Stressing about rising inflation achieves nothing

- Robin Powell

- Jul 21, 2021

- 6 min read

Updated: Nov 25, 2024

Robin writes:

I distinctly remember learning about inflation at around the age of eight. Why, I asked my dad, did petrol stations seem to be changing their advertised prices every day? And why, after months of patiently saving my pocket money, could I still not afford to buy the latest Action Man or Subbuteo set I’d set my heart on?

Only those old enough to remember the mid-1970s know how scary and frustrating runaway prices can be.

There’s plenty of talk about rising inflation today. Last week we learned that UK inflation is rising at its fastest rate for nearly three years, hitting 2.5% in June, after a surge in the price of food and second-hand cars. In the US, consumer prices have been soaring much faster still. They rose 5.4% in the 12 months to the end of June, up from 5% the previous month, the largest increase since 2008.

Unsurprisingly, we’re seeing all sorts of suggestions in the financial media as to how investors should respond. Will prices keep on rising or will inflation fears subside? In each case, what would it mean for the markets? And which assets should we buy and which should we sell?

There’s no getting away from it: rising inflation is bad for consumers, business and economies. Because it erodes the value of our investments in real terms, it's bad for investors too. But, as new research from Dimensional Fund Advisors shows, there’s no need for investors to waste time and energy worrying about what may or may not happen to consumer prices.

Researchers analysed market data from 1927 to the present day — a timeframe which includes periods of double-digit US inflation as well as deflation. Simply staying invested, they found, helps outpace inflation over the long term for a wide range of asset classes. In other words, trying to be clever and tweaking your portfolio now will likely leave you worse not better off.

By WEI DAI, Head of Investment Research and Vice President, Dimensional Fund Advisors

US consumer prices were up by 5.4% for the year ending June 2021, the largest annual increase since August 2008.

Naturally, inflation is the focus of attention for many investors. Our recent paper

US Inflation and Global Asset Returns provides some good news for investors looking to outpace inflation over the long term. But it also contains some sobering facts for investors trying to hedge against inflation through alternatives to inflation-indexed securities.

Inflation outpaced

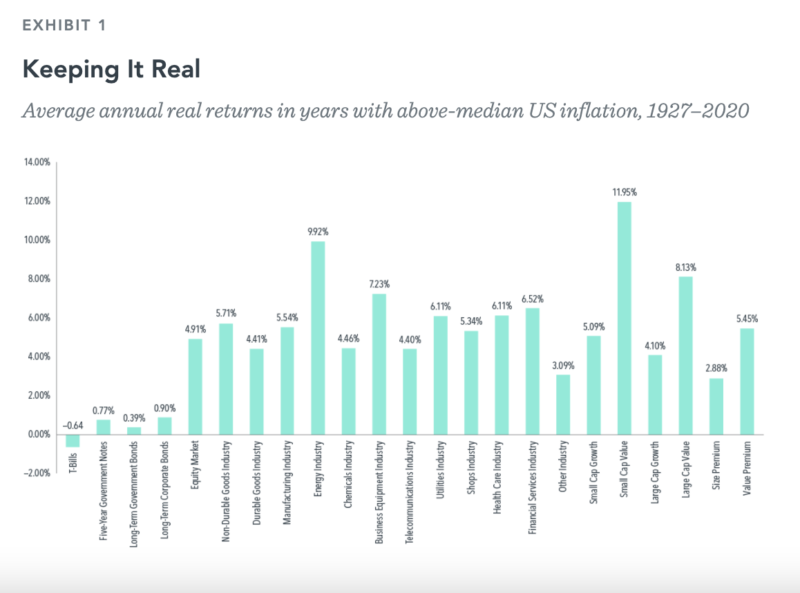

Exhibit 1 shows average real returns (that is, returns net of inflation) to different asset classes in years with high (above-median) inflation from 1927 to 2020. We consider a total of 23 US assets that span bonds, stocks, industries, and equity premiums. Over this period, inflation averaged 5.5% per year in high-inflation years. While average real returns were mostly lower in years with high inflation compared to years with low inflation, the exhibit shows that all assets except one-month T-bills had positive average real returns in high-inflation years. The analysis over 1927–2020 is useful because it covers periods with double-digit US inflation (like the 1940s and ’70s) as well as periods with deflation (like the Great Depression, 1929–32). But we find similar results over the most recent 30-year period (1991–2020), when US inflation was relatively mild and stable. Over this period, we also expand our analysis to non-USD bonds, developed- and emerging-market equities, real estate investment trusts (REITs), and commodities. Overall, outpacing inflation over the long term has been the rule rather than the exception among the assets we study.

Inflation hedged

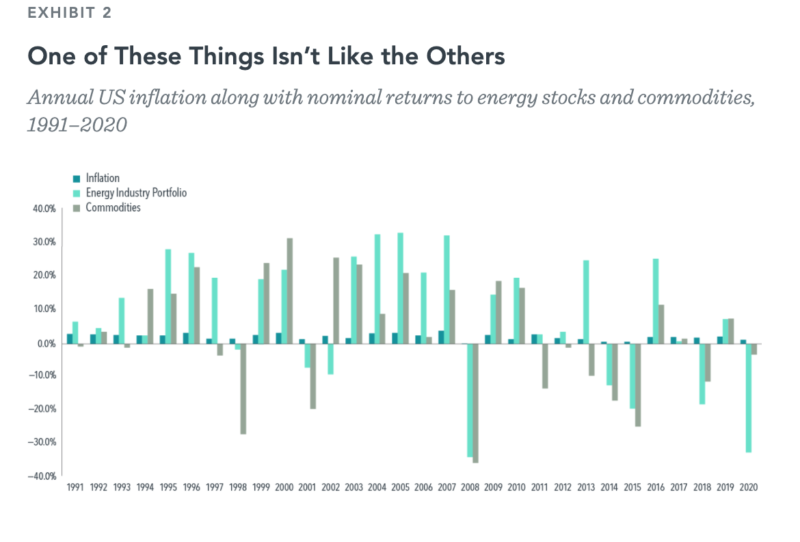

Despite the reassuring findings presented above, emphasising growth assets that have historically outpaced inflation may not be appropriate for everyone. If you’re highly sensitive to inflation and have a low tolerance for market risk, you’ll likely want some exposure to inflation-indexed securities (such as TIPS and inflation swaps), and with good reason: they are designed to provide inflation protection. While stocks from certain industries, REITs, commodities, and value stocks are sometimes considered “inflation-sensitive” assets, the data provide little support that they are good inflation hedges. Nominal asset prices already embed the market’s expectation of inflation. So inflation concerns are really about the negative impact of unexpected inflation on the real value of your invested wealth. An asset is therefore most useful as an inflation hedge when its nominal returns move closely with unexpected inflation. In the paper, we find mostly weak correlations between nominal returns and unexpected inflation. For the few exceptions where the correlations are reliable, such as for energy stocks and commodities over 1991–2020, the assets’ nominal returns have been around 20 times as volatile as inflation, and more than half of their nominal-return variation has been unrelated to inflation.

Exhibit 2 illustrates this by showing how the annual nominal returns to energy stocks and commodities differ dramatically from the annual realisations of inflation. If the goal is to reduce the variability of future purchasing power, it is questionable that hedging with something this volatile will effectively achieve that.

Inflation deflated

What will next month’s inflation reading be? How will it compare to market expectations? Is the rise in inflation temporary or long-lived? Nobody has a crystal ball. Fortunately, we don’t need a crystal ball to address inflation in our portfolios. The data suggest that simply staying invested helps outpace inflation over the long term. And for those of us who are particularly sensitive to unexpected inflation, the protection offered by inflation-indexed securities still appears to be the most effective.

Note: Past performance is no guarantee of future results. Indices are not available for direct investment.

You can read the research here:

FOOTNOTES

Based on the US Consumer Price Index for All Urban Consumers (CPI-U, not seasonally adjusted) from the Bureau of Labor Statistics.

DATA APPENDIX

US inflation

The annual rate of change in the Consumer Price Index for All Urban Consumers (CPI-U, not seasonally adjusted) from the Bureau of Labor Statistics.

US government securities and long-term corporate bonds

The returns to US government securities (one-month T-bills, five-year notes, and long-term bonds) and long-term corporate bonds are from Morningstar (previously from Ibbotson Associates).

US equity portfolios and factors

The US equity market is proxied by the Fama/French Total US Market Research Index. The US industry portfolios are the 12 Fama/French industry portfolios. The US style portfolios (small cap value and growth and large cap value and growth) are from the Fama/French six portfolios sorted on size (market cap) and book-to-market equity. The US size and value premiums are proxied by the Fama/French size and value factors. The returns to all of the above are from Ken French’s data library:

GLOSSARY

T-bills: Short-term debt issued by the US Treasury Department.

Treasury Inflation-Protected Securities (TIPS): Bonds issued by the US Treasury Department that provide protection against inflation. The principal of a TIPS increases with inflation and decreases with deflation, as measured by the Consumer Price Index. When a TIPS matures, the investor is paid the adjusted principal or original principal, whichever is greater.

Inflation swaps: An inflation-swap agreement is a two-sided contract in which one party receives floating payments tied to the actual inflation rate and pays fixed payments based on expected inflation and the inflation risk premium for a given notional amount and period.

Nominal return

: The rate of return on an investment without adjusting for inflation.

Real return: The rate of return on an investment after adjusting for inflation.

DISCLOSURES

Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

© The Evidence-Based Investor MMXXIV. All rights reserved. Unauthorised use and/ or duplication of this material without express and written permission is strictly prohibited.