By LARRY SWEDROE

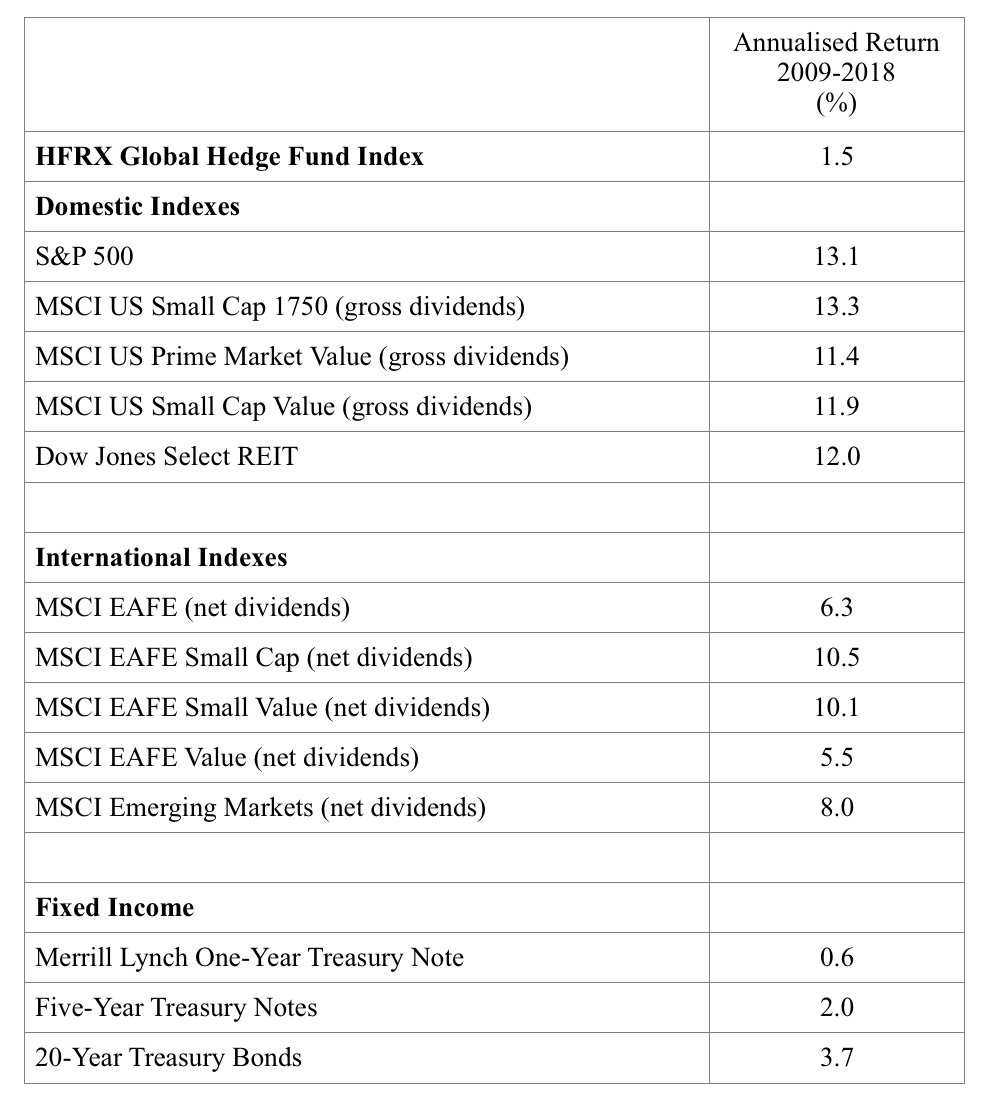

US hedge funds entered this year coming off their 10th straight year of trailing the return of the S&P 500 Index. And as you can see in the following table, over the 10-year period ending December 2018, they underperformed every single major equity asset class by wide margins. They also outperformed virtually riskless one-year Treasuries by just 0.9 percent, and underperformed intermediate and long-term Treasuries.

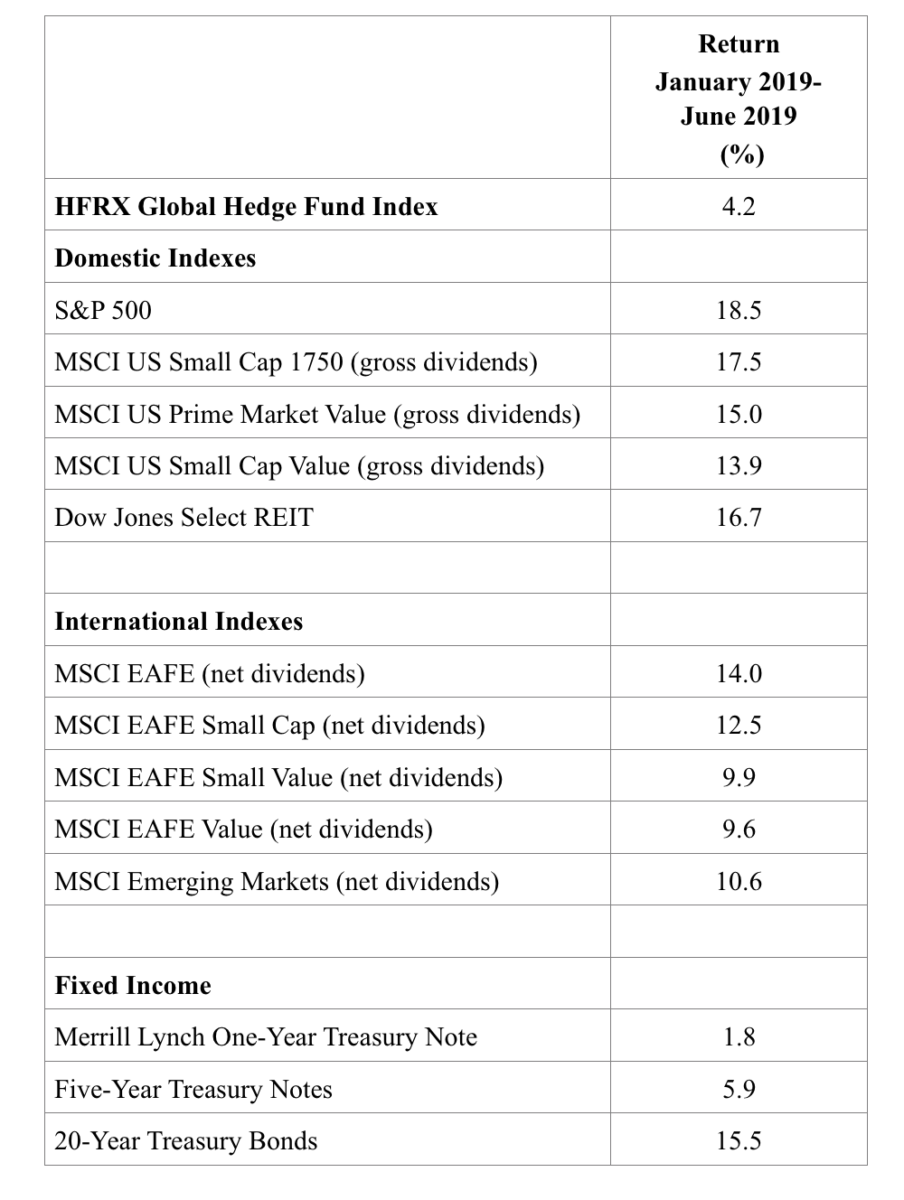

With that perspective, we’ll review their performance over the first half of 2019. For the first six months of 2019, the HFRX Global Hedge Fund Index produced a total return of 4.2 percent.

As you can see, the hedge fund index underperformed every single major equity asset class, and two of the three bond indexes. However, we can take our analysis a step further and determine how hedge funds performed against a globally diversified portfolio.

An all-equity portfolio allocated 50 percent internationally and 50 percent domestically, equally weighted among the indexes from the table within those broader categories, would have returned 13.8 percent, outperforming the hedge fund index by 9.6 percentage points.

Another comparison we can make is to a typical balanced portfolio of 60 percent equities and 40 percent bonds. Using the same weighting methodology as above for the equity allocation, the portfolio would have returned 9 percent using one-year Treasuries (outperforming the hedge fund index by 4.8 percentage points), 10.6 percent using five-year Treasuries (outperforming the hedge fund index by 6.4 percentage points), and 14.5 percent using long-term Treasuries (outperforming the hedge fund index by 10.3 percentage points).

Given the results and the wide dispersion of returns between US and international equities, one might think hedge funds would have used their freedom to move across asset classes, which they often tout as their big advantage, to better effect.

The problem is that the efficiency of the market, as well as the cost of the effort, can turn that supposed advantage into a handicap. Given the evidence on hedge funds’ underwhelming results, it’s puzzling that they are still managing about $3 trillion in assets.

I’ll report back again on hedge fund performance after the third quarter.

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of several investing books.

Larry is a regular contributor to TEBI. Here are some of his other recent articles:

Resulting — what it is and why it misleads poker players and investors alike

Why use passively managed structured portfolios like Dimensional’s?

Active managers no better able to manage risks than passive indices

Four reasons why the SEC’s Best Interest rule doesn’t cut it

Active investing is becoming harder, not easier, as passive grows

Be careful how you frame the problem