By LARRY SWEDROE

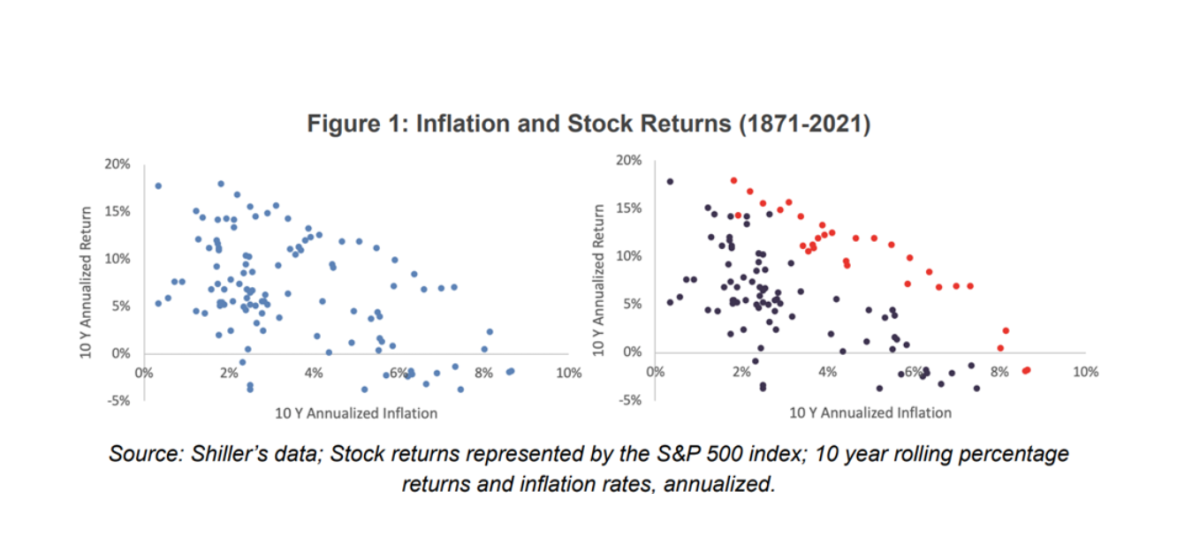

While investors may believe equities provide some protection from inflation (a firm’s debt obligations are inflated away, and product prices may be adjusted to inflation), equities tend to suffer from the less stable economic climate (the rate at which future earnings are discounted rises), and costs tend to rise with inflation more than output prices. You can observe the negative relationship between inflation and stock returns in the following charts. The right panel highlights (in red) observations in the 1940s, 1970s and 1980s, three decades when inflation reached rates that were above average.

Henry Neville, Teun Draaisma, Ben Funnell, Campbell Harvey and Otto Van Hemert, authors of the study “The Best Strategies for Inflationary Times,” published in the August 2021 issue of The Journal of Portfolio Management, analyzed the performance of a variety of asset classes for the United States, the United Kingdom and Japan since 1926 to determine which have historically tended to do well (or poorly) in environments when year-over-year (YoY) inflation was accelerating and when the level moved to 5 percent or more. Among their key findings was that the negative relationship between inflation and stock returns was not linear. They found that despite the poor performance of equities in high and rising inflationary regimes, equities actually benefited from rising inflation when the starting level was below the median (when there was risk of deflation when equities perform poorly, thus reducing that risk) but were hurt by rising inflation if the starting level was above the median (when there was increased risk of escalating inflation)—the risk to equities of rising inflation is much greater when inflation is at higher levels, as is currently the case. In other words, the relationship between equity returns and inflation is time varying and regime dependent.

Relationship between equity risk and inflation is economic regime dependent

Deflation can be just as bad or worse than inflation for economic growth because falling prices can lead to bankruptcies, banking panics and financial instability. Thus, while inflation and stock returns can be negatively correlated in periods of higher inflation, periods of lower-than-expected inflation can increase the risk of deflation and can turn the correlation positive, because higher inflation can be interpreted as positive news for economic prospects and thus stock returns. Which way the correlation goes should depend on the prevailing risk. A good example demonstrating the regime dependency of the relationship between inflation and stock returns is that during the global financial crisis and its aftermath, the greater risk the economy faced was that of deflation and the risk of a debt-deflation spiral. Thus, inflation rising from very low levels was seen as reducing equity risk, and thus the relationship between stock returns and inflation was positive.

Eugene Podkaminer, Wylie Tollette and Laurence Siegel, authors of the study Protecting Portfolios Against Inflation, published in the April 2022 issue of The Journal of Investing, also concluded that equities only “work” over a very long-term horizon and that they are a negative hedge in shorter time frames, tending to fall when inflation rates rise.

Massi De Santis, author of the May 2022 study Unexpected Inflation and Real Stock Returns, examined the relationship between inflation and real stock returns over the period 1871-2021. Following is a summary of his findings:

- Stocks tend to outperform inflation over long horizons; however, controlling for monetary shocks in the post-2008 period, expected real stock returns are significantly lower during periods of higher-than-average inflation.

- A one standard deviation increase in unexpected inflation can lower expected returns by about 1 percent per year over a five-year horizon.

- The effect of unexpected inflation on real stock returns was greater for large and growth portfolios, and smaller for small and value portfolios. However, while the effect of unexpected inflation on the value and size premiums was positive, it was not statistically significant.

His findings led De Santis to conclude: “Results indicate that if inflation is higher than expected, investors should expect lower than average returns.” He added: “Retirees in particular should consider inflation risk as part of a strategy to reduce sequence risk, the oversized effect that bad real returns at the beginning of the retirement period can have over longer horizons.

Investor takeaways

While many investors believe equities provide protection from inflation (a firm’s debt obligations are inflated away, and product prices may be adjusted to inflation), equities have tended to suffer from a less stable economic climate (the rate at which future earnings are discounted rises, lowering valuations), and costs tended to rise with inflation more than output prices. In addition, despite the poor performance of equities in high and rising inflationary regimes, equities benefited from rising inflation when the starting level was below the median (when there was risk of deflation) but were hurt by rising inflation if the starting level was above the median (when there was increased risk of escalating inflation). Unfortunately, today we are certainly well above the historical median rate of inflation (about 3 percent since 1926).

Even if you are optimistic that the Federal Reserve can manage to lower inflation back to its target of 2 percent without having to drive up real interest rates to levels that would dampen demand sufficiently to cause a recession, the dispersion of possible outcomes you should consider should be wider than it was over the past two decades when inflation was quite stable. Thus, it is time to review your asset allocation in the face of the heightened inflation risk. Forewarned is forearmed.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading. Information from sources deemed reliable, but its accuracy cannot be guaranteed. Performance is historical and does not guarantee future results. The opinions expressed by featured authors are their own and may not accurately reflect those of the Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-22-299

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of numerous books on investing.

ALSO BY LARRY SWEDROE

Dividend announcements: What do they tell us about future returns?

Overconfidence is a pension manager’s worst enemy

The Shiller CAPE 10: how to use it, not abuse it

How profitable is retail options trading?

Can investors improve returns by reducing ESG risks?

CONTENT FOR ADVICE FIRMS

Through our partners at Regis Media, TEBI provides a wide range of high-quality content for financial advice and planning firms. The material is designed to help educate clients and to engage with prospects.

As well as exclusive content, we also offer pre-produced videos, eGuides and articles which explain how investing works and the valuable role that a good financial adviser can play.

If you would like to find out more, why not visit the Regis Media website and YouTube channel? If you have any specific enquiries, email Robin Powell, who will be happy to help you.

© The Evidence-Based Investor MMXXII