Luck plays a part in active fund management as it does in sport. But as CRAIG LAZZARA from S&P Dow Jones Indices explains, only genuine skill stands the test of time.

I am not a particularly good athlete, and perhaps the sport at which I am most inept is basketball. Despite that, let’s assume that I somehow challenge Michael Jordan, arguably the best player in the history of the game, to a free throw shooting contest. What are my chances of success? (Stay with me, I promise there’s a non-trivial point here.)

Obviously, the answer depends on how good each of us is. Michael Jordan made 83.5% of his foul shots during his NBA career, so I’m going to be generous and assume that he’s just as good now as he was during his playing days. I’m going to be even more generous to myself, and assume that I can make 20% of my free throw attempts. Obviously, Michael has a considerable advantage in terms of skill. But chance also plays a role.

For example, I might make my first shot (20% probability), and he might miss his first one (16.5% probability). So the probability that I will be ahead after one round is 3.3% (0.20 x 0.165). Alternatively, we might both make our shots (16.7% probability) or we might both miss (13.2% probability). The only way that Michael can be unambiguously ahead of me after one round is if he makes his shot and I miss mine. Of course, that’s the most likely outcome, with a probability of 66.8%.

But if this imaginary contest happened in real life, after one round the likelihood that I would be holding my own against Michael Jordan would be 33.2%, which I would count as the greatest athletic accomplishment of my life (even better than the freak hole-in-one last summer).

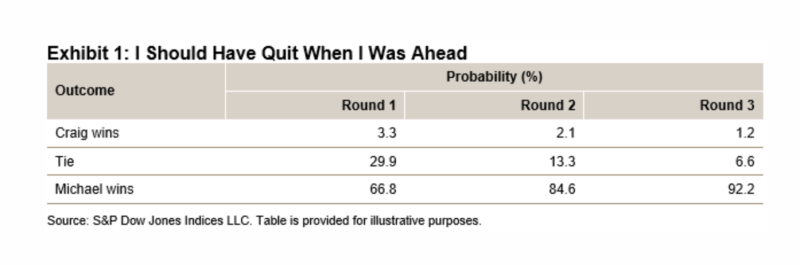

Of course, reality would ultimately intrude; the contest doesn’t end after just one round. There are four possible outcomes after the first round, 16 after two rounds, and 64 after three rounds. Exhibit 1 shows how the likelihood of my success shrinks over time.

The moral of the story is that the low-skill player looks better when there are fewer trials and luck can play a bigger role. Over short periods of time, luck can dominate skill. On the other hand, the high-skill player benefits from more trials, since his higher level of skill is likely to overcome any bad luck that may come his way.

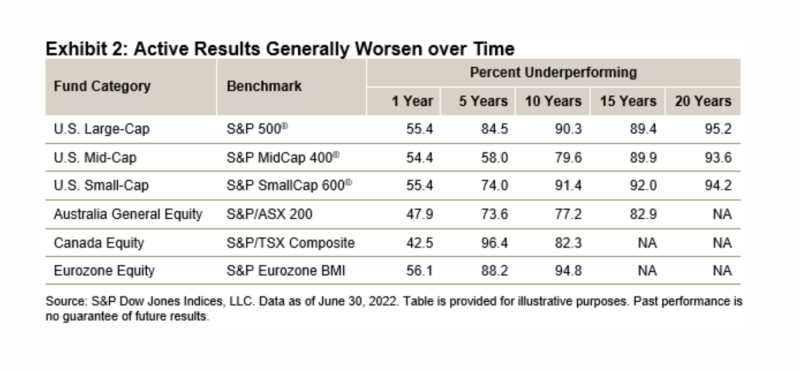

Why is this relevant to an index blog? Because in the investment world, one analogy to shooting multiple rounds of free throws is observing longer periods of active versus passive performance. We have begun to issue our semi-annual SPIVA® scorecards, with reports so far available for Australia, the U.S., Europe and Canada. Exhibit 2 summarises some of the results.

Here, the active managers in each market assume the role formerly played by me, and the benchmarks take over for Michael Jordan. But the moral of the story is the same: more observations reduce the importance of luck. Active managers typically look worse as the observation period lengthens; the good luck from which some benefit over a short period tends to dissipate as more time goes by.

In actual investment experience as in hypothetical basketball, skill persists, but luck is ephemeral.

CRAIG LAZZARA is Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices.

This article was first published on the Indexology blog.

MORE FROM S&P DJI

For more valuable insights from S&P Dow Jones Indices, you might like to read these other recent articles:

Do institutional asset managers beat their benchmarks?

How defensive factor indices mitigate short-term declines

Market history teaches us the value of patience

Which types of stocks have fared best in 2022?

Is outperformance down to luck or skill?

FIND AN ADVISER

The evidence is clear that you are far more likely to achieve your financial goals if you use an adviser and have a financial plan.

That’s why we offer a service called Find an Adviser.

Wherever they are in the world, we will put TEBI readers in contact with an adviser in their area (or at least in their country) whom we know personally, who shares our evidence-based investment philosophy and who we feel is best able to help them. If we don’t know of anyone suitable we will say.

We’re charging advisers a small fee for each successful referral, which will help to fund future content.

Need help? Click here.

© The Evidence-Based Investor MMXXII