A guest post by PRESTON McSWAIN

Are some investors placing votes in favour of private equity based on fake news?

According to a recent McKinsey & Company Global Private Equity Review, in 2017 private investment managers raised a record sum of nearly $750 billion globally. A few factors are driving this, but one is the strong belief that private investments have and will continue to produce outsized investment returns.

As an example, the same McKinsey study reported that over 90% of investors believe that private investments will outperform public markets and that this belief is “echoed by many investment consultants who continue to predict such outperformance”.

To look deeper into why return expectations are so high, I’ve reviewed multiple independent research reports, consultant reviews, and manager presentations. In addition, I’ve attended seminars designed to educate investors on how to allocate to private equity and participated in a series of private equity fundraising calls.

What did I find?

Consistent evidence that the performance claims that seem to be driving funds into private investments are often based on fake news and the presentation of returns that “no client received” (this is a direct quote from of a recent private equity presentation).

Returns that No Investors Have Received

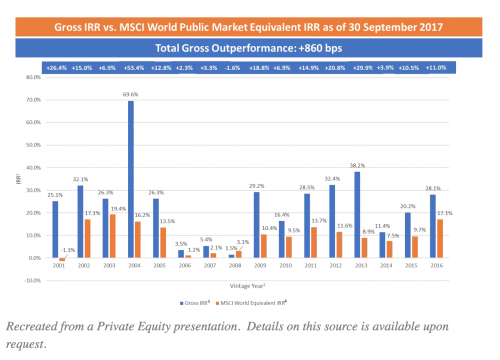

Below are quotes from a leading private equity firm and a chart from their presentation.

“It really all comes down to return and…”

“We have been able to deliver outperformance consistently over the past 17 years.”

“On average across all those years we have provided 8.6% of gross outperformance over the public equity markets and over 6% of estimated net outperformance.”

This all sounds great and would be wonderful, but for the following quote associated with the many footnotes. It was at the very back of the 50-page-plus presentation book in very small print.

“No client received the returns.”

Yes, you read that correctly.

The performance that the firm’s senior representative was boldly selling was, by the firm’s own admission, fake news.

Their estimated net returns also didn’t include additional fees charged on their new offering, but that’s another story (for more on issues related to how net of fees isn’t net of all costs read Where Are Fees and Expenses Not Costs?).

Unfortunately, what I’ve just mentioned is something that the industry has been warned about for many years.

Returns that Make Bad Funds Look Better and Good Ones Look Great

The bolded words above were taken from another McKinsey report from 2004 entitled A Cautionary Tale. It warned investors and industry executives about the fake news I just mentioned (they called it “dangerous”) and pointed out that this is “neither isolated or immaterial.”

What are these fake returns? IRRs or Internal Rates of Return.

As I previously wrote for the CFA institute in a piece called Tall Tales, the way firms report these returns are technically compliant and are often properly disclosed based on “sophisticated investor” accredited investor rules.

So, how can they be fake?

Investment disclosures commonly state that past performance does not guarantee or indicate future returns, but this is exactly what IRRs can do.

IRR calculations assume that future investments will achieve the same returns as past investments. Even though it never happens in the real world, in an IRR calculation, realised cash distributions keep earning the same returns in the future for the complete life of the fund or private investment.

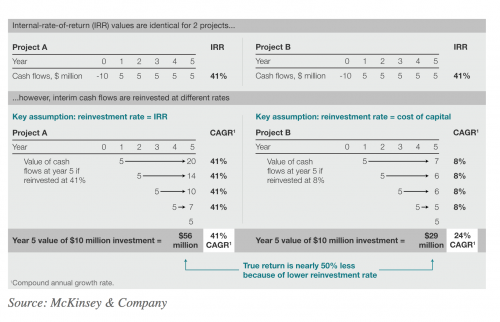

To drive this home, below is an illustration from the McKinsey study that warned about the “unrealistic expectations . . . [and] dangerous assumption[s]” that IRRs create.

It highlights two different methods of projecting, or reporting in the case of many fund presentations, the returns of the same $10 million investment.

Project A uses an IRR methodology, which assumes that each $5 million in realised cash flow is reinvested in a manner that will achieve the 41% IRR.

Project B assumes the $5-million cash flows can be reinvested at a more modest but still relatively high return of 8%.

I hope this helps to highlight a key problem that McKinsey warned about.

To assume “that interim flows can be reinvested at high rates is at best over-optimistic and at worst flat wrong.”

The more realistic 24% return is nearly 50% lower than the investment’s IRR, but even though investors would have never received it, a private investment fund would have been able to market an average annualised of 41% over five years.

Is this why McKinsey used the word “dangerous”? I’ll let you decide.

To be fair, there is no simple way to calculate private equity fund returns. If you Google “IRR Private Equity”, you will get pages of results that discuss the pros and cons of using different methods to evaluate the performance of private equity funds.

As an example, Howard Marks, in a paper titled You Can’t Eat IRR, lists seven different ways to judge private equity performance.

He properly states that to get it right, a “complex, multi-dimensional analysis is required,” but he also details his own cautionary IRR story.

Marks explains that he was asked to evaluate an investment made by a friend in a private equity fund of funds. His friend had committed $750,000 to the fund, $600,000 had been called, and the materials stated that the fund had produced an annualised IRR of 27.1% since inception. As Marks says, “So far, pretty good.”

He then mentions the problem.

“The IRR of 27.1%, if applied to his contributed $600,000 (forget his committed $750,000), would have produced $1,142,000 of gains.

“And yet, [his friend had only] $273,000 of actual gains.”

This prompted Marks to end his story with an iconic question: “Where’s the beef?”

As was mentioned in a paper published by the Harvard Business Review, The Truth About Private Equity Performance, my beef is that “overstated private equity performance [seems to be driving] investors to continue to allocate substantial capital to this asset class, despite… finding[s] that PE funds have historically underperformed broad public market indexes by about 3% per year on average”.

What should investors do?

Ask probing questions with the understanding that even though presentations can contain appropriate disclosures for accredited and sophisticated investors, they can obscure a lot with complex disclosures.

If you look closely, my strong bet is that you will start to notice that most every headline return chart or quote that you see or hear is a fake news IRR (managers, consultant and database indices, and quartile rankings included).

In addition, you might notice that some presenters incorrectly sell IRRs as returns that investors have received.

Somehow, IRRs have become the standard and private investments tend to be presented in ways that make it easy to overlook important fine print technical disclosures.

To drive this all home, the following is my normal and then unique tale.

Not long ago, I sat in on a very well-respected firm’s private equity presentation made to family offices, institutional consultants and RIAs.

As is the norm, impressive presenters made bold statements about how “private equity has consistently outperformed public markets”.

Fine print mentioned that all the returns were IRRs and not net of all fees, expenses and other costs, but this wasn’t discussed. Outperformance comments were backed up with great looking charts, and IRRs were incorrectly pitched as if they were real cash returns that investors had received.

Near the end of the day, the unique part happened.

The firm brought on a young quantitative analyst they had just hired to run models on the best way to invest in private equity. Unlike what had been marketed earlier, I noticed that she was using figures that calculated returns based on the actual cash distributions that investors had received (Distributions to Paid In or DPI).

I asked her why and got a priceless quote.

After a few more words detailing her calculations she said, “IRRs are meaningless and should never be used.”

I hope she didn’t get fired, but the top guys literally locked their jaws and she was out of the room very quickly.

Unfortunately, it was then back to normal.

Next up, to finish the day, was a co-founder of the firm. He gave an emotional and compelling talk about how he had built the multi-billion dollar firm from scratch. It included great war stories of big deals and the significant value that they created.

After the stories ended, an institutional consultant sitting next to me asked the co-founder what his firm’s historical return had been.

With confidence the co-founder said, “our gross IRR has been approximately 20% per year since inception.” Then he went on to talk about how these returns were a great illustration of “how private equity has consistently outperformed public markets”.

Yes, just after his own analyst had stated that IRRs are “meaningless” and, like McKinsey, told us that they “should never be used”, the head of firm ended the day promoting IRRs that “no client [had] received”.

I shook my head in disbelief, but what did I hear?

The same consultant who had asked the question said, “Thank you, very impressive.”

It was one of the finest examples I’ve ever seen of how powerful the Halo Effect can be.

Bottom-line, the next time you see a chart listing the performance of a private equity fund or hear quotes about how private investments are a “need-to-do” based on its outperformance as compared to other types of investments, proceed with care (click here for more).

Some private investment opportunities can provide investors with solid returns, but considering the fact that investors can’t spend IRRs, why are investment firms, consultants, endowments, and pension funds allowed to use them as criteria for investment evaluation and report them as returns that investors have received? See the below cut and paste from two of the largest pension funds in the US:

“Performance will be calculated… with primary emphasis being placed on internal rate of return.”

“Private equity is the system’s best-performing asset class at 13.8%.”

The reporting and marketing of IRRs is common practice and may be legally compliant (after digging I found that the above listed 13.8% return quote was an IRR).

However, just because something is a historical practice or deemed appropriate from a regulatory standpoint, is it right?

I’ll let you decide if I’m too harsh in calling IRRs fake.

On purpose, I’m also not listing the names of the firms I’ve referenced. The point is not to call out any specific firm, as almost everyone (managers, large investors and consultants) seems to be doing it in some form.

Considering how private investment IRRs are being sold and reported, however, isn’t it time to set the record straight?

PRESTON McSWAIN is a Founder and Managing Partner of Fiduciary Wealth Partners, an SEC-registered investment adviser and multi-family office, based in Boston, Massachusetts. This article originally appeared on Preston’s blog, Provoking Posts.

Robin writes:

I’d like to thank Preston for allowing us to use this article as a guest post. Preston is a longstanding friend and supporter of The Evidence-Based Investor, as well as The Transparency Task Force.

TEBI readers will know that the lack of transparency in the reporting of private equity performance is an issue that I attach great importance too. Having twice interviewed Professor Ludovic Phalippou at the University of Oxford on this subject, I’m convinced that private equity is the next frontier in the campaign for greater transparency in asset management.

It’s also a topic that we’re going to be discussing at two breakfast seminars in October, entitled Evidence-Based Investing for Trustees. I’m holding the events in conjunction with the Cheltenham-based financial planning firm RockWealth.

The first seminar is in Cheltenham on Wednesday 3rd October, and the second in London on Wednesday 17th October. Among the other speakers will be Charles Payne, formerly Investment Director at Fidelity, and the hedge fund manager turned indexing advocate Lars Kroijer.

Trustees of pension and investment funds of all kinds are welcome to come., and attendance is free. However, places at both events are strictly limited, so if you’d like to attend I suggest you email Sarah Horrocks at RockWealth as soon as possible at sarah@rock-wealth.co.uk.