The most basic principle of finance is that risk and ex-ante (expected) returns should be related. However, a large body of academic research (for example, here, here, here, and here) has found that individual investors (though not institutions) have an irrational preference (from a traditional finance perspective), or “taste,” for stocks with lottery-like characteristics — positive skewness and excess kurtosis (fat tails). In their 2005 paper “Disagreement, Tastes, and Asset Prices,” Eugene Fama and Ken French explained how this preference leads them to irrationally (again from a traditional finance view) invest in high-volatility stocks (which have lottery-like distributions), driving their prices higher and resulting in poor returns. It would be surprising if the same phenomenon did not occur in corporate debt.

The lowest credit rating to be considered investment grade is BBB- from Standard & Poor’s and Baa3 from Moody’s. These ratings indicate that the issuer has a “moderate credit risk” and is “vulnerable to adverse changes in economic conditions.” However, the issuer is still considered to be “sufficiently likely to meet its financial commitments over the medium term.” Bonds with ratings below BBB- or Baa3 have a higher risk of default and are therefore more volatile. However, they also offer the potential for higher returns.

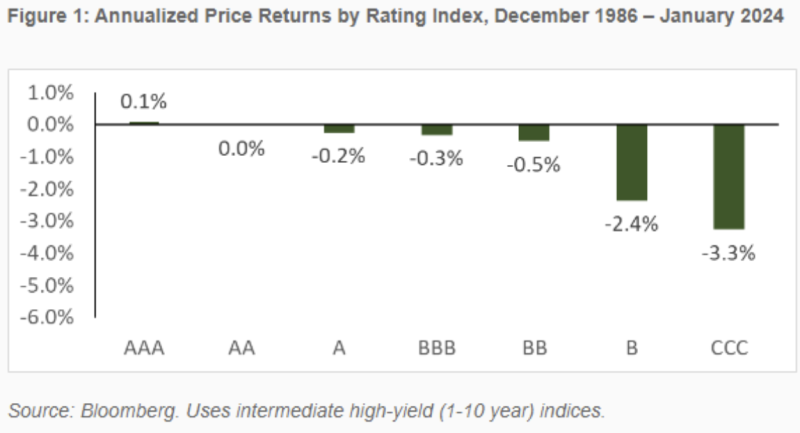

In his February 2024 paper “Yield Is Not Return,” Greg Obenshain of Verdad’s research team examined the performance of corporate bonds that were rated below investment grade to determine if BB (the highest rating of the non-investment-grade bonds) outperformed lower-rated credits (those with lottery-like characteristics due to historically high default rates). His data set covered the period December 1986-January 2024.

Obenshain found that despite the greater risks they entailed, “the lower-rated portions of the market, the B and CCC segments, tend to underperform their yields and have historically delivered returns slightly below that of the BB segment” — despite their much greater risk.

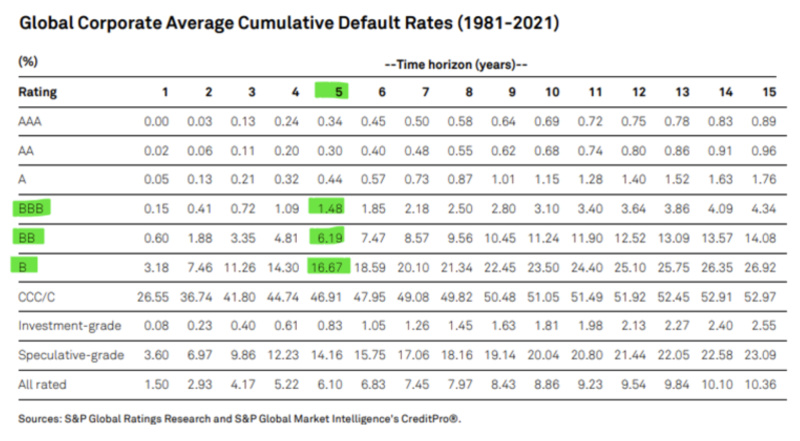

The poor performance of the lowest-rated bonds resulted from price losses. Obenshain noted: “This is consistent with long-term data from Moody’s 2022 annual default study, which showed that, from 1983 to 2022, 32% of CCC and 20% of B debt defaulted over five years while just 8% of BB debt and 2% of BBB debt defaulted over the same period.” In other words, while lower-rated bonds traded at lower prices (higher yields), their bonds were still overvalued because investor preference for the more volatile (risky) assets led to overpricing of the weakest credits. Obenshain’s research confirmed this hypothesis.

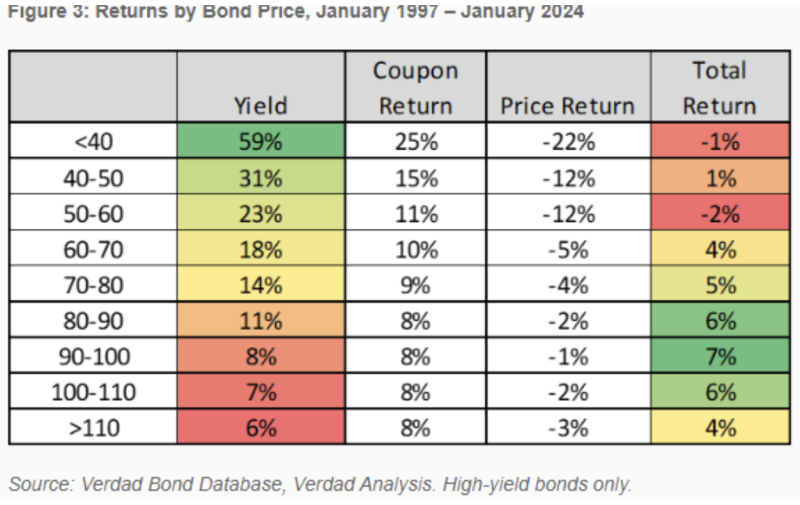

He explained why negative price returns are more damaging to expected returns than may be apparent: “B and CCC bonds often trade at a discount to par, and that discount is included in the yield calculation. Currently, the Bloomberg CCC intermediate (1-10 year) index has an average price of 81, and the B index has an average price of 95. When yields assume a pull to par and the price goes down instead, that increases underperformance relative to yield.” He added: “Discounted bonds often look attractive because they have high yields and there is a belief that they should pull to par. But that is not the result, on average.” As the following table shows, the increased losses offset the higher yields of the lowest price bonds.

It’s that taste for risky assets that leads to overpricing and poor performance. Obenshain also offered this possible explanation: “Just imagine you are an analyst at a big fund. Do you make your name pitching the low-yielding bond or the high-yielding bond? Now imagine you are the PM [portfolio manager] marketing the fund. Do you want to market a fund with a higher or lower yield?”

The following table shows historical default probabilities on publicly rated corporate debt. Note how the default probabilities jump dramatically once a bond falls below the BB level.

Private markets

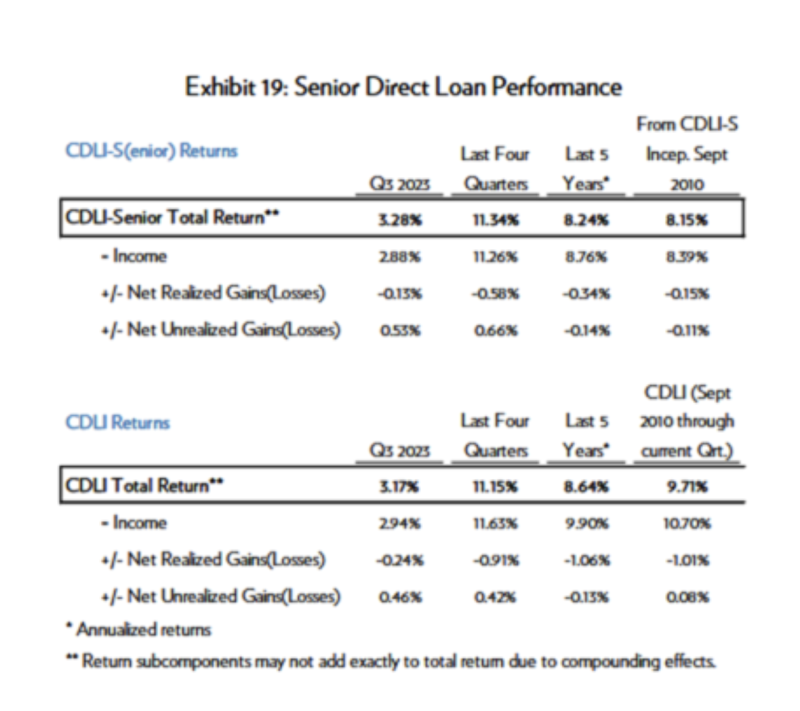

While Obenshain examined public securities, the same phenomenon is at work in private markets. Each quarter, Cliffwater provides an update on the performance of private loans in its “Report on U.S. Direct Lending.” Its performance analysis relies upon the Cliffwater Direct Lending Index, or CDLI, an asset-weighted index of approximately 14,000 directly originated middle-market loans, totalling $295 billion as of September 30, 2023. The CDLI is used globally by institutional investors and asset managers as the index of choice for understanding the return and risk characteristics of U.S. middle-market debt. These loans are generally considered to be just below investment grade quality, or comparable to BB-rated public loans.

Launched in 2015, the CDLI was reconstructed back to 2004 using publicly available quarterly SEC filings required of business development companies whose primary asset holdings are U.S. middle-market corporate loans. Cliffwater also reports on its CDLI-S (an index focusing on senior loans within the CDLI) and CDLI-V (comprised of only venture-backed loans within the CDLI.) The following tables show performance results for the CDLI and CDLI-S. Note that the total of unrealized and realized losses for the CDLI has been about 1% per annum and just 0.26% per annum for the CDLI-S (0.15% realized and 0.11% unrealized).

Despite the low historical level of losses, Cliffwater’s Corporate Lending Fund (CCLFX), which invests in senior, secured loans backed by private equity, has a current yield of about 12%. Since all the loans are floating rate, there is virtually no duration risk. From inception (June 2019) through year-end 2023, CCLFX returned 9.04% per annum (7.25% above the return of 1.79% on one-month Treasury bills). Note that part of the premium return that the fund has provided is due to the fact that as an interval fund it provides only limited quarterly liquidity. For investors who don’t need liquidity for at least some portion of their portfolio, the illiquidity premium is as close to a free lunch as there is in investing.

Investor takeaways

The takeaway for investors is to avoid the preference that many individuals have for the riskiest assets. If you have the ability, willingness, and/or need to take incremental risk in corporate debt, the evidence suggests limiting that risk to loans rated BB or better.

I add the following advice. For investors seeking higher-yielding debt that has historically delivered appropriate risk-adjusted return, the evidence favours private (direct lending) credit that is backed by senior, secured loans sponsored by private equity—the type Cliffwater’s Corporate Lending Fund (CCLFX) invests in. The table in Exhibit 19 above shows the historical return and default losses on loans in Cliffwater’s Senior Direct Lending Index. The data covers the period September 2010-September 2023. Note that the total losses from defaults, unrealized and realized, is just 26 basis points (15 realized and 11 unrealized). (Full disclosure: I have been an investor since around its inception).

Larry Swedroe is head of financial and economic research for Buckingham Wealth Partners, collectively Buckingham Strategic Wealth, LLC and Buckingham Strategic Partners, LLC.

For informational and educational purposes only and should not be construed as specific investing, accounting, legal, or tax advice. Certain information is based on third party data and may become outdated or otherwise superseded without notice. Third-party information is deemed reliable, but its accuracy and completeness cannot be guaranteed. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading. Information from sources deemed reliable, but its accuracy cannot be guaranteed. Performance is historical and does not guarantee future results. All investments involve risk, including loss of principal. Mentions of specific securities are for educational purposes only and should not be construed as a specific recommendation. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-24-629

ALSO BY LARRY SWEDROE

The consequences of short squeezes

Do markets reward firms for being more green?

The growth of hedge funds is the greatest financial anomaly

TEBI ON YOUTUBE

Have you visited the TEBI YouTube channel lately? There’s already a wide selection of high-quality videos on there. Why not subscribe and be one of the first to see our latest content? You’ll also find our videos on Instagram and TikTok.

© The Evidence-Based Investor MMXXIV