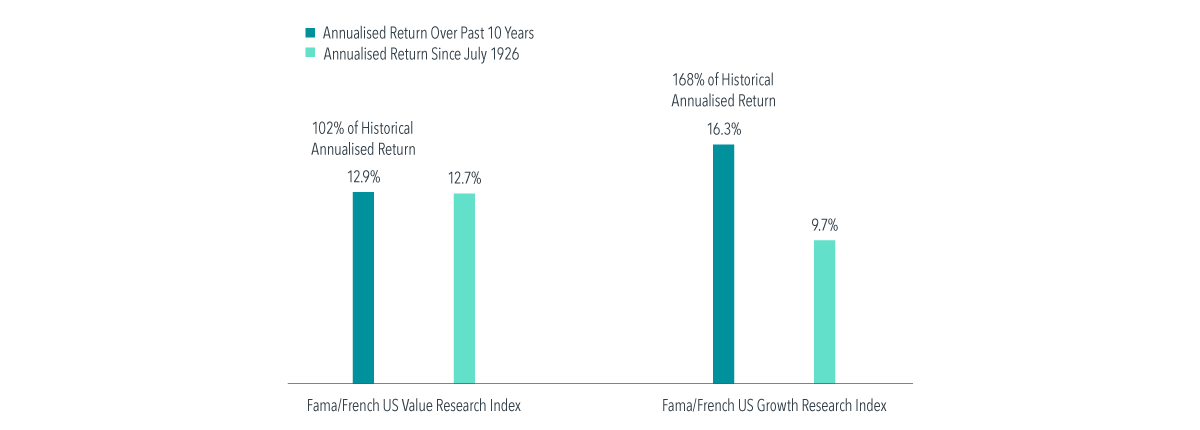

Value stocks have underperformed growth stocks over the past decade. In the US, the annualised compound return has been 12.9% for value stocks, or those trading at a low price relative to their book value. That contrasts with 16.3% annualised compound return for growth stocks, or those with a high relative price. [1]

Lessons of the past

Value underperforming growth by 3.4 percentage points a year over a decade is indeed disappointing. But one question investors might ask themselves is, how do the returns for value and growth stocks over the past decade compare with their long-term averages?

Looking at returns for the US value and growth indices separately in Exhibit 1, we see that growth’s annualised compound return of 16.3% over the 10-year period ending June 2019 was much higher than its return since July 1926, at 9.7%. On the other hand, value performance over the past decade has been more or less in line with its historical average: 12.9% vs. 12.7%. We can see value has performed similarly to how it has historically behaved. It is growth stocks that have had very good recent returns relative to the long-term history. Investors maintaining an emphasis on growth stocks may be hoping this departure from the trend will endure, despite the historical long-term averages.

A quick comeback

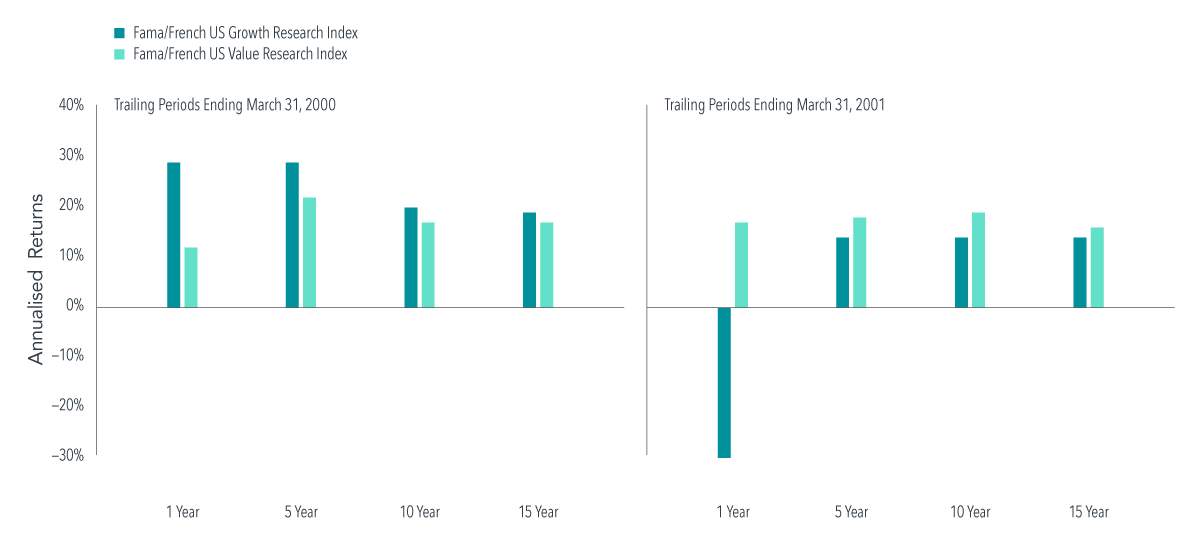

While stock returns are unpredictable, there is precedent for the value premium turning around quickly after periods of sustained underperformance. For example, some of the weakest periods for value stocks when compared to growth stocks have been followed by some of the strongest (see Exhibit 2). On March 31, 2000, growth stocks had outperformed value stocks in the US over the prior year, prior five years, prior 10 years, and prior 15 years. As of March 31, 2001—one year and one market swing later—value stocks had regained the advantage over every one of those periods.

Positioned for the long term

The theoretical support for value investing is longstanding—paying a lower price means a higher expected return. However, realised returns are volatile. A 10-year negative premium, while not expected, is not unusual.

But history also tells us that changing course after a disappointing spell for known premiums can lead to missed opportunities. When those drivers of outperformance have turned around in the past, steadfast investors have been rewarded. A key to successful long-term investing is sticking with your approach, even through difficult periods, so that you are there for the good times too.

This article first appeared on the Dimensional Fund Advisors blog, Dimensional Perspectives.

Also in this series:

Booth & Fama: a friendship that changed investing

Do IPO returns match the hype?

Robert Merton: Technology and trust should go hand in hand

Ten questions investors need to ask

This is how random global returns are

[1] Value stocks’ performance is measured by the Fama/French US Value Research Index. Growth stocks’ performance is measured by the Fama/French US Growth Research Index.