Robin writes:

I’m delighted to welcome a new regular contributor to the team here at TEBI. JONATHAN HOLLOW has worked in several senior communications roles in the UK public sector, including at the Cabinet Office. He has recently left his post at the Money and Pensions Service, where he was Head of National and Corporate Strategy. Before that he was Head of Financial Capability, Strategy & Innovation at the Money Advice Service. He is now a writer and commentator on financial education and consumer protection. Jonathan is going to be writing about a range of money-related issues. Here he kicks off with a warning about an ever-present danger investors face — pension fraud and other financial scams.

The Evidence-Based Investor has long warned about the risks to your wealth from active managers and their fees. I strongly support these warnings. But today I’m asking which matters more to investors — active manager fees, or an outright scam?

I believe that in the grand scheme of risks, we should be equally wary of both. Because these days, savvy investors are the most tempting of targets for scammers.

How to lose £105,000

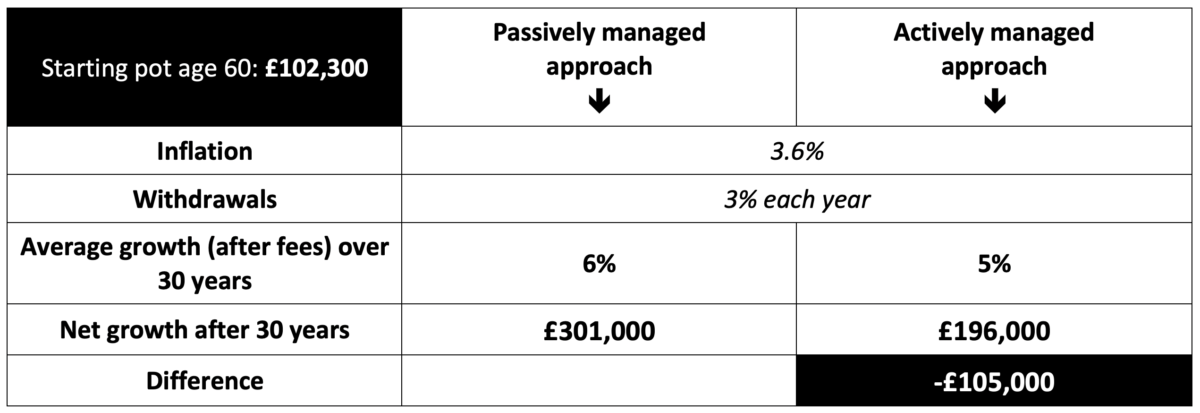

The latest ONS figures give a median pension wealth of £102,300 for people aged 55–64. Let’s look at two investment pathways for that pension pot. Both are illustrative, but plausible (perhaps a little generous to active managers by proposing just a 1% difference in net performance).

In this imaginary but plausible scenario, the investor that chose passive management over active would end up £105,000 better off over their retirement.

But how plausible is it that over a 30-year period, both investors could lose £105,000 or more – simply to a scam?

There are no absolutely comprehensive statistics that allow us to estimate this probability. Not all fraud gets reported. But there are plenty of statistics to show why fraud really matters for investors:

- In the first half of 2021, the Financial Conduct Authority analysed scam figures and found that the average pension fraud loss was £50,949. The average had doubled in just one year.

- The banking body UK Finance analyses all reported financial fraud. They found that during 2020 there were more than 6 million scams. At least 1 in every 11 UK adults experiences fraud every year.

- Millions of these cases are low-value. For example, 2.8 million payment card cases averaged just £2 each. But the the total value of all reported fraud was nearly £1.3 billion, and the average for the more complex cases was nearly £7,000.

- Romance scams are especially lucrative. The Guardian reported the case of Anna, a professional in her 50s, who handed over £350,000 before she realised her “lover” was a liar.

Fighting a flood of fraud

So the fraudsters’ reach is wide, deep, and growing in many areas. To grasp why fraud really matters for investors, it’s worth understanding two key reasons why it’s more tempting, and easier, than it used to be:

- UK investors, especially pensioners, have more access to liquid wealth than ever before. When most people’s pensions were a final salary scheme or came from an annuity, there was an annual income, but no pot of gold for fraudsters to target. Now life-changing amounts are within reach. If you are reading this blog, you will most likely be a tempting target at some time in your life.

- Digitisation of financial services has made scamming easy — as easy as sitting on your backside and sending off emails. Compare this to 20 or 30 years ago. Back then, almost all fraud would have involved face-to-face impersonation, and the attendant risks of getting caught in the act.

We may think we are the clever ones. We wouldn’t fall for a Nigerian prince. But sadly, fraud is an arms race. Techniques vary from the laughably obvious to the terrifyingly sophisticated and patient. Artificial intelligence is not a mainstream tool for fraudsters at present. But when it is, they will find it easy to spawn new personas, and even sophisticated video fakes, at an ever-decreasing cost.

How to protect yourself

Robin Powell and I have been working on a new book about evidence-based investing, due to be published later this year. When we reflected on the key messages that needed to be front and centre of our book, we concluded that the growing risk and sophistication of financial scams means they really matter – even for the savviest investors. There will be a whole chapter in our book as a warning.

Because they are always shape-shifting, there’s no one rule that will avoid scams and fraud. But in all our reading around the matter, three good recommendations rose to the top.

- The first is a cliché that has surely stood the test of time. “If it sounds too good to be true, it probably is”. Anyone who offers a guaranteed return of even 5% needs to be treated with a healthy dose of suspicion, and above 10%, guaranteed – forget it! London Capital & Finance failed in 2019, owing investors £120 million. They had been tempted by a promise of a fixed-rate return of 6.5%. Whether or not it was a scam, it is now a scandal, and sadly just the latest in a long list calling on the appealing phrases “fixed rate” or “guaranteed return”.

- Our second recommendation touches on our culture. We Brits simply must stop being embarrassed about money! If you are making a transaction that involves a life-changing sum of money, talk to a trusted friend about it. Ask them to think through everything that could go wrong. Even if the transaction is sound, they can check the details of a large sum of money being transferred. Talking to them will have two benefits. The first is getting somebody else’s perspective. The second is simply slowing yourself down. Fraudsters love to get at you in what psychologists call a “hot state” … a state of anxiety, excitement, tunnel vision. The faster you move, the more you will be caught up in it. Slow down, and you’ll have a better chance of avoiding scams and fraud.

- Our final recommendation is to treat your digital security as an absolute priority.

This last point needs its own article. So I’ll be returning to it in February.

In the meantime: stay safe, and follow the evidence!

JONATHAN HOLLOW worked for the UK Government’s Money and Pensions Service and is a writer and commentator on consumer education and protection.

WHAT TO READ NEXT

Here are some other recent TEBI posts we think you will enjoy:

The reasons why investors stick with losers

Spending decisions that end up costing a million dollars

Nudges are still the best way to tackle investor inertia

Is today’s market conducive to successful active management?

A one-page financial plan really is enough

How good are we at predicting our longevity?

FIND AN ADVISER

The evidence is clear that you are far more likely to achieve your financial goals if you use an adviser and have a financial plan.

That’s why we offer a service called Find an Adviser.

Wherever they are in the world, we will put TEBI readers in contact with an adviser in their area (or at least in their country) whom we know personally, who shares our evidence-based investment philosophy and who we feel is best able to help them. If we don’t know of anyone suitable we will say.

We’re charging advisers a small fee for each successful referral, which will help to fund future content.

Need help? Click here.

© The Evidence-Based Investor MMXXI