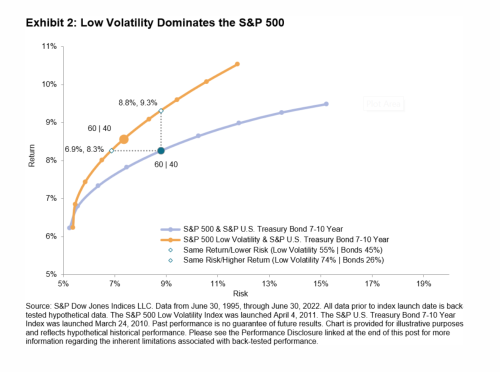

For the period summarised in Exhibits 1 and 2, Low Volatility outperformed the S&P 500, but with lower risk. It’s therefore not surprising that an efficient frontier using Low Volatility as the risky asset dominates a frontier using the S&P 500. A 60/40 equity/bond allocation using Low Volatility experienced both lower risk and higher return than a 60/40 mix using the S&P 500.

Importantly, time-sensitive investors could use Low Volatility to improve their risk/return tradeoff. A 60/40 mix of the S&P 500 and bonds produced a total return of 8.3%, with a standard deviation of 8.8%. By using Low Volatility as the equity vehicle, the same return could have been achieved at a lower risk level (6.9%) and with a lower equity exposure (55%). Alternatively, using Low Volatility as the equity vehicle would have increased returns to 9.3% with the same risk level. Indeed, regardless of the starting point, shifting any part of an equity allocation from the S&P 500 to the S&P 500 Low Volatility Index would have resulted in both a reduction in overall risk and an increase in return.

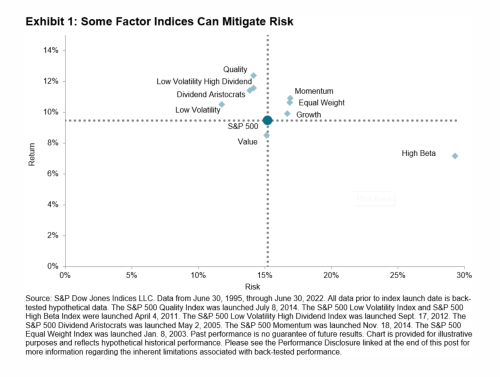

What is true of Low Volatility is also true of other defensive factors. Time-sensitive investors should consider the record of defensive factor indices in mitigating short-term declines while retaining the long-run benefits of equity exposure.