Let’s face it, 2022 has been a tough year for equity investors. The temptation when markets have had a bad run is to assume that the trend will continue into the future. Of course, it may well be that markets have further to fall. The good news, however, as CRAIG LAZZARA explains, is that the stock market has no memory, and what happens to stock prices going forward bears no relation to the immediate past.

When the stock market declines by nearly 24%, as the S&P 500 did in the first nine months of 2022, investors typically lick their wounds and wonder what comes next. Spoiler alert: I don’t know. But there are ample historical data to explore amidst our befuddlement.

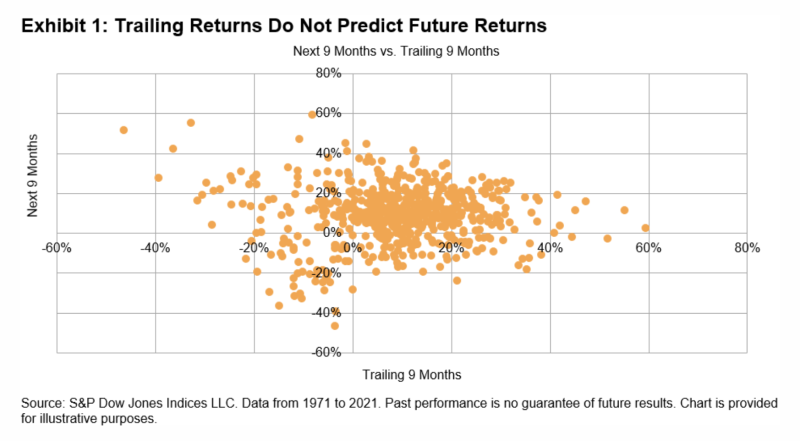

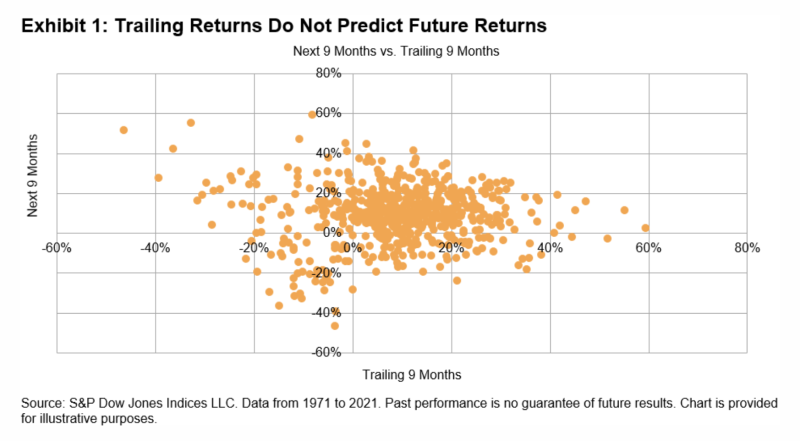

First, the bad news: Exhibit 1 shows that there is very little relationship between trailing returns and future returns. These data comprise every nine-month period since 1971, not just the January-September intervals; the exact correlation between the last nine months’ returns and the next nine months’ returns is 0.006. A statistician’s best guess of the next nine months’ returns would simply reflect the median return of the series, ignoring whatever the last nine months’ returns had actually been.

But there’s good news hidden within Exhibit 1. The stock market has no memory; the best guess of future returns does not depend on the immediate past.

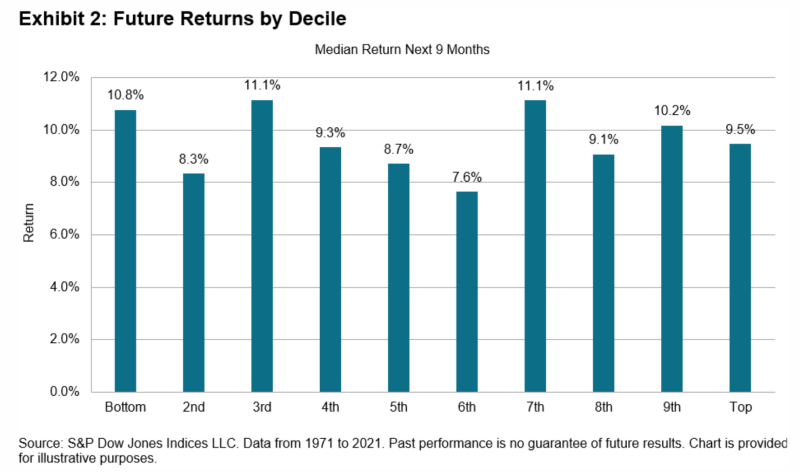

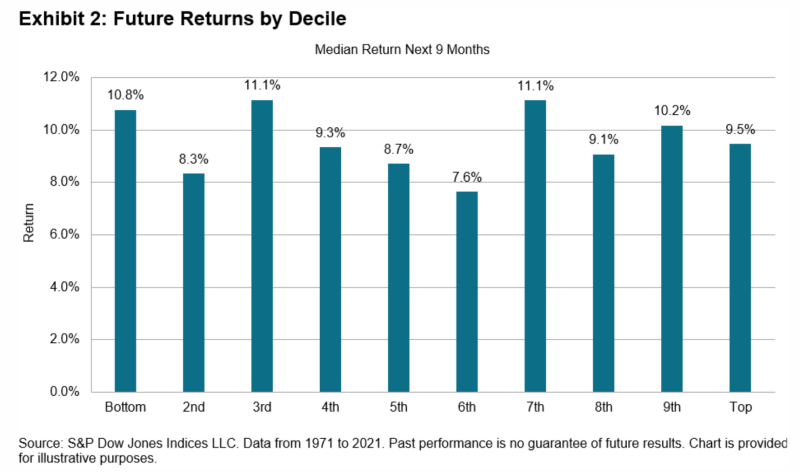

Exhibit 2 shows this a bit more clearly. This exhibit groups our observations into deciles, based on trailing returns. The bottom decile thus contains the worst 10% of nine-month returns (including, we need hardly add, the first nine months of 2022). Over all nine-month periods in the last 50 years, the median return was 9.5%. When historical returns were in the bottom decile, the median return in the next nine months was 10.8%, a not-inconsiderable improvement over the global median.

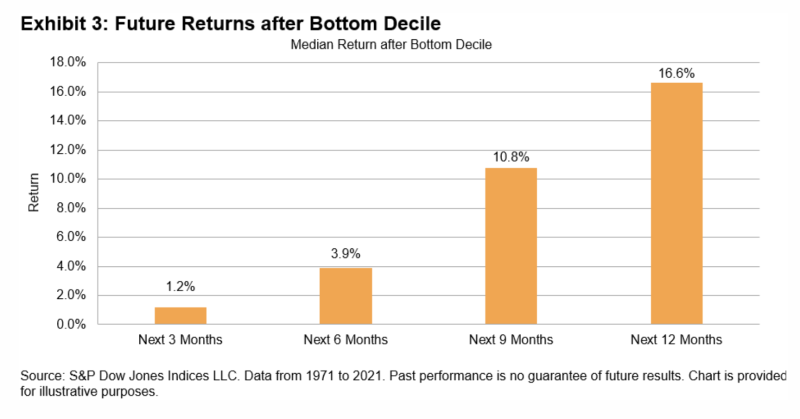

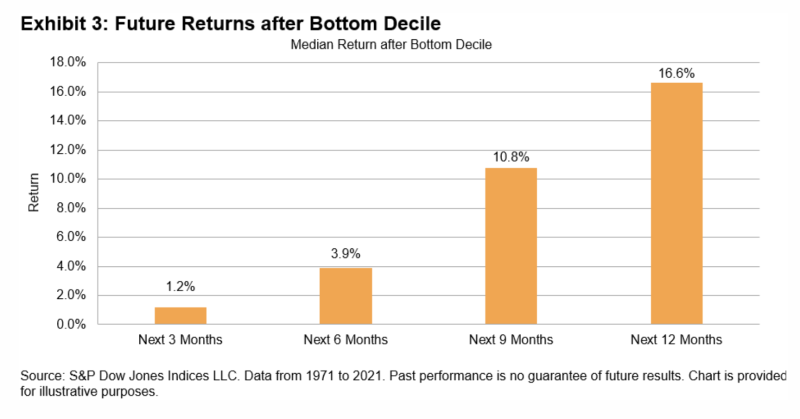

Exhibit 3 gives us more detail on results after a bottom-decile experience; the median return in the subsequent 12 months is 16.6%, well above the unconditional median (14.0%).

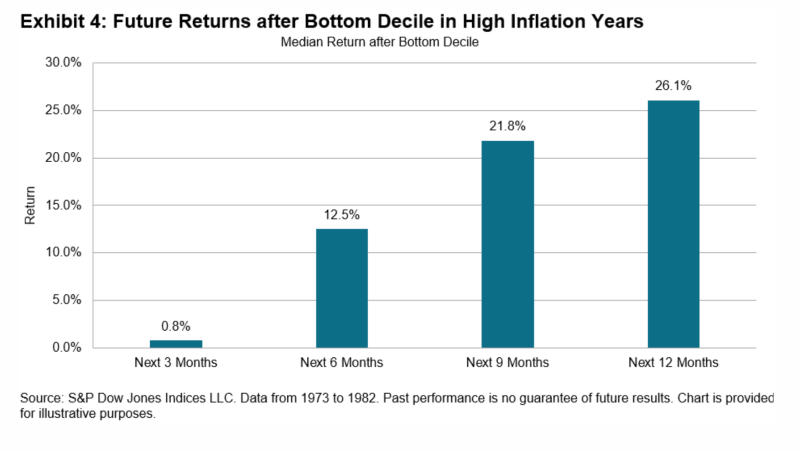

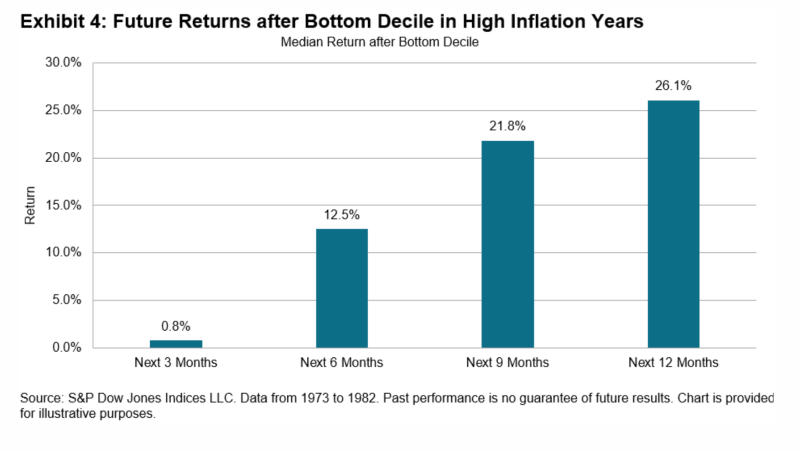

Although these results are drawn from a full 50 years of data, we can draw similar conclusions if we limit ourselves to periods of relatively high inflation. The U.S. Consumer Price Index (CPI) rose above 6.0% in 1973 and remained elevated until 1982; after 1982, the CPI remained below 6.0% until this year. If we look only at those high inflation years, we see similar results, as Exhibit 4 illustrates.

Nothing in these data is certain, of course. After a bottom decile performance, the stock market might decline further, or might not rebound as much as is typical. Uncertainty is the investor’s constant companion, but historical data can at least give us some clues to the future. Bad returns occasionally come. But the fact that they have come in the last nine months does not make it more likely that they will come in the next nine months. Long-term investors should bear the long-term results in mind.

CRAIG LAZZARA is Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices.

MORE FROM S&P DJI

For more valuable insights from S&P Dow Jones Indices, you might like to read these other recent articles:

Indexing has saved investors $403 BILLION since 1996

Skill persists but luck is ephemeral

Do institutional asset managers beat their benchmarks?

How defensive factor indices mitigate short-term declines

Market history teaches us the value of patience

NEED AN ADVISER?

It’s at times such as these that a good financial adviser comes into their own. If you don’t already have one, we may be able to help.

Wherever you are in the world, we will try to put you in contact with an adviser in your area whom we know personally, who shares our evidence-based investment philosophy and who we feel is best able to help you. If we don’t know of anyone suitable we will tell you.

We’re charging advisers a small fee for each successful referral, which will help to fund future content.

Click here and let’s get started.

© The Evidence-Based Investor MMXXII