“We have seen a number of proposals from private equity funds where the returns are really not calculated in a manner that I would regard as honest.”

— Warren Buffett, 2019 Annual shareholders meeting of Berkshire Hathaway

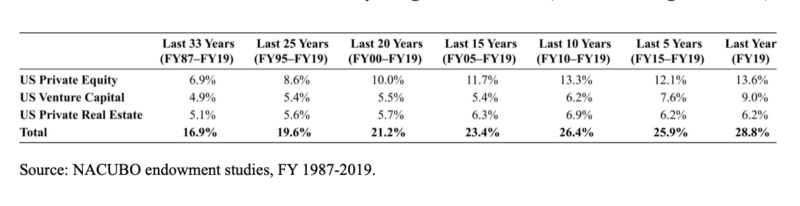

Since its inception in the 1970s, the private equity (PE) industry has grown significantly. According to Preqin data, there are now more than 18,000 private equity funds, with assets under management exceeding $4 trillion. The following table shows the dramatic growth by large endowments to private equity.

Asset Allocation to Private Investments by Large Endowments (Periods ending June 2019)

The question is how well the faith in private equity has been rewarded.

Dennis Hammond contributes to the literature with his study Should Endowments Continue to Commit to Private Investments? published in the December 2020 issue of The Journal of Investing. He began by noting that in addition to the well-documented problem of artificial smoothing of returns (understating risks), private equity returns are likely overstated as a result of returns being determined through internal rate of return (IRR) calculations.

For example, a common practice by PE firms is forcing acquired companies to pay a dividend to the private equity fund immediately after acquisition, which boosts the IRR because of the money-weighted calculation. However, the IRR methodology assumes a reinvestment of interim cash flows at equivalent returns, which is largely unrealistic. For example, a PE fund reports a 50 percent IRR and has returned cash early in its life. The IRR assumes the cash was put to work again at a 50 percent annual return. In reality, investors are unlikely to find such an investment opportunity every time cash is distributed.

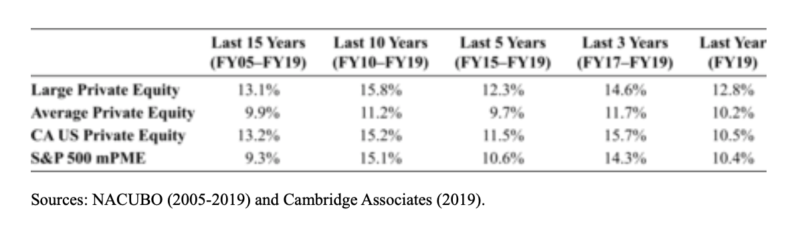

To eliminate distortions due to IRR methodology and develop a meaningful comparison to private investments, any public market benchmark return must be re-characterised as a public market equivalent (PME) return. Cambridge Associates, long recognised as a reliable source of excellent information and consulting advice for endowments, has created and maintained a modified public market equivalent (mPME) for both previously identified public market benchmarks. The following table shows the performance of both large endowments and average endowments for periods ending June 20, 2019:

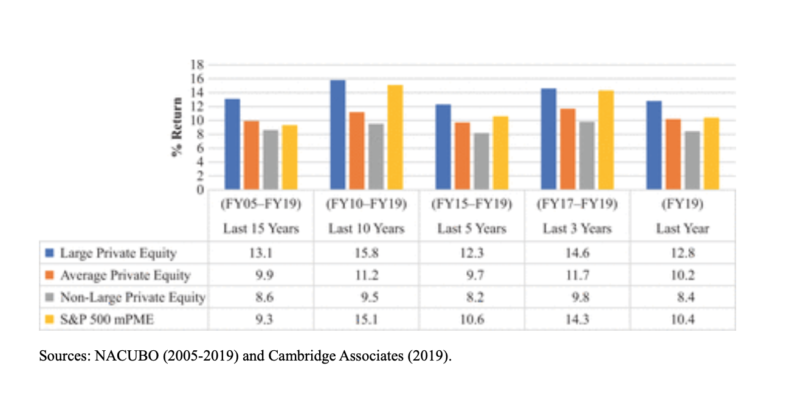

The table below shows the returns of the non-large endowments as well as those of the large and average endowments:

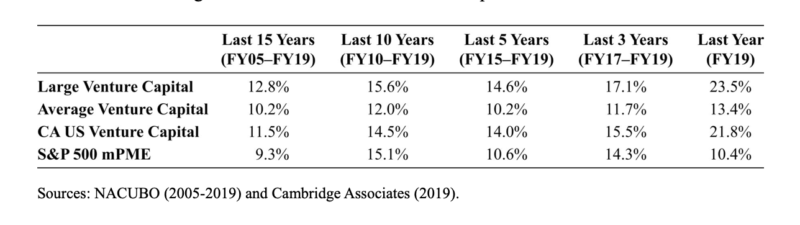

The following table shows the returns to venture capital investments:

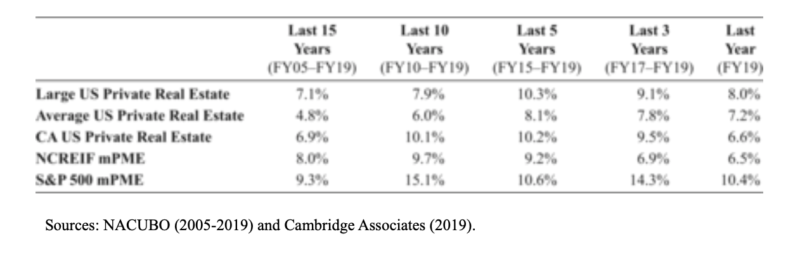

The final table shows the performance of private real estate:

Following is a summary of Hammond’s findings:

— Over the last 15 years, in most time periods reviewed, the returns for the average endowment in private investments underperformed private market indexes, large endowments (large endowments outperformed smaller ones), and the S&P 500 adjusted to a modified public market equivalent (mPME). Over the last 10 years, they underperformed by almost 4 percentage points. Even worse was the performance of the non-large endowments, which underperformed by 5.6 percentage points.

— The Cambridge Associates U.S. Private Real Estate Index underperformed the S&P500 mPME benchmark by 160 basis points (bps) annualized for the last 25 years. In addition, the Cambridge Associates U.S. Private Real Estate Index also underperformed the NCREIT mPME benchmark by meaningful amounts in the 25-, 20- and 15-year periods, though it did outperform the benchmark during the recent 10-, 5-, 3- and 1-year time frames.

— Large endowments kept pace with the Cambridge Associates U.S. Private Real Estate Index over the trailing 15-year period, outperforming by a modest 20 bps annualized, but underperformed during the 10-year period by 2.2 percentage points. Again, large endowments’ private real estate returns outperformed those of average endowments in every period. However, large endowment private real estate underperformed the S&P 500 mPME in every time frame examined, lagging the PME by 30 bps annualized (the 5-year period) and 720 bps (the 10-year period) annualized.

— Private investments did not compensate the average endowment for the illiquidity, delayed pricing and misleading performance accounting during the 15-year period.

— Large endowments outperformed the average endowment, demonstrating their ability to leverage to advantage their access to the premier private equity providers. However, even they did not outperform the Cambridge Private Equity Index over the 15-year period. And recall, their returns are likely overstated because they don’t reflect the costs of internal staff.

— In terms of venture capital, while large endowments outperformed public market equivalents over all periods, smaller endowments outperformed over the 15-year period by 0.9 percentage points and underperformed over the 10-year period by more than 3 percentage points. The outperformance by large endowments is likely attributable to their access to superior managers.

His findings led Hammond to conclude: “The average endowment’s allocation to private investments fails to produce returns that equal or exceed those available through public equity markets when modified to public market equivalence.” That raises the question of why investment managers for endowments (other than large ones) continue to make the attempt. He added: “Endowments are well advised to reconsider future commitments to private equity in light of the dry powder, debt multiples, and price multiples extant today. Fiduciaries should carefully evaluate whether private investments are likely to provide adequate compensation for the illiquidity and risks assumed.”

Summarising his findings, Hammond stated: “Unfortunately, for endowments with fewer assets than those in the largest cohort, the promises of high returns, low risk, and better diversification touted by private investment firms have proven to be more quicksand than terra firma. The preponderance of evidence across endowments indicates that attempts to achieve index-level returns in private investments for endowments without the access enjoyed by the large endowments constitutes an expensive and time-consuming exercise in futility, regardless of which type of private investment allocation is chosen.”

Hammond’s findings and conclusions are consistent with those of Richard Ennis, who analyzed the performance of large and small endowments in his 2020 study Endowment Performance. 2019) Source: NACUBO endowment studies, FY 1987–2019.

Important Disclosure: This article is for educational and informational purposes only and should not be construed as specific investment, accounting, legal or tax advice. The analysis contained in the article is based on third-party information and can become outdated or otherwise superseded at any time without notice. Third-party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Wealth Partners, collectively Buckingham Strategic Wealth® and Buckingham Strategic Partners® R-20-1

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of numerous books on investing.

ALSO BY LARRY SWEDROE

Market efficiency and the case of Pete Rose

Can machines identify winning fund managers in advance?

Can active managers time factor exposures?

© The Evidence-Based Investor MMXXI