Robin writes:

Looking back, and knowing what I do now, I’m embarrassed at how naïve I used to be about the financial industry, and how willing I was to trust the opinions of so-called experts.

I always urge consumers to start from a position of scepticism. Generally speaking, financial professionals aren’t bad people. They’re just human beings, with their own agendas and incentives, and that alone should make us very cautious about any “advice” they give us. As Warren Buffett once put it, “Never ask a barber if you need a haircut.”

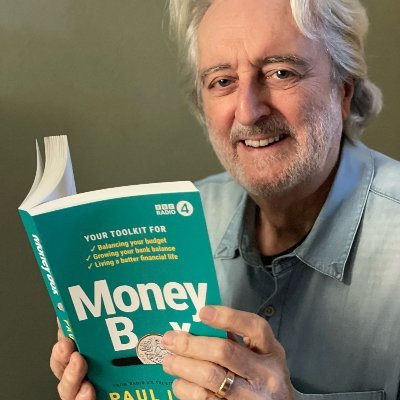

Someone who shares this view with me is PAUL LEWIS. Paul has been writing and talking about personal finance for four decades. The presenter of Money Box on BBC Radio 4 and, like me, the son of two teachers, there isn’t much he doesn’t know about money.

He’s now written a book, also called Money Box, which is designed to help you live a better financial life.

In this interview, Paul discusses the issue of trust in financial services. Who can, and can’t, you trust? And is it possible to tell the difference between the two?

Paul, there’s a great quote right at the start of your book: “Treat the financial industry not like your friend, but more like a vague acquaintance you don’t really trust but have to see from time to time and who always makes you pay for the drinks.” Why do you say that?

Most of the financial industry is, of course, honest. I’m not saying anything else. But a lot of it confuses people, and I think it sometimes deliberately confuses people because their job is to make money — to make money out of your money.

Very often they don’t make anything useful like a book case or a television or a car. They make money out of money, and it’s your money they make it out of. That is their purpose in life. And of course they’ll be friendly, because they’re making money off you. So you can’t think of them as a friend. They’re a business. They’re there to make money and you have to be very aware of the things they might do to take money off you. I don’t mean illegally, though I do deal with fraud and criminals in the book, because there’s a lot of those about as well. I mean the regulated financial services industry, because it’s there to take money off you, and very often it takes too much off you.

There’ve been loads of instances where the regulators have had to step in — to stop insurers, for example, putting up your premiums every year and hoping you wouldn’t notice. That’s been stopped now. But of course, the result is that premiums have just gone up for everybody because they’ve got to make that money somewhere.

That happens a great deal in financial services. You’ve just got to be aware of the traps.

There are consumer groups that are working hard to make the financial industry more transparent and trustworthy. So are things heading in the right direction?

It’s true, there are organisations that are trying to make things better for consumers, like the True and Fair Campaign and the Transparency Task Force. But when I look at what they do, they’re fighting a losing battle because the financial industry doesn’t want you to know a lot of things.

The True and Fair Campaign wants charges, for example, to be completely clear, so that when you make an investment you know how much it’s going to cost you.

Working out all the different ways the industry takes money off you — the cost of buying and selling shares, the various fees and charges, and so on — is very hard to do. There are even laws that say fund companies should tell you all the costs, but they’re not very clear. When I look at charges on investments, they’re not clear to me. It’s as though there are lots of little taps at the bottom of your pot where your money is that other people have control over.

So I think that what these organisations are doing is good. But I don’t think it will ever make the financial industry completely clear and transparent about how much it costs you to invest.

What about the financial media? Look at any investment magazine or the money section of a national newspaper and you’ll find articles suggesting that now is a good time to invest in such-and-such a fund, country, sector or asset class. Can those sorts of tips be trusted?

That’s right, if you read the financial pages, or if you go online, you’ll find lots of tips about what to invest in, and particularly at the end of the year or the start of the year. But people who say “This is what you should do in 2023” can’t be trusted because nobody knows what’s going to happen to stocks and shares. People who knew what shares were going to go up this year and what shares were going to go down would be making money; they wouldn’t be writing in a newspaper. So no, you can’t trust those sorts of tips.

If you want to invest, the safest way in the long term is to buy a fund that just tracks the whole market. And in the long term, you will do better than anyone’s tips.

I’m not saying those people are trying to deceive you, but like astrology, treat it like a bit of fun because they cannot predict the future.

In your book, you make it very clear that social media is a very bad place to look for financial advice. Why do you feel so strongly about it?

I always say to people, and I say in the book, never, ever, ever trust financial advice you get from social media.

A lot of it is written by people who don’t know what they’re talking about. A lot of it is put on there by criminals who want to steal money off you. There are a lot of tempting offers on social media. It’s very easy for young people to become what are called money mules. People say, “I’ll put £1000 in your account, I’ll take out 990 tomorrow and you’ll keep 10.” That is illegal activity. You are money laundering, and if you are caught doing that, then you may be prosecuted, and you will certainly find it very, very hard to open a bank account in future. It will mean you can’t get a student loan, for example, and it would be harder to get a job. So it’s very damaging.

So don’t trust get-rich-quick schemes on social media. And don’t trust the advice on social media either because a lot of it is from people who don’t know what they’re talking about and are out to take money off you, not to help you with your money.

Social media is a street full of strangers, and they might be smiling, they might sound very pleasant, they might have nice photographs, but they are often out to get you. These people are very good at playing psychological games with you and leading you into things in the heat of the moment that in retrospect you think, Oh, that was a bit silly.

There is perhaps one exception to all this. There are mortgage brokers and regulated financial advisers who are also on social media. (I personally have a presence on Twitter and I hope people can trust what I say on there!) But make sure that the people you are taking advice from are regulated and that they know what they’re talking about, and aren’t just claiming to have some brilliant scheme to make money quickly.

Just be very, very cautious. The safest rule is never to trust anyone, but if you want to trust someone, check who they are, what they’ve done, and whether they’re regulated, and then look at their advice and accept it cautiously. But don’t believe everything you read because a lot of it is rubbish.

.

Why did you write your new book and what do you hope it will achieve?

I wrote the book Money Box because I’ve been writing and broadcasting about personal finance for nearly 40 years, and I wanted to give people a guide, not just to the facts and the figures, but to the way the whole finance industry works. I want readers to be cautious about things and to know what traps to look out for.

It’s a guide for the whole of life, from age 0 to age 99. So it starts with the cost of babies and having children, and then it looks at teaching children about money. Then it moves on to adult things like borrowing, tax, working benefits and things like that. And finally it covers later life, making a will and what I call “dying tidily”, because I think that’s important.

So I hope that people of any age will read it and get something out of it to help them live a better financial life.

Money Box: Your toolkit for balancing your budget, growing your bank balance and living a better financial life by Paul Lewis is published by Penguin.

PREVIOUSLY ON TEBI

Why did similar strategies perform so differently in 2022?

UK investors are still too heavily concentrated in UK assets

Light green or dark green? Most of us are in between

OUR STRATEGIC PARTNERS

Content such as this would not be possible without the support of our strategic partners, to whom we are very grateful.

TEBI’s principal partner in the UK is Sparrows Capital. We also have a strategic partner in Ireland — Biograph Wealth Advisors, a financial planning firm in Dublin.

We are currently seeking partnerships in North America and Australasia with firms that share our evidence-based and client-focused philosophy. If you’re interested in finding out more, do get in touch.

© The Evidence-Based Investor MMXXIII