A meaningless phrase we hear at the start of every year is “this is a stockpicker’s market”, or “this is the year for active management”. As regular TEBI readers know, most active managers underperform most of the time. Active management is also a zero-sum game before costs (and a negative-sum game after costs); in other words, one active manager can only win at another manager’s expense. That said, there are times when picking the right stocks — whether through skill, luck or a combination of both — carries a higher premium than at other times. So, how conducive have market conditions been for successful active management in recent weeks and months? And what can we expect in 2022? CRAIG LAZZARA from S&P Dow Jones Indices has been taking a look.

The history of active investment management is, for the most part, a history of failure and frustration. Most active managers underperform most of the time, and success in one period seems not to predict subsequent success. We have long argued that active underperformance is not coincidental — it happens for identifiable and understandable reasons, and is therefore likely to continue.

But — most of the time is not all of the time, and most active managers are not all active managers. Some market environments may be more conducive to relatively favourable (or, to be precise, relatively less unfavourable) active performance.

The data for the calendar year 2021 are still being collated, but I can attempt some informed speculation about what SPIVA will reveal when the final results are in.

There are both positive and negative signals about the prospects for active management:

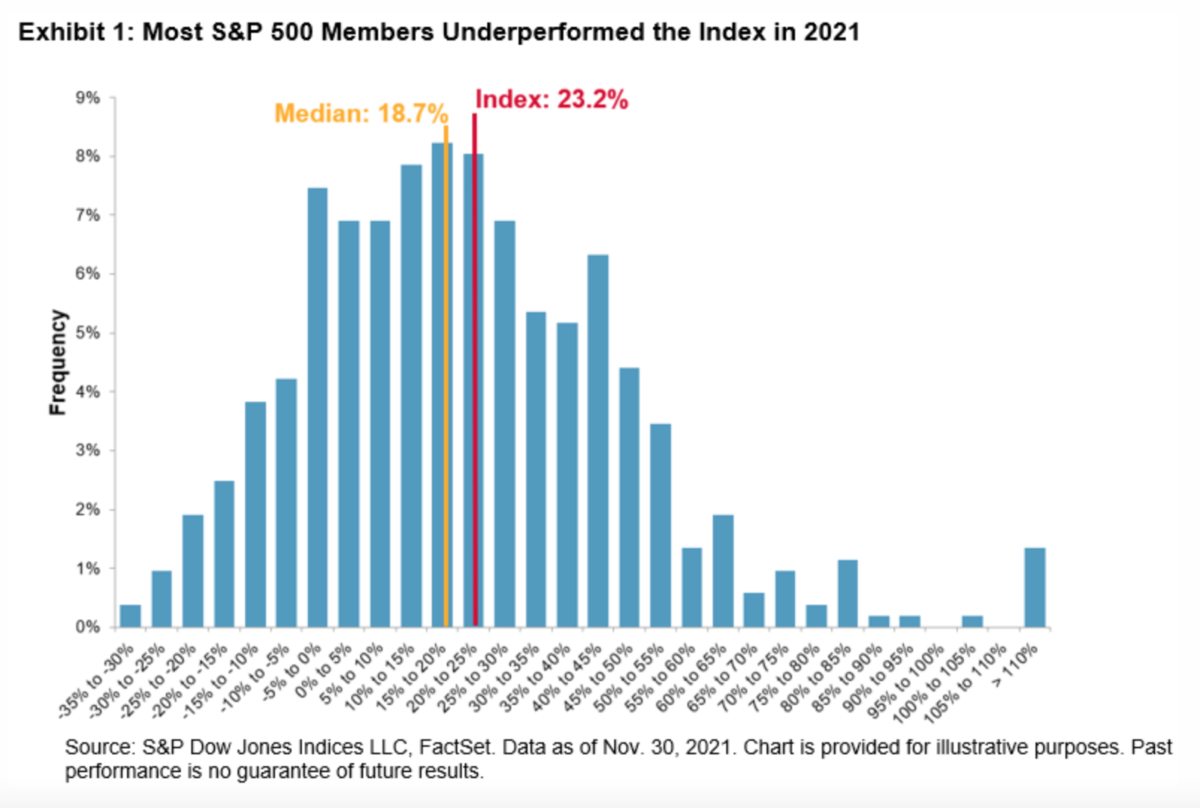

- One of the most consistent challenges for active managers arises because, in most years, most stocks in the S&P 500 underperform the index. Returns are typically driven by a relatively small number of strong performers, which pull the index’s return above that of most of its constituents. Through the end of November, this was precisely the situation in the S&P 500: the index was up 23%, versus a gain of only 19% for the median stock. Only 42% of index members outperformed through the first 11 months of the year. Needless to say, fewer outperformers make for more challenging stock selection.

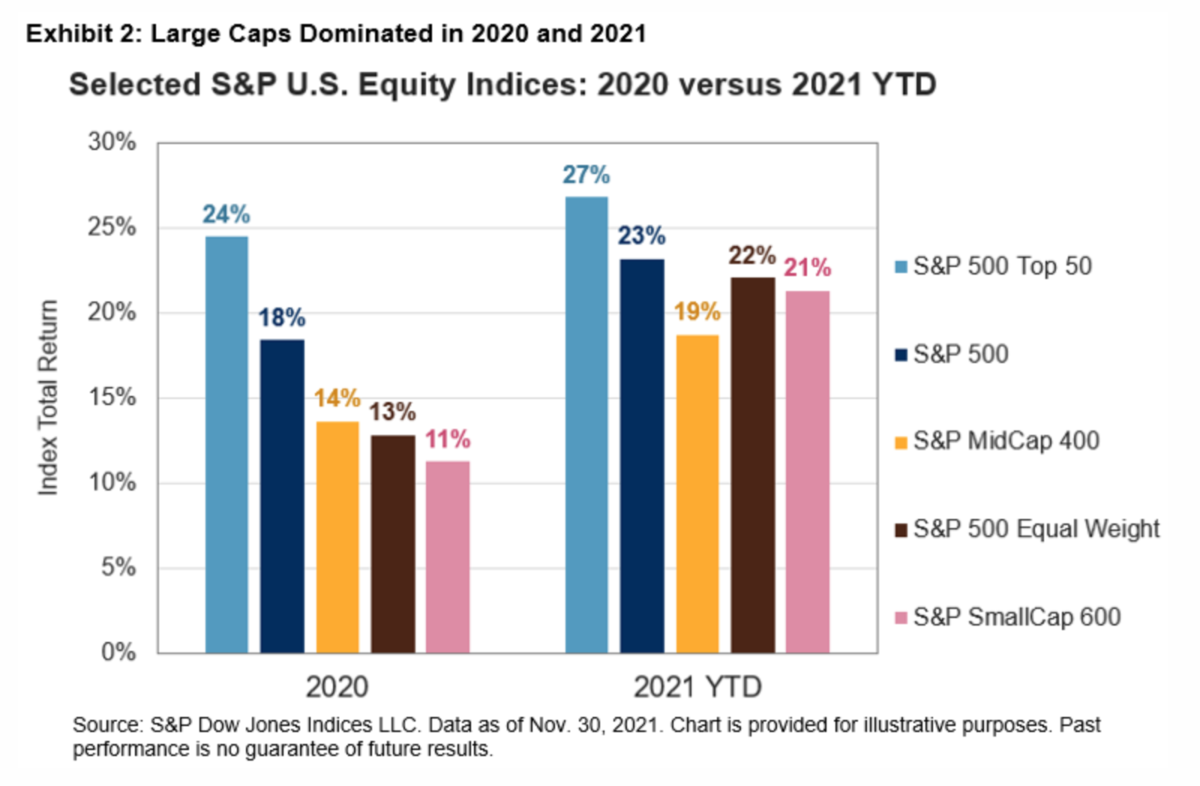

- Strong markets historically have been somewhat more challenging for active managers; this is particularly true when the strong market is driven by some of the index’s largest names. Exhibit 2 shows us that the largest 50 stocks in the S&P 500 are comfortably in the lead for 2021. While it’s relatively difficult for active managers to overweight the largest names in their benchmark index, the reverse is not true. In fact we’ve found that large-cap managers tend to do better in periods when the superior performance of mid- or small-cap names gives them a chance to “cheat” (I use the term lovingly) down the cap scale. Not this year — although the performance of larger names may give mid- and small-cap managers an edge.

- On the other hand: SPIVA data suggest that most active managers typically underweight lower volatility, low beta stocks; when Low Volatility underperforms, or High Beta outperforms, active results tend to improve. Through November 30, the S&P 500 Low Volatility Index was up 13% for the year, while the S&P 500 High Beta Index had risen 36%. The gap narrowed in December, but so far this signal augurs well for active managers.

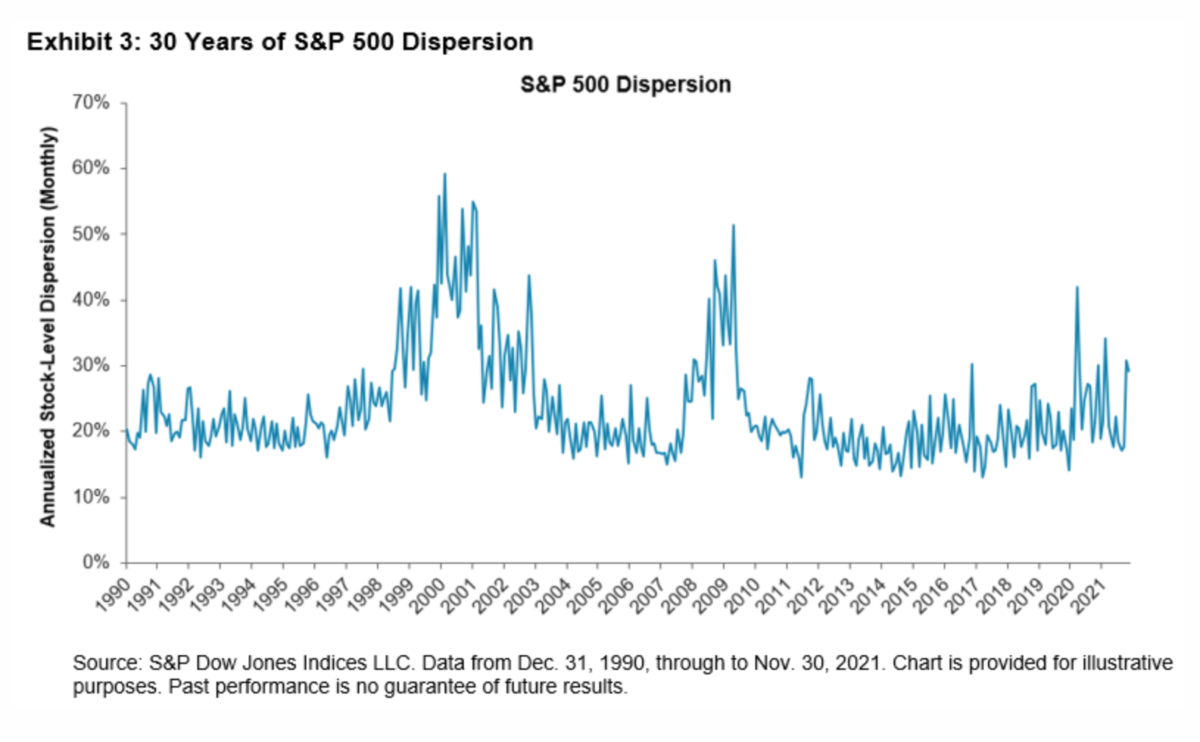

- Dispersion began the year at a relatively modest level, but has recently begun a noticeable rise, closing November well into the top quartile of its historical range. Although dispersion tells us relatively little about the success of active managers as a group, heightened dispersion suggests that the range of active outcomes will be greater than usual. The best active performers should shine, as the value of stock selection skill rises when dispersion is high.

Readers can form their own opinions about the proper balance of these observations. Recognising the hazard intrinsic to all predictions, my guess is that when we draw a line under 2021, active underperformance, at least for large-cap U.S. managers, will persist.

Of course, the conditions that make active management more or less difficult can change. If, for example, 2022 sees a declining market, with mega caps and lower volatility names leading the way down, it’s conceivable that active underperformance could become less prevalent. That may be cold comfort to the active management community and its customers — but sometimes cold comfort is all the comfort there is.

CRAIG LAZZARA is Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices.

MORE FROM S&P DJI

For more valuable insights from Craig Lazzara and his colleagues, you might like to read these other recent articles:

Reasons for optimism post COP26

How will a strengthening dollar affect emerging markets?

How should an infallible vaccine for Omicron be priced?

OUR STRATEGIC PARTNERS

Content such as this would not be possible without the support of our strategic partners, to whom we are very grateful.

TEBI’s principal partners in the UK are S&P Dow Jones Indices and Sparrows Capital.We also have a strategic partner in Ireland — PFP Financial Services, a financial planning firm in Dublin.

We are currently seeking partnerships in North America and Australasia with firms that share our evidence-based and client-focused philosophy. If you’re interested in finding out more, do get in touch.

© The Evidence-Based Investor MMXXI