Are Dimensional funds worth the extra cost?

- Robin Powell

- Sep 7, 2021

- 5 min read

Updated: Nov 21, 2024

There's a big difference in cost between funds — and that includes passive, or broadly passive, funds. Dimensional funds, for example, are generally more expensive than market-cap-weighted index funds from, say, Vanguard, BlackRock or Fidelity. But, as LARRY SWEDROE explains, investors should always look beyond a fund's expense ratio.

Index funds and passively managed structured/systematic asset-class funds are similar in the way rectangles and squares are similar. All squares are rectangles, but not all rectangles are squares. Similarly, while all index funds are passively managed (no individual stock selection or market timing), not all passively managed structured/systematic asset-class (or factor-based) funds attempt to the returns of popular retail indexes like the S&P 500 or the Russell 2000. Structured. or systematic, portfolios tend to use academic definitions of asset classes and structure portfolios in order to minimise the weaknesses of indexing. Those weaknesses, which result from the desire to minimise “tracking error” (returns that deviate from the return of the benchmark index) include:

Sensitivity to risk factors, which varies over time. Because indexes typically reconstitute annually, they lose exposure to their asset class over time as stocks migrate across asset classes during the course of a year. Structured/systematic passive portfolios typically reconstitute monthly, allowing them to maintain more consistent exposure to their asset class. That allows them to capture a greater percentage of the risk premiums in the asset classes in which they invest.

Forced transactions as stocks enter and leave an index, resulting in higher trading costs. If a fund’s main goal is to replicate an index, it must trade when stocks enter or exit an index, and it must also hold the exact weighting of each security in the index. A fund whose goal is to earn the return of the asset class and is willing to live with some random tracking error can be more patient in its trading strategy, using algorithmic trading and block trading that can take advantage of discounts offered by active managers that desire to quickly sell large blocks of stock. Patient trading reduces transaction costs, and block trading can even create negative trading costs in some cases. To try to quantify the benefits of their flexible approach to trading, in their June 2021 study Dimensionalexamined their trading price advantages over the 2017-2020 period across almost 50 stock markets. They found that their patient trading led to prices that were 10.5 basis points (bps) more favorable on average than those obtained by market participants that demand immediacy. They also found that the price advantages increased as much as 100 percent in times of extreme return volatility, such as March 2020. In addition, the price advantage was greater in less liquid small caps (about 15 bps versus about 5 bps for large caps) and in less liquid emerging markets (about 15 bps in large caps and about 25 bps in small caps).

Risk of exploitation through front-running. Active managers can exploit the knowledge that index funds must trade on certain dates. Structured/systematic portfolios avoid this risk by not trading in a manner that simply replicates the return of the index.

Inclusion of all stocks in the index. Research has found that very low-priced (“penny”) stocks, stocks in bankruptcy, extreme small growth stocks and IPOs have poor risk-adjusted returns. A structured/systematic portfolio could exclude such stocks using a simple filter to screen them out.

Limited ability to pursue tax-saving strategies, including avoiding intentionally taking any short‐term gains and offsetting capital gains with capital losses.

Another advantage of structured funds, in return for accepting tracking error risk, is that they can gain greater exposure to the factors for which there is persistent and pervasive evidence of a return premium (such as size, value, momentum, profitability, momentum, carry, term).

For example, a small value fund could be structured to own smaller and more “value-y” stocks than a small-cap value index fund might have. It can also be structured to have more exposure to highly profitable companies. And it can also screen for the momentum effect (avoiding buying stocks that are exhibiting negative momentum and delaying selling stocks with positive momentum). Importantly, the differences in exposure to common factors can be dramatic. For example, as of June 30, 2021, the largest small-cap value index ETF, Vanguard’s Small-Cap Value ETF (VBR), had an average market capitalisation of $5.5 billion versus just $1.2 billion for Bridgeway’s Omni Small-Cap Value Fund (BOSVX)—VBR’s market cap was 4.6 times greater than that of BOSVX. In terms of exposure to the value factor, VBR’s price-to-book (P/B), price-to-earnings (P/E) and price-to-cash flow (P/CF) ratios were 14.1, 1.9 and 9.2, respectively, while BOSVX’s were 10.1, 1.3 and 4.7—relative to BOSVX, VBR’s valuation metrics were 40 percent, 46 percent and 96 percent more expensive.

Unfortunately, most of the investing public is unaware of many of these differences, which collectively can have significant impacts on the returns of funds that appear to be substantially similar on the surface. While most professionals/advisors are aware of these differences, there is another way for an aggressive firm to add value that is often overlooked; it involves the temporary lending of a portfolio’s securities.

Securities lending

Securities lending refers to the lending of securities by one party to another. Securities are often borrowed with the intent to sell them short. As payment for the loan of the security, the parties negotiate a fee. In the international markets, there is another reason for securities lending, which is the ability to utilise the foreign tax credit. Thus, the opportunities to add value are greater in foreign markets. Fees are also greater in less liquid smaller stocks. Thus, a fund’s exposure to the size factor impacts its ability to generate securities lending revenue.

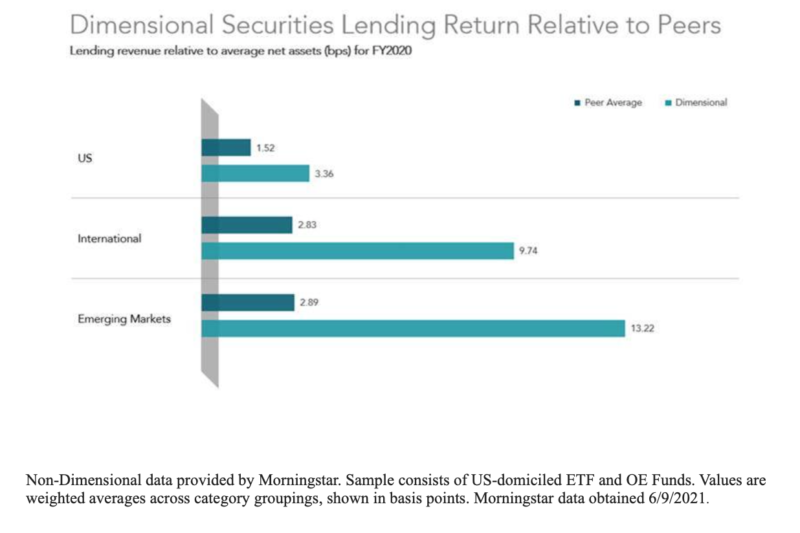

In addition, funds with lower turnover have greater capacity to lend securities. The following table shows that Dimensional, which typically has greater exposure to smaller stocks than most of its peers, was able to generate significantly greater revenue through securities lending in fiscal year 2020. Those revenues go toward offsetting fund expenses, in effect reducing the expense ratio. Thus, the lending fees are earned in a tax-efficient manner.

Summary

There is only one way to see things rightly, and that is as a whole. While the expense ratio should be an important consideration in choosing a fund, it should not be the only consideration. Expenses should be the only consideration when buying a pure commodity, such as when considering the choices for investing in an S&P 500 Index fund or a total stock market fund. However, even similar passive funds in the same asset class can have significant differences in trading costs, turnover, exposure to common factors and securities lending revenue — differences that can have a far greater impact on net returns than the difference in the expense ratio, which is unfortunately the only consideration for far too many investors and advisors. A little bit of extra due diligence can pay significant dividends.

© The Evidence-Based Investor MMXXIV. All rights reserved. Unauthorised use and/ or duplication of this material without express and written permission is strictly prohibited.