UK investors have a world of opportunities at their fingertips. It has never been easier to gain exposure to share and bonds markets around the globe. And yet the latest data show that UK investors are still too heavily concentrated in UK assets, as BENEDEK VÖRÖS from S&P Dow Jones Indices explains.

At more than 300 years old, the British government bond and stock markets are among the world’s oldest. They are also among the largest globally; ranked by float-adjusted market capitalisation, the UK gilt market and UK stock market are the fourth and third biggest, respectively. The British investment industry has existed for centuries. Yet despite this long history, UK investment funds have been just as likely to suffer from home country bias as their international peers.

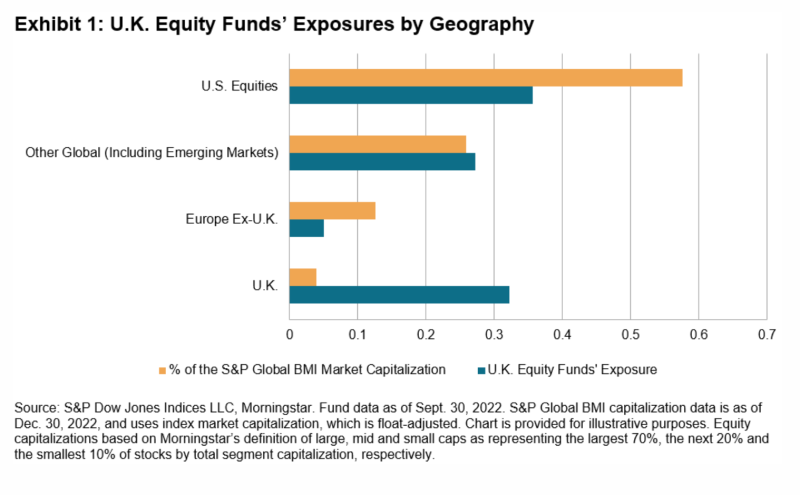

Exhibit 1 shows that UK-domiciled equity funds are substantially overweight their home market and underweight elsewhere, with the largest underweight in the U.S. By investing a disproportionate fraction of their assets in companies and industries based in their home country rather than globally, UK investors may be missing out on diversification benefits and potentially higher returns.

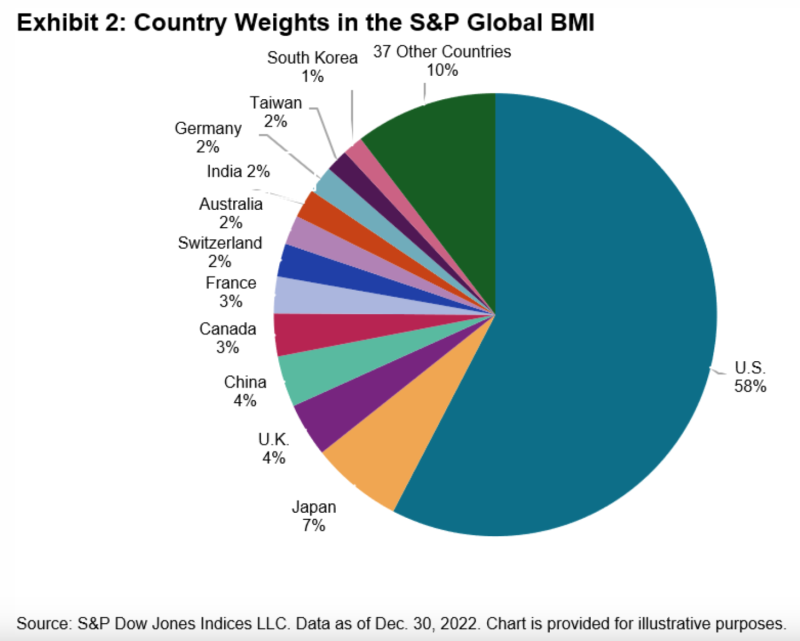

There is a large global opportunity set available to UK investors, ranging across countries, sectors and currencies, and including large global companies without British equivalents. There were approximately 41,000 listed companies in the world at the end of 2019. Eliminating the smallest and least liquid names leaves around 14,000 companies from 25 developed and 24 emerging markets; Exhibit 2 shows how these compose the S&P Global BMI. With an aggregate free-float market capitalisation of USD 66 trillion, the index is designed to reflect the global investable opportunity set. Given its 58% weight in the S&P Global BMI, for many investors the U.S. market represents the natural first step to globalising their exposures.

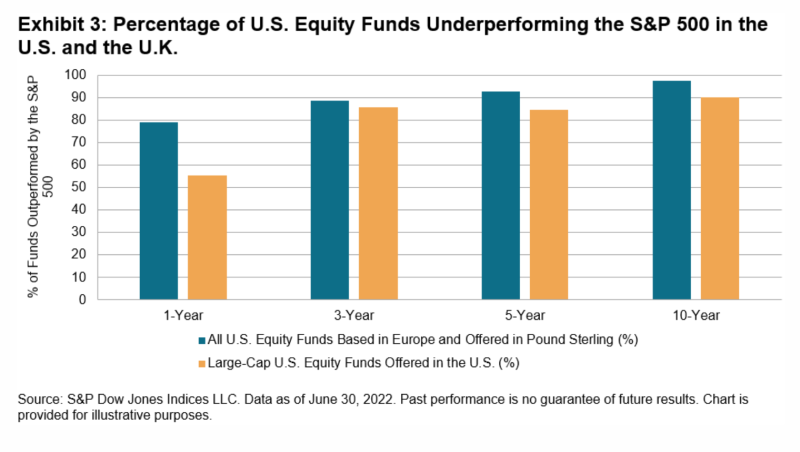

When considering an allocation to any market segment, including U.S. equities, investors must choose between active security selection and tracking a broad-based market portfolio. The SPIVA Europe Mid-Year 2022 and SPIVA U.S. Mid-Year 2022 Scorecards can help inform this decision. The historical data summarised in Exhibit 3 suggest that outperformance in large-cap U.S. equities is uncommon for fund managers based in either market, with outperformance even more elusive for longer time horizons.

These results are unsurprising. Simple arithmetic indicates that the average market participant earns the market return before fees and costs. Professional fund managers might expect to outperform in a market dominated by small retail traders, over whom they arguably have an informational and operational edge. But in markets dominated by large institutional and professional investors — as large-cap U.S. equities have been for at least 50 years — consistent outperformance becomes less likely, making the case for passive management stronger.

BENEDEK VÖRÖS is Director, Index Investment Strategy at S&P Dow Jones Indices (S&P DJI).

This article was first published on the Indexology blog.

MORE FROM S&P DJI

For more valuable insights from S&P Dow Jones Indices, you might like to read these other recent articles:

Just 2% of large-cap core funds have beaten the S&P 500 since 1993

Do historic bear markets tell us anything about this one?

Two silver linings to the market tumult of 2022

TEACHING UK INVESTORS ABOUT EVIDENCE-BASED INVESTING

When it comes to planning your financial future, you need a strategy that’s based on solid foundations.

In their new book, How to Fund the Life You Want, Robin Powell and Jonathan Hollow explain how evidence-based investing works, and the practical steps you need to take to implement an evidence-based investment strategy.

The book is specifically aimed at UK investors and is published by Bloomsbury and is primarily intended for a UK audience.

You can buy the book on Amazon, on Bookshop.org, and in all good bookshops. There are eBook and audio book versions as well.

© The Evidence-Based Investor MMXXIII