By LARRY SWEDROE

Interest in sustainable investing has grown so dramatically over the past decade that by 2020, environmental, social and governance (ESG) investing accounted for more than one-third of total assets under management in the United States, or about $17 trillion. That trend has been accompanied by heightened research into the subject.

Savva Shanaev and Binam Ghimire contribute to the sustainable investing literature with their study When ESG Meets AAA: The Effect of ESG Rating Changes on Stock Returns, published in the May 2022 issue of Finance Research Letters, in which they investigated the impact of 748 MSCI ESG rating changes on stock returns of U.S. firms over the period 2016-2021. (The idea is similar to the concept of fundamental momentum in equities—in his 2015 study Fundamentally, Momentum is Fundamental Momentum, Robert Novy-Marx demonstrated that stocks that have recently announced strong earnings tend to outperform going forward.)

While other research has examined the impact of ratings levels, the authors believe that theirs is the first to examine the impact of ratings changes. Following is a summary of their findings:

- There were 552 ESG rating upgrades and 196 downgrades.

- In 96.9 percent (93.4 percent) of documented cases, firms were upgraded (downgraded) by one category.

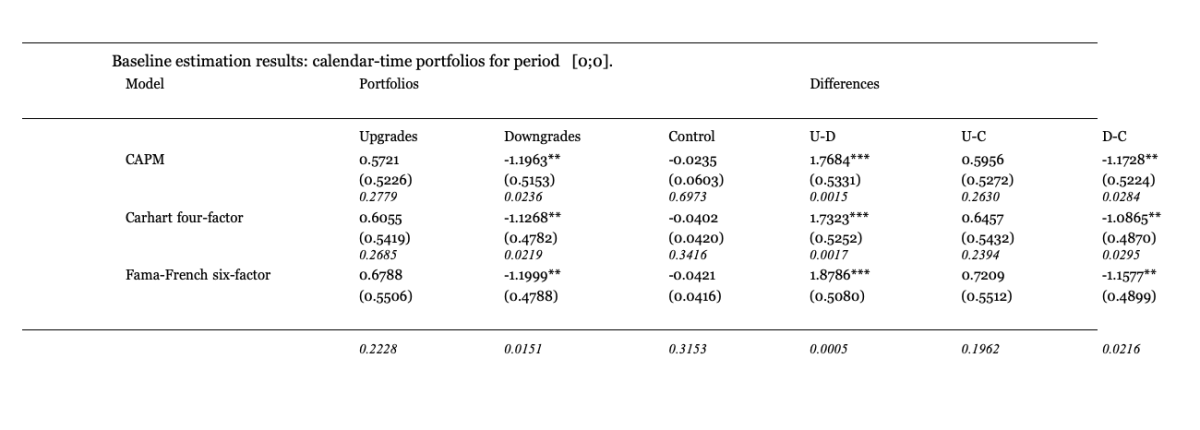

- While ESG rating upgrades led to positive yet inconsistently significant abnormal returns of 0.57 percent per month, downgrades were detrimental to stock performance, leading to statistically significant monthly risk-adjusted returns of -1.20 percent per month.

- The findings were more pronounced for ESG leaders than laggards and were robust to asset pricing model specifications (Carhart four factors of beta, size, value and momentum and Fama-French five factors of beta, size, value, profitability and investment plus momentum).

Their findings led Shanaev and Ghimire to conclude: “ESG considerations are especially important for institutional investors seeking to screen for the most socially responsible stocks, with increases (decreases) in ratings promptly causing such investors to increase (decrease) exposure to upgraded (downgraded) firms. Conversely, marginal changes in ratings for ESG laggards are not impactful, implying that ESG-conscious investors are using positive or best-in-class screening and not negative screening.” They added: “ESG rating downgrades are shown to materially depress stock prices, highlighting the importance of ESG risk factors and the informational value of ESG ratings to institutional and individual investors alike. The magnitude of such effects might increase in the future as more agencies provide ESG ratings data free of charge for public use and wider investor communities start relying on these to guide their screening process and asset allocation decisions.”

Shanaev and Ghimire’s findings are consistent with those of Madelyn Antoncic, Geert Bekaert, Richard Rothenberg and Miquel Noguer, authors of the 2020 study Sustainable Investment — Exploring the Linkage Between Alpha, ESG, and SDGs, and those of Matus Padysak, author of the 2020 paper ESG Scores and Price Momentum Are More Than Compatible. Both found that combining traditional momentum (trend following) and ESG strategies improved performance. That finding should not be a surprise, as research, including such studies as A Century of Evidence on Trend-Following Investing, has found momentum to exist everywhere: in stocks, bonds, commodities and currencies, as well as within and across industries. In addition, the increasing cash flows into ESG strategies have led to firms with high sustainability scores to earn rising portfolio weights and thus momentum in their stocks.

Investor takeaways

While economic theory suggests that if a large enough proportion of investors choose to avoid the stocks of companies with low sustainability ratings, the share prices of such companies will be depressed. Thus, they would offer higher expected returns (which some investors may view as compensation for the emotional cost of exposure to what they consider offensive companies). With this knowledge, investors are positioned to pursue their financial goals in a manner that reflects their values and at the costs (in the form of lower expected returns) they are willing to bear to achieve those values. However, the research points a way for ESG investors to “have their cake and eat it too.” By combining classic trend-following momentum and ESG momentum, they can reduce drawdown and volatility risk while improving risk-adjusted returns. Another way to enhance returns of ESG strategies is to “tilt” portfolios to those sustainable firms with greater exposures to the size, value, momentum, investment and profitability/quality factors that have historically provided premiums.

When considering these findings, keep in mind that investor preferences (in this case, for sustainable investments) lead to different short- and long-term impacts on asset prices and returns. Firms with high sustainability scores earn rising portfolio weights, leading to short-term capital gains for their stocks—realized returns rise temporarily. However, the long-term effect is that higher valuations reduce expected long-term returns. The result can be an increase in green-asset returns even though brown assets earn higher expected returns.

And finally, as my co-author Sam Adams and I demonstrate in our book Your Essential Guide to Sustainable Investing, sustainable investors can take satisfaction in the fact that there were almost three times as many upgrades as downgrades, as companies are recognising that poor ESG scores lead to a competitive disadvantage in the form of a higher cost of capital. Thus, they are taking actions to improve their scores.

Important Disclosure: The information contained in this article is for educational purposes only and should not be construed as specific investment, legal, tax, or accounting advice. Certain information contained in this article are based upon third party information and deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the third-party links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements, or representation whatsoever by us regarding third party websites. We are not responsible for the content, availability, or privacy policies, of these sites, and shall not be responsible or liable for any information, opinions, advice, products, or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-22-308

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of numerous books on investing.

ALSO BY LARRY SWEDROE

If you found this post interesting, you might also want to read these other articles that Larry has written about sustainable investing:

ESG investing: Is best-in-class the way to go?

Can investors improve returns by reducing ESG risks?

ESG strategies: do risk factors explain returns?

Is there an opportunity cost of responsible investing?

The impact of CSR on credit risk

OUR STRATEGIC PARTNERS

Content such as this would not be possible without the support of our strategic partners, to whom we are very grateful.

TEBI’s principal partners in the UK are S&P Dow Jones Indices and Sparrows Capital. We also have a strategic partner in Ireland — Biograph Wealth Advisors, a financial planning firm in Dublin.

We are currently seeking partnerships in North America and Australasia with firms that share our evidence-based and client-focused philosophy. If you’re interested in finding out more, do get in touch.

© The Evidence-Based Investor MMXXII