2022 will go down as one of the most challenging years for investors in recent memory. It wasn’t just equities that suffered, but government bonds as well — and that in itself is extremely rare. But, as ANU GANTI from S&P Dow Jones Indices explains, there are some crumbs of comfort for investors as the year draws to a close.

As we reflect on the notable market themes of 2022, one trend is certain: it has been a tumultuous market characterised by rate hikes and inflation concerns across regions, with significant losses across asset classes. Crypto market performance added to jitters, with the S&P Cryptocurrency LargeCap Index down 66% YTD. Losses throughout the year culminated in the collapse of FTX, one of the largest global cryptocurrency exchanges, as a result of its founder’s fraud charges. A turnaround in broad market equities that began in October provided much-needed relief, with easing inflation and optimism surrounding a potential slowing pace of U.S. rate hikes, but the S&P 500 has still declined by 15% YTD.

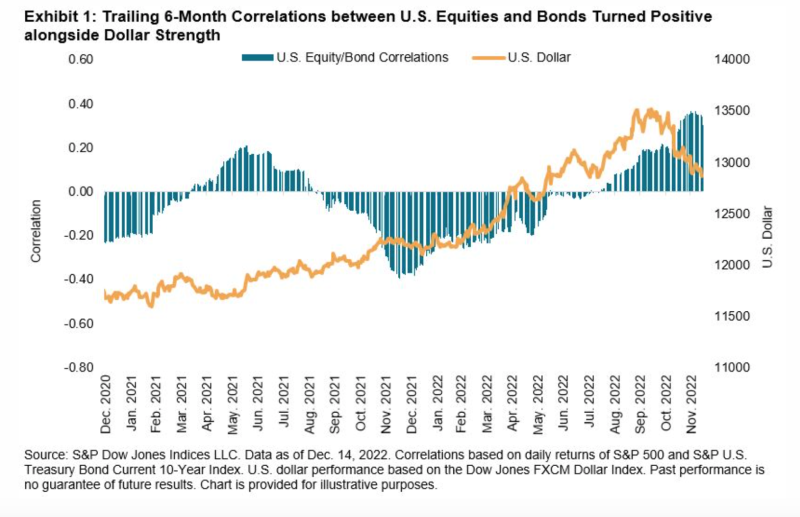

Meanwhile, U.S. Treasuries are on track for their worst year on record, with the S&P U.S. Treasury Bond Index down 9%. As a result, correlations between U.S. equities and bonds turned positive, which last occurred during the second quarter of 2021, as Exhibit 1 illustrates. Corporates and high yield bonds also suffered, with the iBoxx USD Liquid Investment Grade Index and iBoxx USD Liquid High Yield Index down 15% and 8%, respectively. The combined underperformance of equities and bonds meant record losses for the traditional 60/40 portfolio. Other regions were not spared, and the U.K. bond market downturn taught us the importance of liquidity, which can be hard to find when it most needed. Another consequence of rising rates along with safe-haven demand globally was the rally in the U.S. dollar.

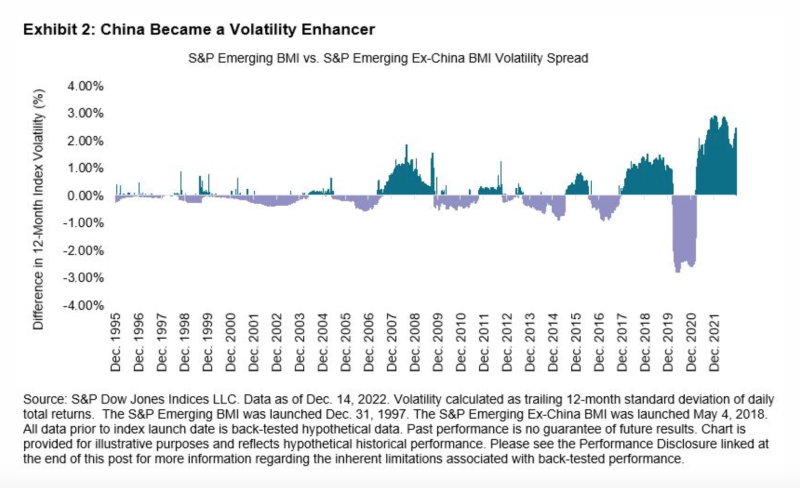

Investors’ search for income led to renewed interest in dividend and low volatility strategies, with the S&P 500 Low Volatility High Dividend Index significantly outperforming the benchmark. Additional safe harbours came from value strategies, which have outperformed growth in the U.S. and globally after decades of underperformance. After years of mega-cap dominance, further reversals came with the strength of smaller caps, boosting the performance of S&P 500 Equal Weight Index. Emerging market equities offered little solace, with the S&P Emerging BMI down 17% YTD, although a rebound in the final quarter was aided by optimism in the U.S., a pullback in the dollar and especially the rebound in China equities as a result of the potential move away from strict pandemic policies. The swings in Chinese equity performance make their diversification properties interesting to analyse.

In Exhibit 2, we calculate the spread in trailing 12-month volatility between the S&P Emerging BMI versus S&P Emerging Ex-China BMI. When this spread is positive, the inclusion of the country increases volatility in the benchmark; when negative, the country acts as a diversifier. Note the positive spread for China since March 2021, highlighting China’s switch from a volatility diversifier to a volatility amplifier, as the country’s fortunes have increasingly been tied to the rest of the emerging markets.

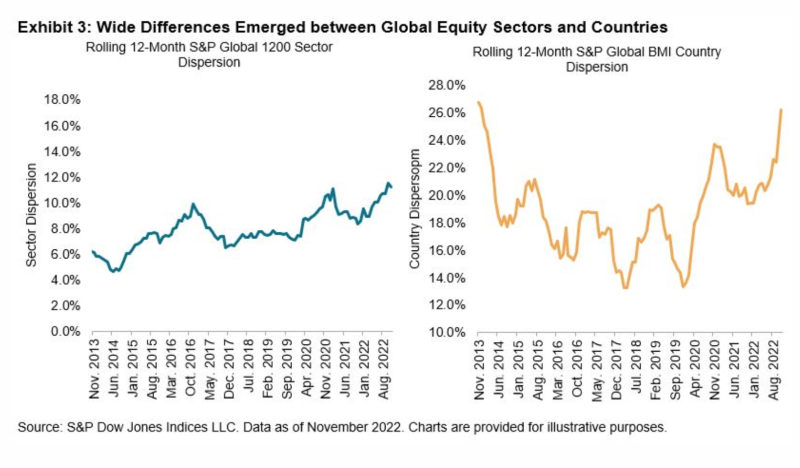

Unsurprisingly, as macro headwinds whipsawed markets, volatility rose. Index dispersion remained elevated, potentially leading to relatively better U.S. large-cap fund outperformance in the first half of the year by creating greater opportunities to add value from stock selection. Volatility also manifested itself in the rising differences among global sectors and countries that we see in Exhibit 3, which implies greater potential opportunities to add value from sector and country allocation. The S&P Global 1200 Energy led among sectors with a YTD gain of 46%, driven by the surge in oil prices from supply shocks, including the Russia-Ukraine conflict and companies’ increased willingness to participate in the energy transition. In contrast to China, Energy, despite being the most volatile sector, has acted as a volatility diversifier.

As uncertainty over the future global economic outlook lingers, with concerns around Q4 corporate earnings, a record inversion between 2- and 10-year Treasury yields, alongside a backdrop of geopolitical tensions, forecasting the market outcome for 2023 may be a futile exercise.

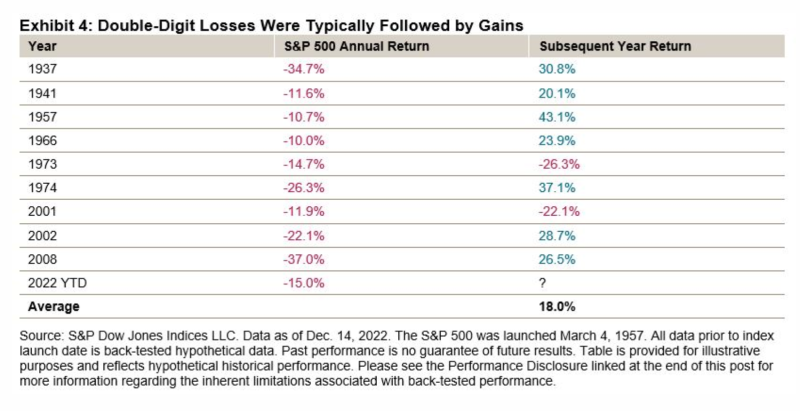

But, as 2022 draws to a close, a couple of silver linings are worth noting: the torrid losses in fixed income have made bonds more attractive with relatively high current yields, particularly in the emerging markets and high yield space. As far as equities are concerned, U.S. history might offer a glimmer of hope, with Exhibit 4 showing that since 1936, of the nine prior years with double-digit losses, seven of those years experienced double-digit gains the following year, proof that the best guess of future returns does not depend on the immediate past.

ANU GANTI is Senior Director, Index Investment Strategy, at S&P Dow Jones Indices.

This article was first published on the Indexology blog.

MORE FROM S&P DJI

For more valuable insights from S&P Dow Jones Indices, you might like to read these other recent articles:

Why indexing works and continues to grow

The stock market has no memory of recent falls

Indexing has saved investors $403 BILLION since 1996

HAVE YOU READ THIS BOOK?

Robin Powell and Jonathan Hollow have been friends since childhood and share a passion for helping people understand the world of money, savings, pensions and investments.

Now they’ve authored a book called How to Fund the Life You Want, which explains in plain English what you need to know to pay for the life you want to lead.

The book is published by Bloomsbury and is primarily written for a UK audience.

It’s available to buy on Amazon, on Bookshop.org, and in all good bookshops. There’s an eBook and an audio book version as well.

© The Evidence-Based Investor MMXXII